Understanding Employer-Sponsored Health Insurance in 2025

- Understanding Employer-Sponsored Health Insurance in 2025

- Traditional Group Health Insurance: The Standard Approach

- ACA Compliance: What Employers Need to Know in 2025

- Health Reimbursement Arrangements: A Tax-Advantaged Alternative

- Health Stipends: Simple but Taxable

- Why You Can't Directly Pay for Individual Health Insurance

- Special Considerations for Small Businesses

- How to Implement Your Chosen Health Insurance Solution

- Frequently Asked Questions About Paying for Employee Health Insurance

- Making the Right Choice for Your Business

In short: employer-sponsored health insurance means you either buy a group plan for your staff or you help fund their individual coverage. Employer coverage still forms the backbone of the U.S. system — millions rely on it — and your choice affects taxes, compliance, and how happy your people are.

Ultimately, the decision on how to pay for employees health insurance can impact your company’s culture and employee morale.

When deciding how to pay for employees health insurance, it’s essential to consider all available options, including group plans and HRAs.

When considering how to pay for employees health insurance, it’s crucial to weigh the benefits of different plans available to your business.

Most employers handle this in one of two ways:

- Offer a group plan and split the insurance premiums with employees (classic group plan).

- Reimburse employees for individual health insurance and qualified medical costs through a compliant vehicle like an HRA.

Quick example: a tiny coffee shop might favor a QSEHRA or a small stipend to control costs, while a 100-person office usually benefits from the stability and negotiated rates of a traditional group health plan.

Not Sure Which Health Insurance Option Is Right For Your Business?

Talk to an expert about ICHRA vs. a group plan — we’ll walk through costs, compliance, and what actually fits your employees.

Traditional Group Health Insurance: The Standard Approach

Employers often wonder how to pay for employees health insurance effectively while balancing costs. This guide will clarify your options.

The most familiar way to pay for employees health insurance is a traditional group plan. You pick one (or a few) plans from an insurer or broker, offer them to eligible staff, and share the cost of premiums.

Many business owners seek advice on how to pay for employees health insurance without exceeding their budgets.

To effectively understand how to pay for employees health insurance, employers should analyze their budget and employee needs.

By researching how to pay for employees health insurance, employers can make informed decisions that benefit both their finances and their employees.

How Group Plans Work

Think of a group health plan as buying insurance in bulk. Typical payment mechanics:

When deciding how to pay for employees health insurance, understanding the common practices can help you make the best choices.

- The employer covers a portion of the premium (commonly 50–80%).

- Employees pay the rest via payroll deductions.

- Both sides’ contributions are usually pre-tax when set up through a cafeteria plan.

Average Employer Costs for Group Health Insurance in 2025

The average costs associated with how to pay for employees health insurance can vary greatly depending on the plan and provider.

Numbers help with budgeting, but remember — these are averages and will vary by state, industry, and plan design.

| Coverage Type | Total Annual Premium | Average Employer Contribution | Average Employee Contribution |

| Single Coverage | $8,900 | $7,400 (83%) | $1,500 (17%) |

| Family Coverage | $25,000 | $17,500 (70%) | $7,500 (30%) |

How to read this: totals are national averages for 2025 — your exact insurance premiums will depend on your location, plan metal level, and employee demographics.

Understanding how to pay for employees health insurance aligns with a company’s overall growth strategy.

Pros and Cons of Traditional Group Plans

Advantages

- Employees usually get comprehensive coverage they recognize.

- Tax advantages for both employer and employees when premiums are pre-tax.

- Group buying can yield better rates than individual plans.

- Straightforward path to meeting ACA employer mandate rules for larger firms.

- Simplifies enrollment and benefits administration for employees.

Disadvantages

- Costs can climb quickly, making budgeting harder for employers.

- Less choice for employees — one-size-fits-all plans aren’t for everyone.

- Admin overhead: enrollment, compliance, carrier rules, and renewals.

- Some carriers require minimum participation (commonly around 70%, though this varies).

