Ready to find a plan that fits your needs without endless searching?

Open Enrollment runs Nov. 1, 2024 through Jan. 15, 2025, and this is the best time to review coverage options on the Colorado marketplace. You can compare plans from private carriers and the official marketplace, see premiums and networks side by side, and request help from licensed experts.

This guide shows how to get quick co health insurance quotes, use cost estimators, and check plan features like prescriptions, mental health, and emergency care. It explains when special enrollment applies and how free certified assistance can speed accurate enrollment.

Plans and prices change yearly, so checking new rates and coverage updates helps balance monthly cost with the care you need. Gather household and income details, review formularies and networks, then connect with a licensed advisor to move from comparison to enrollment with confidence.

Key Takeaways

- Open Enrollment is Nov. 1, 2024–Jan. 15, 2025; special events may allow outside enrollment.

- Compare plans and premiums side by side through the Colorado marketplace and private carriers.

- Use cost tools to preview premiums, deductibles, and out-of-pocket maximums.

- All ACA plans include essential benefits like preventive care and emergency services.

- Free certified, in-person and virtual help is available year-round to assist enrollment.

Start Here: CO Health Insurance Quotes to Compare Plans and Costs

Begin with real-time rate checks from both the state marketplace and private carriers to compare premiums and coverage in one view. Use those live estimates to narrow plans that match your expected care needs.

Get real-time quotes from Colorado marketplace and private carriers

Request up-to-date price estimates at Connect for Health Colorado and at insurer sites to see differences in networks and covered benefits.

Get marketplace plans to confirm eligibility for financial help that can lower monthly premiums and out-of-pocket costs.

Use cost estimators to preview premiums, deductibles, and out-of-pocket max

Cost tools show premium, deductible, copay, coinsurance, and the out-of-pocket maximum so you can match a plan to how often you use care.

How plan prices change yearly and why it matters when you shop

Insurers update filings and subsidies shift each year. Annual review prevents overpaying and helps avoid gaps in coverage.

Free expert help: in-person and virtual assistance to review your options

Certified, no-cost navigators offer appointments to review options, upload documents, and even complete enrollment paperwork with you.

“Use marketplace tools and expert help to compare plans side-by-side and pick the option that best fits your budget and providers.”

| Feature | Marketplace Estimate | Private Carrier Estimate |

|---|---|---|

| Premium | Includes tax credit eligibility | List price without marketplace subsidies |

| Cost-sharing | Shown with potential reductions | Shown as filed by insurer |

| Provider network | Filterable by network type | Network details on carrier site |

- Filter plans by metal level, network, and benefits to compare total costs.

- Check drug formularies and provider lists before you pick a plan.

- Save your quote and revisit it if household or income changes.

Find the Right Coverage: Plan Levels and What’s Included in Colorado

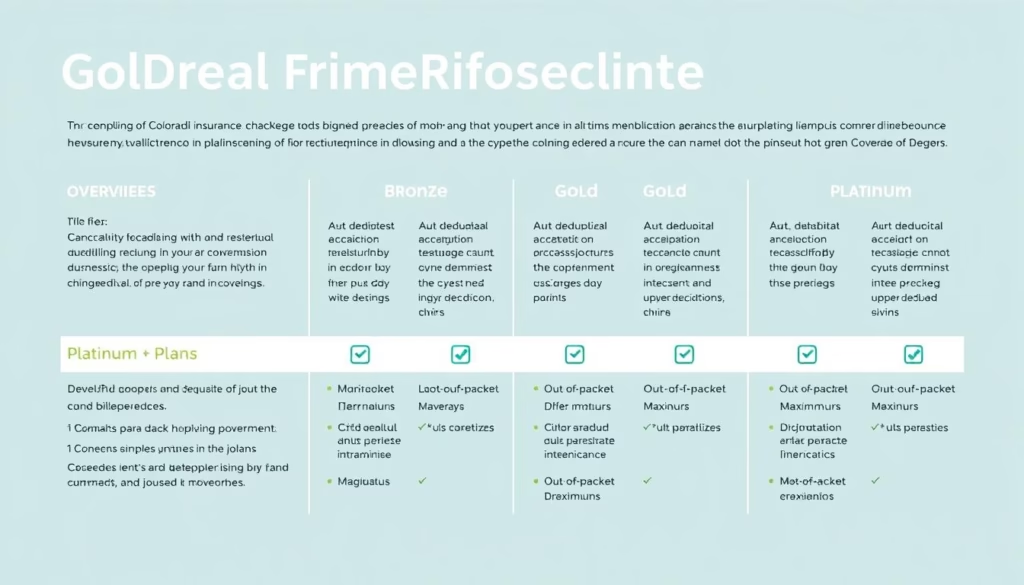

Understanding Gold, Silver, and Bronze makes it easier to match coverage to your expected care needs.

