Who this guide is for: folks between jobs, small business owners weighing group options, and anyone wondering about supplemental or Medicare-related plans. Spoiler: the answer depends on your situation — read on for costs, coverage limits, customer experience, and smart alternatives. Scroll to the FAQ at the end if you want the quick takeaway or jump to comparisons to start saving time.

What is Allstate Health Solutions? Understanding Your Options

- What is Allstate Health Solutions? Understanding Your Options

- Is Allstate Health Insurance Good? The Pros and Cons

- Allstate Short-Term Health Insurance: Is It Actually Good?

- Customer Experience: What People Say About Allstate Health Insurance

- Who Should (and Shouldn't) Consider Allstate Health Insurance

- Allstate Medicare Supplement Insurance: Important Updates

- Allstate Benefits for Small Businesses: Is It a Good Choice?

- Supplemental Insurance from Allstate: Worth the Investment?

- Better Alternatives to Allstate Health Insurance

- Frequently Asked Questions About Allstate Health Insurance

- Conclusion: Is Allstate Health Insurance Good for You?

First things first: Allstate Health Solutions (you might also see the name National General in older materials) is the health-focused arm tied to the Allstate family. Most people think of Allstate for auto and home insurance, but their health offerings are narrower and operate a bit differently than the big national health insurers.

The Allstate Health Insurance Portfolio

Allstate Health Solutions sells a handful of insurance options — mostly short-term and supplemental products rather than full, long-term individual health plans. Here’s a quick, friendly breakdown and who each option might suit:

- Short-term health insurance: Temporary coverage (often 30 days up to several months) to bridge gaps — good for healthy people between jobs who need stopgap protection.

- Medicare Supplement (Medigap): Historically offered to fill gaps in Original Medicare, though Allstate has said it stopped selling new Medigap policies in recent years — existing members were generally allowed to keep theirs.

- Supplemental health plans: Products like accident insurance, critical illness, hospital indemnity, and dental/vision — useful if you want to top off a primary plan or cover specific risks.

- Small business health insurance: Group options and self-funded plans for employers — aimed at businesses that want customizable packages for employees.

Important note: most individual Allstate plans are not ACA-compliant. That means they don’t have to follow Affordable Care Act rules like covering pre-existing conditions or including all essential health benefits. If that sounds like a dealbreaker for your needs, jump to the short-term deep dive or the Medicare section below to compare options.

Is Allstate Health Insurance Good? The Pros and Cons

I’ve dug through policy details, customer reviews, and industry ratings — here’s a friendly, no-fluff look at the benefits and drawbacks so you can decide if an Allstate plan fits your needs.

Pros of Allstate Health Insurance

- Affordable basic coverage: If you need catastrophic protection while between jobs or waiting for employer coverage, Allstate’s short-term plans can be cheaper than some competitors — good for healthy people who want low monthly costs.

- Immediate urgent care benefits: Some plans start covering urgent care right away, which is handy if you want a safety net for sudden minor emergencies without waiting for the deductible.

- Strong financial backing: Being part of the Allstate family gives these products financial stability — that can matter when a big claim needs paying (verify current ratings like A.M. Best for the latest data).

- Customizable options: Multiple plan designs and deductible levels let you pick more affordable or more protective options depending on your budget.

- LIFE Association perks: Membership-style benefits (medication discounts, telemedicine, fitness savings) can be a nice extras package on top of core coverage.

Cons of Allstate Health Insurance

- High complaint rates: Public complaint data shows Allstate Health subsidiaries get more complaints than average — in some cases several times higher — which signals potential friction around claims and service.

- Pre-existing conditions not covered: Short-term and many supplemental plans generally exclude pre-existing conditions, so they’re a poor fit if you need ongoing care.

- Expensive for solid coverage: The cheapest plans are affordable, but plans with lower deductibles and better coverage can be pricey compared with rivals.

- Limited preventive care: Preventive services often aren’t covered until after you meet the deductible — unlike ACA-compliant plans that usually offer free preventive care.

- Claims and service headaches: Common complaints focus on denied claims, delayed payments, and fights over condition status — so expect to be proactive when filing claims.

“After researching Allstate health insurance extensively, I’ve found their plans can be a good fit for specific situations—like temporary coverage between jobs—but they’re not ideal as a long-term, comprehensive health insurance solution for most people.”