- Often expensive for small employers who can’t spread risk across many people.

Who should choose a group plan?

- Medium to large employers seeking predictable health plan costs and broad coverage options.

- Organizations that prioritize compliance with the Affordable Care Act and want a single group health solution.

- Companies that prefer negotiated network access and simplified employee enrollment.

Quick action tip: compare quotes from a couple of brokers — group plan pricing can surprise you. And if you’re a small employer, consider whether an HRA or QSEHRA might deliver more flexibility for similar spend.

ACA Compliance: What Employers Need to Know in 2025

Before you pick a way to pay for employees health insurance, you’ve got to understand the Affordable Care Act rules that apply to employers. Compliance affects whether an option is even feasible — and whether you could face penalties down the road.

Being proactive about how to pay for employees health insurance helps ensure compliance and employee satisfaction.

Understanding how to pay for employees health insurance can help prevent penalties under the ACA.

The Employer Mandate

If your business has 50 or more full-time equivalent employees (FTEs), you’re an Applicable Large Employer (ALE). That means you generally must offer affordable health coverage that provides minimum value to at least 95% of your full-time employees and their dependents — or risk potential penalties.

2025 Affordability Threshold: Coverage is considered “affordable” for 2025 if an employee’s required contribution for self-only coverage doesn’t exceed 9.02% of their household income.

It is essential to understand how to pay for employees health insurance within the framework of the ACA to avoid penalties.

Penalties for Non-Compliance

There are two main penalty scenarios to watch for:

- Penalty A (No offer): If you don’t offer coverage to at least 95% of full-time employees, the penalty generally uses the formula (Total full-time employees − 30) × $247.50 per month.

- Penalty B (Unaffordable or lacking minimum value): If an employee gets a Premium Tax Credit because employer coverage is unaffordable or doesn’t meet minimum value, the penalty can be about $371.67 per affected employee per month.

Plain example: if you have 60 FTEs and fail to offer coverage, Penalty A would be calculated on (60 − 30) = 30 employees × $247.50 per month. That’s a meaningful monthly hit, so it’s worth running the math before choosing a cheaper-but-noncompliant route.

Quick checklist: Are you on the hook?

Employers should regularly evaluate how to pay for employees health insurance to adapt to changing regulations.

- Do you have 50+ full-time equivalent employees? If yes, you’re an ALE.

- Are you offering affordable, minimum-value coverage to most full-time staff? If not, run the affordability test.

- Are you documenting offers and employee eligibility? Keep records — they matter in audits.

- Unsure? Consult IRS/HHS guidance or a benefits advisor before you finalize your plan.

Small businesses with fewer than 50 FTEs aren’t subject to the employer mandate penalties, but you still need to consider how any group health or reimbursement approach affects insurance coverage, taxes, and employee expectations.

Health Reimbursement Arrangements: A Tax-Advantaged Alternative

Utilizing tools and resources can aid in figuring out how to pay for employees health insurance and ensuring compliance.

Utilizing HRAs can be a strategic way of how to pay for employees health insurance while providing flexibility.

Health Reimbursement Arrangements (HRAs) are a popular way for employers to reimburse employees tax-free for individual health insurance and qualified medical expenses — without buying a traditional group plan. In plain terms: you set a budget, employees pick the individual coverage that fits them, and you reimburse eligible costs on a tax-advantaged basis.

How HRAs Work

Here’s the basic flow (simple, but important to manage correctly):

-

- You set a monthly or annual allowance for each eligible employee.

- Employees buy their own individual health insurance or pay out-of-pocket for eligible medical care.

- Employees submit proof (receipts, premium invoices) to show expenses qualify.

Knowing how to pay for employees health insurance can empower employees to choose plans that suit their needs.

- You reimburse employees up to their allowance on a tax-free basis when it’s a qualified HRA.

That setup gives employees choice and gives you predictable employer costs — a nice combo if you want flexibility without surprise insurance premiums every renewal.