Quick take: who benefits most

- Best fit: Young, healthy people between jobs who want cheap, short-term coverage; small businesses seeking flexible group options; customers wanting supplemental plans (dental, accident).

- Not a fit: Anyone with pre-existing conditions, people who need prescription coverage or routine preventive care, and those who want a long-term primary insurance plan.

- My two cents: I’d use Allstate for a short-term bridge, not as my main health insurance — and I’d keep records handy if I had to file claims.

If you want to compare short-term vs. ACA-compliant plans (a must if you have ongoing care needs), jump down to the short-term deep dive or the alternatives section for side-by-side options and rates.

Allstate Short-Term Health Insurance: Is It Actually Good?

Short-term health insurance is Allstate’s primary individual offering, so let’s break down what you actually get — costs, coverage limits, and when it might make sense (or not).

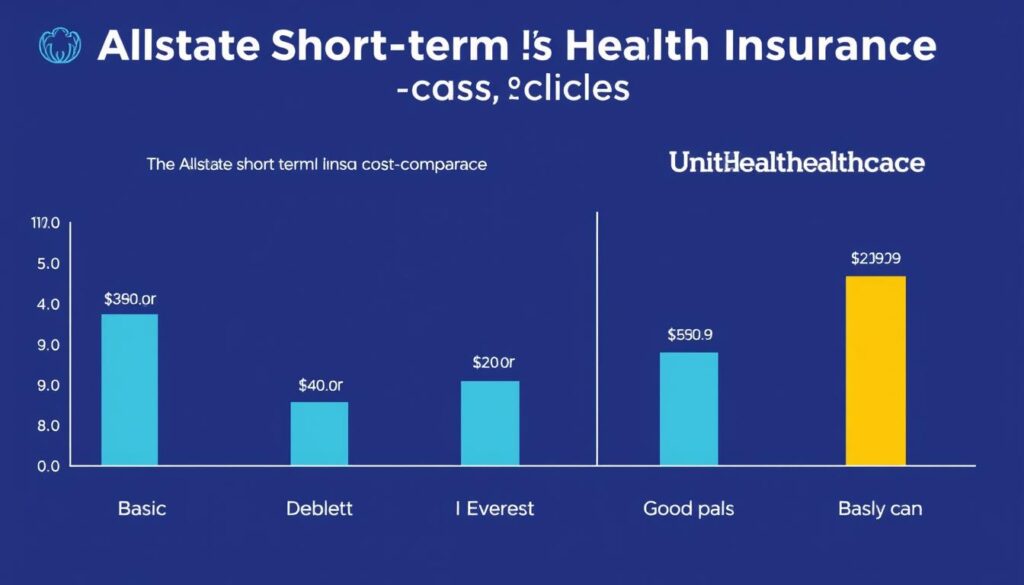

Cost of Allstate Short-Term Health Plans

Here’s the quick math: Allstate’s basic short-term plan averages about $132 per month with very high deductibles, while more protective versions can jump to roughly $443/month. Those numbers mean Allstate can be cheaper for bare-bones, catastrophic-style coverage — but pricier if you want lower deductibles and more day-to-day protection.

| Company | Basic Plan Cost | Good Coverage Cost |

| Pivot Health | $114 | $202 |

| Allstate Health | $132 | $443 |

| Everest | $158 | $274 |

| UnitedHealthcare | $179 | $390 |

When a short-term plan makes sense

- You’re healthy, between jobs, and mainly want protection against a catastrophic event.

- You need immediate coverage while you wait for employer coverage to start or for ACA enrollment to kick in.

- You understand these plans usually exclude pre-existing conditions and routine prescriptions.

Coverage Details: What’s Included and What’s Not

Allstate short-term plans tend to follow the usual short-term playbook: fast, limited coverage for emergencies and big-ticket events — not a replacement for a full health insurance plan.

Typical costs and deductibles:

- Basic plans: high deductibles often in the $10,000–$25,000 range (which keeps monthly rates low).

- Better-coverage plans: lower deductibles around $2,000–$2,500, but monthly premiums rise substantially.

What’s covered before you hit the deductible:

- Urgent care visits on some plans — a nice safety net for immediate minor emergencies.

- Child vaccines in certain plan variants.