Types of HRAs Available in 2025

Two HRA flavors are most relevant if you want to reimburse employees for health insurance:

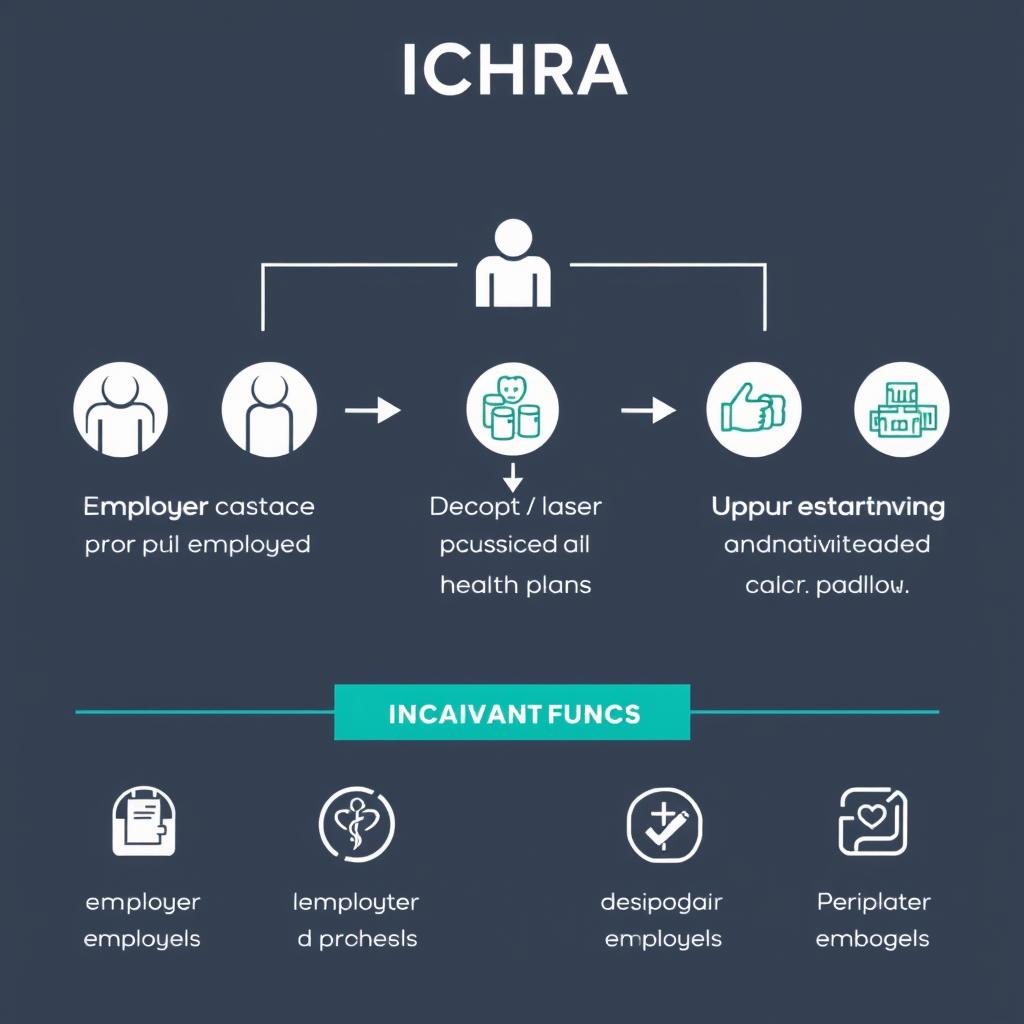

Individual Coverage HRA (ICHRA)

- Available to businesses of any size — very flexible for employers and employees.

- No statutory minimum or maximum contribution limits — you control the allowance.

- You can vary allowances by employee classes (hourly vs. salaried, location, etc.).

- Employees must have individual coverage (exchange plans, Medicare, etc.) to use an ICHRA.

- When designed properly, an ICHRA can satisfy ACA rules for applicable large employers (check plan design carefully).

Quick pro/con: Great employee choice and tax-free basis for reimbursements — but you’ll need clear documentation and class rules.

Qualified Small Employer HRA (QSEHRA)

- Only for employers with fewer than 50 full-time equivalent employees (qualified small employer).

- Subject to annual contribution limits (for 2025 the limits are listed as $6,350 for single and $12,800 for family — confirm current IRS guidance when you implement).

- Must offer the same overall terms to all eligible employees (though amounts can be adjusted within rules).

- Employees need minimum essential coverage (MEC) to use reimbursements.

- QSEHRA cannot be offered alongside a traditional group health plan — it’s specifically for employers without group coverage.

Quick pro/con: Easy for small employers to offer tax-advantaged help, but annual limits and documentation matter.

What Health Insurance Premiums Can HRAs Reimburse?

| Premium Type | ICHRA | QSEHRA |

| Individual health insurance (exchange plans) | ✓ | ✓ |

| Medicare premiums | ✓ (with conditions) | ✓ |

| COBRA insurance | ✓ | ✓ |

| Dental and vision insurance | ✓ | ✓ |

| Spouse’s group plan | ✗ | ✓ |

| Healthcare sharing ministries | ✗ | ✗ |

Admin checklist: setting up an HRA

- Decide which HRA type fits your company (ICHRA for flexibility, QSEHRA for small employers).

- Design employee classes if using ICHRA, and set allowance amounts.

- Create required plan documents and notice templates (ICHRA requires advance notice to employees).

- Define the process for employees to submit proof and for you to process reimbursements.

- Consider an HRA administration platform to automate compliance, payroll integration, and reimbursement tracking.

Ready to Explore HRA Options for Your Business?

Schedule a demo with our HRA specialists — we’ll estimate per-employee costs and show how an individual coverage HRA or QSEHRA would work for your team.

Health Stipends: Simple but Taxable

If you want something easy to run and low-friction, a health stipend is tempting: give employees cash to help with health insurance or medical expenses and call it a day. Just remember — simplicity comes with taxes.

How Health Stipends Work

In practice:

To improve understanding of how to pay for employees health insurance, consider seeking expert advice.

- You give employees a fixed dollar amount (monthly or yearly) to help with health insurance or medical costs.

- The stipend is paid through payroll or as a separate payment.

- Employees can spend the money however they like on healthcare needs.

- The stipend is taxable income to employees, and you must withhold payroll taxes and employer-side payroll taxes apply.

- Because it’s taxable, a stipend can affect an employee’s Modified Adjusted Gross Income (MAGI) and potentially their Premium Tax Credit eligibility — check marketplace rules before assuming otherwise.

Pros and Cons of Health Stipends

Advantages

- Very simple to administer — low compliance overhead.

- Maximum flexibility for employees to pick what they need.

- No limits on what expenses the money can cover.

- No need for HRA plan documents or proof workflows.

Disadvantages

- Stipends are taxable for employees and increase payroll taxes for employers.

- They don’t satisfy the ACA employer mandate for applicable large employers.

- No accountability — employees might use funds for non-health items.

- Less tax-efficient than HRAs or employer-paid premiums over the long term.

- Can unintentionally affect employees’ premium tax credit eligibility because they change MAGI.

Quick example: Give an employee $150/month as a stipend — that $150 is added to wages, so they pay income and payroll taxes on it, and you pay your employer payroll tax. Compared to a tax-free HRA reimbursement, the after-tax help to the employee is smaller.

Who it’s best for: small employers not subject to the ACA employer mandate who want an ultra-simple perk, or teams where employees prefer cash flexibility and understand the tax tradeoffs.

Ultimately, knowing how to pay for employees health insurance is a key part of your business strategy.

Tip: Run a stipend‑vs‑HRA calculator or talk to a benefits advisor — a slightly higher pre-tax employer contribution through an HRA often delivers more take-home help to employees than the same dollar as a taxable stipend.