What’s covered after you meet the deductible:

- Doctor visits and preventive care (once the deductible is met)

- X-rays, lab tests, and imaging

- Hospitalization, surgery, and cancer treatment

- Physical therapy, nursing facilities, and home health care

What’s usually NOT covered:

- Pre-existing conditions (standard exclusion for most short-term plans)

- Pregnancy and maternity care

- Prescription drugs in many plans

- Preventive care before the deductible

Important: Unlike ACA-compliant plans, Allstate short-term plans generally only cover preventive care after you reach the deductible. That means routine checkups and screenings can cost you thousands out-of-pocket until the deductible is met.

Example: a quick calculator-style scenario

If you’re 30, healthy, and between jobs: expect roughly $130–$150/month for a basic plan with a $10,000–$15,000 deductible. That’s cheap monthly, but you’d pay most routine care yourself until the deductible is met — fine for short gaps, not ideal as primary coverage.

Enrollment and timing note: short-term plan lengths and renewal rules vary by state — some states limit duration or renewals, so check plan enrollment rules before signing up.

Need Temporary Health Coverage?

Compare Allstate’s short-term plans with ACA marketplace options and other competitors to see which plan and costs match your needs. If you have pre-existing conditions, check the marketplace — it may be the better coverage option.

Customer Experience: What People Say About Allstate Health Insurance

So, is Allstate health insurance good according to customers? Short answer: experiences are mixed, and many buyers report friction — especially around claims and service. Below I summarize the complaint trends, real user anecdotes, and practical tips so you know what to expect.

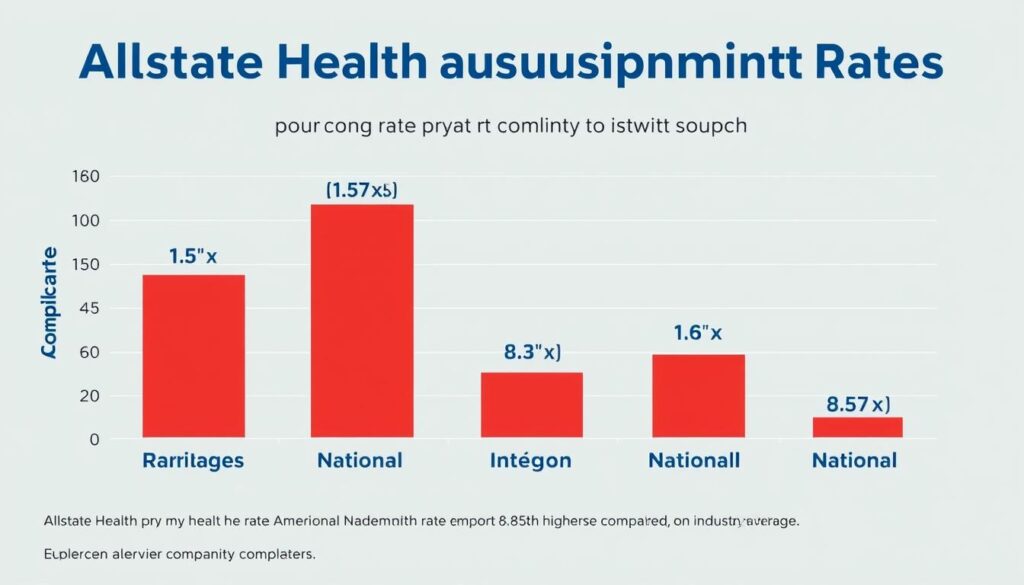

Complaint Rates and Customer Satisfaction

Public complaint data (state insurance departments and NAIC filings) show higher-than-average complaint activity for several Allstate Health subsidiaries. That doesn’t always mean every customer will have problems, but it is a red flag worth noting when you compare insurers.

| Allstate Health Subsidiary | Rate of Complaints |

| American Heritage | Average |

| National Health | 1.5 times higher than average |

| Integon Indemnity | 6 times higher than average |

| Integon National | 8.5 times higher than average |

Common complaint themes you’ll see in the data and regulator reports include:

- Denied claims — disputes over whether care was covered or considered pre-existing

- Delayed payments — providers and customers report slow reimbursements

- Confusion around pre-existing conditions — appeals and documentation requests are frequent

What Reddit Users Say About Allstate Health Insurance

“I had Allstate short-term health insurance between jobs and found it adequate for my basic needs, but when I actually needed to use it for something serious, the claims process was frustrating and took months to resolve.”