Why You Can’t Directly Pay for Individual Health Insurance

It’s a tempting idea: just pay an employee’s individual health insurance premium and call it a day. But since the Affordable Care Act, directly paying (or reimbursing) premiums without using a compliant vehicle can create big tax and compliance headaches.

The ACA’s Impact on Direct Reimbursement

Before the ACA, small employers often reimbursed individual premiums. Today, those Employer Payment Plans (EPPs) are generally treated as non-compliant group health plans — meaning they can trigger penalties and unwanted tax consequences.

- Direct reimbursement arrangements labeled as EPPs are risky because they don’t meet ACA group plan rules.

- These setups can disqualify employees for certain tax benefits and expose the employer to penalties or audits.

- Historically cited penalty examples (used to illustrate risk) have been high — check current IRS guidance for exact figures before assuming safety.

Important: The 21st Century Cures Act created a pathway for compliant reimbursements through qualified HRAs (like ICHRA and QSEHRA). That safe harbor is why health reimbursement arrangements are now the preferred, tax-advantaged way to reimburse employees for individual coverage.

Do / Don’t cheat sheet:

- Do use a compliant health reimbursement arrangement if you want to reimburse employees tax-free.

- Don’t simply pay premiums from the company bank account or call reimbursements “bonuses” without understanding the tax and ACA consequences.

- Do consult a benefits advisor or tax pro if you’re unsure — it’s an area where small mistakes get expensive.

Bottom line: if your goal is to help employees with individual health insurance, set up an ICHRA or QSEHRA (when eligible) rather than paying premiums directly — that protects both your team and your bottom line.

Special Considerations for Small Businesses

Small employers face different tradeoffs when deciding how to pay for employees health insurance. If you run a shop with fewer than 50 full-time equivalent employees, you’ve got options that larger companies don’t — and some useful tax tools to lower costs.

Small Business Health Options Program (SHOP)

SHOP is a marketplace for small businesses to buy group health coverage. Enrollment varies by state and carrier participation, so SHOP can be a good fit in some places — especially if you want a straightforward group plan and access to SHOP-specific support.

Small Business Health Care Tax Credit

You might qualify for a meaningful tax credit that reduces the net cost of offering health benefits. In short: you generally qualify if you meet these conditions:

- Have fewer than 25 full-time equivalent employees (qualified small employer)

- Pay average employee wages of about $56,000 or less

- Contribute at least 50% of employees’ premium costs

- Often requires enrollment in a SHOP plan to claim the credit

The credit can cover up to 50% of employer premium costs for small businesses (35% for certain nonprofits) — check current IRS guidance or an advisor to confirm your eligibility and exact percentage.

QSEHRA: Designed Specifically for Small Businesses

The Qualified Small Employer HRA (QSEHRA) was created with small employers in mind. If you’re a qualified small employer (under 50 FTEs), QSEHRA lets you reimburse employees tax-free for individual health insurance and eligible medical expenses — subject to annual contribution limits and documentation rules.

Quick comparison: SHOP + tax credit = traditional group plan with potential tax help; QSEHRA = employer-funded reimbursements without a group plan. Which is better depends on your payroll, benefits goals, and whether you prefer administrative simplicity or employee choice.

Small Business Owner? Get Personalized Guidance

Use our one-click eligibility checklist to see if you qualify for the small business tax credit or a QSEHRA — or request a free consultation with a small employer specialist.

Asking questions about how to pay for employees health insurance is a great way to start the conversation.

How to Implement Your Chosen Health Insurance Solution

Okay — you picked a direction. Now comes the practical part: implementation. Below are clear, time-lined checklists for each major path (group plan, HRA, or stipend), who to involve, and the key admin steps so nothing blindsides you.

Implementing a Traditional Group Plan

- 6+ months before: Talk to 2–3 brokers or carriers to compare quotes and network options (who to involve: broker, CFO, HR).

- 4–5 months before: Decide contribution strategy (percentage of premium or fixed employer contribution) and estimate annual budget.

- 3 months before: Confirm plan design and set up a Section 125 cafeteria plan if you want pre-tax payroll deductions.

- 2 months before: Configure payroll to handle employee premium deductions and employer contributions; test payroll entries.

- 1 month before: Create and distribute plan documents, SBCs (Summary of Benefits and Coverage), and FAQs to employees.

- Open enrollment: Run enrollment, collect elections, and process enrollments with the carrier; follow up on any missing paperwork.

- Ongoing: Maintain monthly reconciliation with the carrier and review renewals 60–90 days before plan anniversary.

Implementing an HRA (ICHRA or QSEHRA)

- 90–180 days before plan year: Choose between ICHRA and QSEHRA based on company size and goals (who to involve: benefits advisor, legal counsel, payroll).

- 90 days before (ICHRA): Prepare and send required written notice to employees explaining the ICHRA offer and how to enroll (ICHRA typically requires advance notice — confirm current rules).

- 60–90 days before: Design employee classes (ICHRA), set allowance amounts, and document eligibility and reimbursement policies.

- 45–60 days before: Create plan documents, employee notices, and reimbursement forms; build a submit-proof workflow (receipts, premium invoices).

- Implementation: Choose an HRA admin platform or set internal processes to receive submissions, verify proof, and issue reimbursements (employer hra admin helps with compliance).

- Payroll integration: Coordinate reimbursements with payroll/finance — even though many HRAs are tax-free to employees, tracking and reporting matter.

- Ongoing: Reconcile reimbursements, monitor eligible expenses, and keep documentation for audits.

Implementing a Health Stipend

- 4–8 weeks before: Decide stipend amount and frequency (monthly is common) and confirm budget impact with finance.

- 2–4 weeks before: Determine payroll treatment — stipends are taxable wages, so set up proper payroll codes and withholdings (who to involve: payroll, HR).

- Launch: Announce the stipend policy clearly, showing net vs gross examples so employees understand tax effects.

- Ongoing: Process stipends via payroll, withhold taxes, and track as taxable compensation for reporting and benefits coordination.

Common Admin & Compliance Tasks (for all approaches)

- Documentation: Keep plan documents, notices, and enrollment records in a centralized place for at least three to seven years depending on tax/audit guidance.

- Communications: Send clear employee guides, examples of “what this means for your paycheck,” and step-by-step enrollment instructions.

- Expense verification: For HRAs, establish how employees submit proof (scan/upload receipts or premium invoices) and who reviews them — a clear “submit proof” process avoids delays.

- Payroll coordination: Ensure payroll codes are set for employer contributions, employee pre-tax deductions, or taxable stipends; reconcile monthly.

- Who to involve: broker or benefits consultant, payroll provider, finance lead, legal/tax advisor, and an HRA admin if you use one.

- Testing & launch: Do a soft launch or pilot with a small group if you can — it surfaces process bugs before a full roll-out.

Micro-CTAs & tools you can use: download an HRA notice template, grab a payroll line-item sample, or run a stipend-vs-HRA calculator to compare after-tax employee benefit. If you want, we can generate those templates for your situation.

Clear communication is the last mile: no matter which route you choose, spell out timelines, employee actions, and who to contact for help — it saves HR time and keeps employees from being confused about their health plan or reimbursements.

Frequently Asked Questions About Paying for Employee Health Insurance

How much are employers required to pay for health insurance?

There’s no federal rule that forces employers to pay a specific dollar amount toward health insurance. However, Applicable Large Employers (50+ full-time employees or full-time equivalents) must offer coverage that’s considered “affordable” — for 2025, that means employee contributions for self-only coverage shouldn’t exceed about 9.02% of household income. In practice, many employers cover roughly 50%–80% of insurance premiums, but your number will depend on your budget and benefits strategy. If you’re unsure, run an affordability test or ask your broker.

Can a business pay for employees’ individual insurance plans?

You can’t safely just pay employees’ individual premiums directly without creating tax and ACA compliance issues. The tax-friendly, compliant way to help employees buy individual coverage is to reimburse them through a qualified Health Reimbursement Arrangement (HRA) such as an ICHRA or QSEHRA. Those employer hra setups let you reimburse employees tax-free for individual health insurance and qualified medical expenses when designed correctly.