Online forums (Reddit, consumer review sites) show a spread of experiences: some customers praise low monthly rates and quick urgent-care visits, while others report long appeals, claim denials, and poor customer service. If you’re reading reviews, pay special attention to posts about claims processing and how long disputes took to resolve — that’s where patterns usually show up.

TL;DR — Expect friction on claims (and how to reduce it)

- Document everything: Keep copies of bills, provider notes, and any pre-authorization forms.

- Ask for clear coverage rules up front: Get written answers about pre-existing conditions and prescription coverage.

- Be ready to appeal: If a claim is denied, file an appeal promptly and follow the insurer’s process (state DOI guidance can help).

If you sign up — quick checklist

- Ask the agent which subsidiary will underwrite your plan (important for complaint data and regulator records).

- Confirm in writing what’s covered before vs. after the deductible (urgent care, vaccines, preventive care).

- Keep contact details for claims and an escalation path (supervisor, state insurance commissioner’s complaint portal).

Who Should (and Shouldn’t) Consider Allstate Health Insurance

Based on complaint data (state filings and NAIC trends), customer experiences, and plan features, here’s a straightforward breakdown of who might benefit from Allstate health insurance — and who probably shouldn’t:

Allstate Health Insurance Might Be Good For:

- People between jobs who need affordable, temporary catastrophic coverage for a few months.

- Healthy individuals with no pre-existing conditions who primarily want protection against major medical emergencies.

- Those who need immediate urgent care coverage without waiting periods.

- Small business owners looking for self-funded health plans with potential cost savings.

- Individuals seeking supplemental coverage (dental, accident, critical illness) to complement their primary health insurance.

Allstate Health Insurance Is Probably Not Good For:

- People with pre-existing conditions (most Allstate plans won’t cover these).

- Those needing comprehensive, long-term health insurance (ACA marketplace plans offer better protection).

- Individuals who prioritize preventive care (Allstate only covers this after high deductibles are met).

- People who need prescription drug coverage (most Allstate plans don’t include this).

- Those who value smooth claims processing (high complaint rates suggest issues in this area).

- Medicare-eligible individuals seeking new Medigap policies (Allstate no longer sells these).

Allstate Medicare Supplement Insurance: Important Updates

Important Update: Allstate has announced it will no longer sell Medicare Supplement Insurance (Medigap). If you already have an Allstate Medigap plan, you can typically keep it, but new customers will need to shop elsewhere for Medicare supplement coverage.

To give you context, Allstate’s Medigap offerings historically competed on price and plan choice. Typical features included:

- Competitive pricing: At times Allstate’s Medigap rates ran lower than some competitors (reported examples suggested savings in the low‑teens percentage range), though rates vary by state and year.

- Available plan types: Standard Medigap options like Plan A (basic), Plan N (lower premiums with some copays), and Plan G (near‑comprehensive for many new Medicare enrollees).

- Discounts: Historically advertised discounts — for example household or multi-person discounts and wellness/device-related discounts in some programs — but availability depended on the specific product and state rules.

- Complaint activity: Regulators’ complaint data showed elevated complaint levels for some Allstate Medigap operations compared with peers; check your state’s insurance department or NAIC reports for the latest data.

Alternatives for new enrollees

If you’re shopping for a medicare supplement plan now, consider well-known carriers with large Medigap books and stronger complaint/financial records. Common alternatives include:

- UnitedHealthcare/AARP — large provider network and market share

- Mutual of Omaha — solid financial strength and competitive pricing

- Blue Cross Blue Shield plans — broad availability in many states

If you’re already in an Allstate Medigap plan

Don’t panic — existing members are usually allowed to keep their coverage. Still, pay attention to renewal notices, rate changes, and any shifts in service contacts. It’s smart to get quotes from alternatives during your next open enrollment, especially if you notice rate increases.

Looking for Medicare Supplement Coverage?

Since Allstate no longer sells new Medigap policies, compare top-rated alternatives and check guaranteed-issue windows if you’re switching carriers or losing other coverage.

Allstate Benefits for Small Businesses: Is It a Good Choice?

If you run a small company and are wondering whether Allstate Benefits is a smart move for employee coverage, the short answer is: maybe — depending on what you value most (cost flexibility vs. service consistency). Below I break down the types of business health plans Allstate offers and when they might make sense.