How much do employers pay for health insurance on average?

Average employer costs vary a lot by industry and location. For 2025 national averages, employers paid about ,400 annually (roughly 83% of the premium) for single coverage and about ,500 annually (about 70% of the premium) for family coverage. These figures are averages — expect variation by state, plan metal level, and workforce demographics.

How do I set up payroll deductions for employee health insurance?

Typical steps are: 1) calculate each employee’s premium share, 2) set up a Section 125 Cafeteria Plan so contributions can be pre-tax, 3) configure your payroll system to withhold the correct amounts, and 4) provide clear documentation to employees showing what’s deducted and why. Most payroll providers can handle the mechanics — just loop in your broker and payroll vendor early so gross-to-net examples are ready for open enrollment.

Can business owners deduct employee health insurance payments?

Yes — generally the cost of employer-paid health coverage (premiums or qualified HRA reimbursements) is deductible as a business expense on federal returns. That said, specific tax treatment can vary depending on entity type and how benefits are structured, so consult your tax advisor for guidance tailored to your situation.

How to pay health insurance for S Corp employees?

Consider how to pay for employees health insurance as part of your business’s employee retention strategy.

If you’re an S corporation owner who owns more than 2% of the company, rules differ: the corporation can pay for your health insurance, but those amounts are usually reported as wages on your W-2 and are subject to income tax (though they may be exempt from FICA). Regular employees can participate in group plans or HRAs like anyone else. It’s a good idea to check with a CPA to make sure you follow the right reporting steps.

Quick recap

- There’s no fixed legal employer contribution — employers commonly pay 50%–80% of premiums.

- Don’t directly pay individual premiums; use a compliant HRA (ICHRA or QSEHRA) to reimburse employees tax-free.

- Run payroll/affordability tests and consult a benefits advisor to avoid ACA penalties or lost premium tax credits for employees.

Making the Right Choice for Your Business

Decisions about how to pay for employees health insurance should align with your business’s long-term goals.

Deciding how to pay for employees health insurance affects your bottom line, your tax picture, and how attractive your benefits are to current and future hires. There’s no single right answer — the best approach depends on your company size, budget, and how much flexibility you want to give employees.

In conclusion, mastering how to pay for employees health insurance is crucial for maintaining a satisfied workforce.

Quick cheat sheet by employer size:

- Small (under 50 FTEs): Consider a QSEHRA or a modest stipend if you want simplicity, or SHOP plus the small business tax credit if you prefer a group plan and may qualify for the credit.

- Medium (50–200 employees): A traditional group plan often makes sense for predictable insurance premiums and simplified enrollment; an ICHRA can work if you want to offer choice and control costs.

- Large (200+ employees): Group health plans or self-funded options usually offer the best leverage and benefits control; work closely with brokers and benefits teams to optimize insurance premiums and compliance.

Top 3 quick answers:

- How to pay for employees health insurance: use a group plan, a compliant HRA (ICHRA/QSEHRA), or a stipend — each has tradeoffs.

- Want to reimburse employees tax-free? Use an employer health reimbursement arrangement rather than direct payments.

- Looking to lower net costs? See if you qualify for the small business tax credit or run a stipend‑vs‑HRA comparison to find the most tax-efficient approach.

If you’d like a hand, our benefits specialists can run numbers for your team and recommend the most cost-effective health insurance coverage and reimbursement structure. Book a free 15-minute review this month and get a tailored cheat sheet for your business.

With so many options, mastering how to pay for employees health insurance is crucial for employee satisfaction.

Our specialists are here to help you navigate how to pay for employees health insurance effectively for your business.

Ready to Find the Perfect Health Insurance Solution? Learn how to pay for employees health insurance today!

Our team of benefits experts can guide you through options — from traditional group plans to HRAs — and help you implement the ideal approach for your business size, budget, and employees, focusing on how to pay for employees health insurance.