Types of Small Business Health Plans

Allstate Secure Choice (ACA Compliant)

- PPO-style group plans that follow Affordable Care Act rules in the markets where they’re offered

- Out-of-network coverage options and standard Bronze/Silver/Gold tiers

- Free preventive care under ACA rules for enrolled employees

- Available in select states (availability varies — check with a broker for your state)

- Optional add-ons in some markets, like fertility coverage

Self-Funded Health Insurance

- Employer pays employee medical costs directly up to a stop-loss limit

- Secondary stop-loss insurance available for very large claims

- Potential cost savings in low-claim years compared with fully insured plans

- Flexible benefit design to tailor offerings to your team

- Claims administration may be handled by Allstate or a third-party administrator depending on the setup

Is Allstate Good for Small Business Health Insurance?

Allstate Benefits can work well for certain small business needs — particularly companies looking for customizable packages and potential cost savings from self-funded arrangements. But keep the caveats in mind: complaint rates for some Allstate Health subsidiaries are higher than average, which could affect employee experience.

- Potential advantages: Cost savings in good years, customizable group plans, and the convenience of bundled supplemental benefits (dental, vision, accident).

- Potential drawbacks: Mixed service and claims experiences in some subsidiaries — which may impact employee satisfaction and administrative effort.

Small business owner tips

- Have a stop-loss and legal review done before choosing self-funded — it’s worth the up-front cost.

- Survey employees about which benefits matter most (prescriptions? dental? telemedicine?) to build a package they’ll actually use.

- Ask who handles claims (Allstate vs. TPA) and get a service-level agreement in writing.

Small Business Owner?

Get a free quote to see if Allstate Benefits fits your company — and compare with other group health insurance providers before deciding.

Supplemental Insurance from Allstate: Worth the Investment?

Supplemental plans from Allstate are designed to fill gaps — they’re not replacements for comprehensive coverage but can be useful add-ons for specific risks. Below are common types and who they suit.

Types of Supplemental Coverage

Accident Insurance

Helps cover out-of-pocket costs after an accidental injury. Typical monthly ranges vary widely by benefit level — examples across the market run from very low-cost options to richer plans (illustrative ranges often start around the low teens).

Critical Illness Insurance

Provides a lump-sum payment if diagnosed with covered conditions like cancer, heart attack, or stroke. These plans are useful if you want cash to cover lost income or non-medical bills during recovery.

Dental & Vision

Standalone dental or combined dental/vision plans can help reduce out-of-pocket costs for routine care. In many Allstate offerings, dental plans may start coverage quickly (some markets show little to no waiting period).

Unique Benefit: In several markets, Allstate’s dental plans advertise minimal waiting periods — so you may be able to get cleanings or basic work soon after enrollment (verify for your state).

Quick example: a 10-employee shop choosing between fully insured and self-funded options might see lower premiums with self-funding in a year with few claims, but should budget for stop-loss insurance and administrative overhead. In short: self-funding can save money — sometimes — but adds volatility.

Remember: supplemental plans are great for targeted protection (accidents, critical illness, dental/vision), but they don’t replace a primary health insurance plan that covers hospitalizations, prescriptions, and ongoing care.

Better Alternatives to Allstate Health Insurance

If Allstate doesn’t feel like the right fit, no worries — plenty of other insurers and health plans may suit your needs better. Below are practical alternatives depending on whether you want short-term coverage or a medicare supplement.

For Short-Term Coverage

UnitedHealthcare

- If you want robust short-term plan features and a big provider network, UnitedHealthcare is worth a look.

- Stronger digital tools and apps make managing claims and finding in-network care easier.

- Tends to be pricier than the cheapest options, but gives more convenience and network breadth (example market rate: ~$179/mo).

Pivot Health

- Good pick if low monthly cost matters — often cheaper than Allstate for basic short-term plans (example market rate: ~$114/mo).

- Solid value for coverage at that price and generally favorable customer ratings.

- Consider Pivot if you want low-cost catastrophic protection for a short gap.

ACA Marketplace

- Best choice if you need comprehensive health insurance that covers pre-existing conditions.

- Offers free preventive care and potential subsidies to lower your monthly premiums.

- Not a short-term fix, but likely the right long-term option for most people who need ongoing care.

For Medicare Supplement

AARP / UnitedHealthcare

- One of the largest Medigap providers — widely available and familiar to many Medicare shoppers.

- Often has household discounts and strong service infrastructure.

- Example pricing for Plan G in some markets: around $132/mo (rates vary by state and year).

Mutual of Omaha

- Known for strong financial ratings and competitive pricing among Medicare supplement companies.

- Generally low complaint rates and reliable customer service.

Blue Cross Blue Shield

- Available in many states via regional BCBS companies — strong provider networks and brand recognition.

- Good option if you value network access and local customer service (example pricing for popular plans: roughly $155/mo in some areas).

Quick comparison tips

- If you have pre-existing conditions or need prescriptions and preventive care, prioritize ACA marketplace plans or comprehensive health insurance plans — not short-term coverage.

- If your top priority is the lowest monthly premium for a short gap, compare Pivot and other low-cost competitors against Allstate.

- Get at least 3 quotes from different companies to compare costs, networks, and benefits — small differences in network can mean big differences at the doctor’s office.

Compare All Your Options

Get personalized quotes from multiple providers to find the best health insurance plan for your situation — and remember to check provider networks before you enroll.

Compare Health Insurance Plans

Tip: aim for 3 quotes to see real differences in rates and network coverage.

Frequently Asked Questions About Allstate Health Insurance

Is Allstate health insurance good for people with pre-existing conditions?

Short answer: no. Most Allstate short-term and supplemental plans exclude pre-existing conditions. If you have ongoing health needs, an ACA-compliant plan from the marketplace is the safer bet because it can’t deny coverage or charge more based on medical history.

Is Allstate a good health insurance company compared to major providers?

Allstate isn’t a top player for comprehensive individual health plans the way UnitedHealthcare, Anthem, or Cigna are. Their offerings focus on short-term, supplemental, and small-business options rather than full, long-term health plans — and publicly available complaint data shows higher-than-average issues for some subsidiaries.

Is Allstate short-term health insurance good for temporary coverage?

It can be — if you’re healthy, between jobs, and mainly want catastrophic protection. Basic short-term plans have lower monthly premiums (example market averages cited earlier) but very high deductibles and limited benefits. For many people who need prescriptions or regular care, an ACA marketplace plan is better.

Is Allstate health insurance good for small businesses?

Allstate Benefits offers group health insurance and self-funded options that can suit some small employers seeking customization and potential cost savings. But weigh those savings against complaint histories and service expectations — shop multiple group health insurance providers before deciding.

What do Reddit users say about whether Allstate health insurance is good?

Online forums show mixed reviews: people praise low premiums and quick urgent-care coverage, but many report frustration with claims handling and slow appeals. If you read user posts, focus on claim stories and resolution time to get a realistic picture of service experience.

How do I appeal a denied claim with Allstate?

File the insurer’s appeal form quickly, include medical records and provider notes, and use your state insurance department as an escalation path if needed. Keep copies of everything — documentation helps with faster resolutions.

When should I choose ACA vs. short-term coverage?

Choose ACA marketplace plans if you need comprehensive coverage, prescription drug benefits, free preventive care, or you have pre-existing conditions. Short-term plans are best only as temporary bridges for healthy people who can tolerate high deductibles.

Conclusion: Is Allstate Health Insurance Good for You?

After reviewing Allstate’s offerings, customer complaints, and competitive alternatives, the verdict is: it depends on your needs. Allstate health products can be a good, low-cost option for very specific, short-term situations — but they aren’t the best pick for long-term, comprehensive care or for people with ongoing medical needs.

- Quick takeaways:

- If you’re between jobs and healthy, an Allstate short-term plan might save money temporarily.

- If you need coverage for pre-existing conditions, prescriptions, or preventive care, choose an ACA-compliant health insurance plan.

- Small businesses may benefit from Allstate Benefits’ flexibility, but compare group plans and check service records before committing.

Final tip: always get at least three quotes from different insurers, check provider network coverage for your doctors, and keep clear documentation if you need to file claims. If you want personalized help, talking to a licensed broker or contacting healthcare.gov during open enrollment can save you time.

Find the Right Health Insurance for Your Needs

Compare personalized quotes from multiple providers to make an informed decision — and consider talking to a broker to simplify the process.