Gold, Silver, Bronze: balancing premiums, deductibles, and care needs

Gold plans have higher monthly premiums but lower costs when you receive care. Silver plans balance premium and deductible. Bronze plans offer the lowest monthly price and higher out-of-pocket costs when you use services.

Essential benefits included with every plan

All ACA-compliant plans sold on the marketplace include preventive visits, mental services, prescriptions, emergency services, hospitalization, and maternity and newborn care.

Mental health, prescriptions, preventive care, ER and hospitalization

Verify therapist networks and formularies before you enroll. Check tier placement and prior authorization rules so ongoing meds stay affordable.

Options for maternity, newborn care, dental and vision

Maternity and newborn care are covered. You can add pediatric dental or routine vision options to fill gaps.

Small business coverage options

Employers can compare plan choices, set contribution strategies, and confirm staff eligibility through marketplace tools like Connect for Health Colorado.

“Document your regular providers and prescriptions first — it makes plan comparison faster and more accurate.”

| Feature | Gold | Silver | Bronze |

|---|---|---|---|

| Monthly premium | Higher | Moderate | Lower |

| Deductible and cost when used | Lower out-of-pocket | Balanced | Higher out-of-pocket |

| Best for | Frequent care users | Moderate care use | Rare care users |

Enrollment Timeline and Qualifying Life Events in Colorado

Know the important dates and events that unlock enrollment windows and start your coverage.

Open Enrollment dates and what to plan for

Open Enrollment runs Nov. 1, 2024 through Jan. 15, 2025. Use this window to compare plans, confirm eligibility, and submit an application for 2025 coverage.

Special Enrollment for qualifying life events

Special Enrollment lets you sign up outside the open enrollment period after a qualifying life event. Common triggers include losing job-based coverage, marriage, the birth of a baby, or a household move.

Document the event date—timely proof often determines eligibility for the special window.

When your plan becomes effective

Effective dates depend on when you apply and select a plan. Apply early in the month to avoid gaps, since some selections take effect the first of the next month.

What information and documents to gather

Have these ready: household size, Social Security numbers, income proof, current policy details, and documents showing the qualifying event.

“Gather documents before you start — it speeds enrollment and reduces follow-up requests.”

| Item | What to expect | Action |

|---|---|---|

| Open Enrollment dates | Nov. 1, 2024 – Jan. 15, 2025 | Shop and submit by deadlines |

| Special Enrollment | Triggered by qualifying life events | Provide proof and apply within time limits |

| Medicaid (Health First Colorado) | Year-round enrollment | Apply via PEAK or call 1-800-221-3943 |

| Marketplace help | Phone and in-person support | Call 1-855-752-6749 or find local help |

Need help? Call the marketplace or work with a certified expert to confirm deadlines and required information. Plans sold on the marketplace are reviewed by the Colorado Division of Insurance, so you get clear, regulated plan details.

Financial Help in Colorado: Lower Your Premium and Care Costs

Federal tax credits, state assistance, and reduced cost-sharing can make coverage much more affordable.

Premium tax credits, cost-sharing reductions, and Colorado premium assistance

Premium tax credits can cut your monthly premium when you enroll through the marketplace. Cost-sharing reductions lower deductibles and copays for eligible Silver plans.

Colorado premium assistance may further reduce what you pay, stacking with federal help for many households.

Where to apply: Connect for Health Colorado vs. Health First Colorado (Medicaid)

Apply for marketplace financial help and private insurance through Connect for Health Colorado. For Medicaid, use PEAK or call 1-800-221-3943 (State Relay: 711). Both pathways offer enrollment support.

- Eligibility is based on projected annual income and household size, so update your information if things change.

- Gather pay stubs or tax documents, complete the online application, or meet a certified assister to finish enrollment.

- Compare total costs after subsidies—don’t pick by sticker premium alone.

“Small income changes can alter your subsidy — check your application during the year to keep premiums accurate.”

Need help? Free in-person and virtual assistance is available; call Connect for Health Colorado at 1-855-752-6749 or visit lower your monthly premiums to learn options. You may qualify now even if you didn’t before, so check both marketplace and Medicaid pathways to find the best option for your care and coverage.

Conclusion

Conclusion

Wrap up your shopping by comparing a shortlist of plans and confirming costs, networks, and prescription coverage before you enroll.

Mark the open enrollment dates — Nov. 1, 2024 to Jan. 15, 2025 — on your calendar and act quickly after any qualifying life event like a move, marriage, or a newborn.

Remember: ACA plans include mental care, prescriptions, preventive visits, ER and hospital services, and maternity/newborn benefits.

Get accurate estimates and free, certified help via marketplace tools or by calling official numbers. For more guidance and plan comparisons, see a practical marketplace guide at health insurance resources.

Gather documents, pick a plan that balances cost and care, schedule help, and finalize enrollment before the deadline. Save your plan papers and check your effective date and subsidy amounts after you enroll.

FAQ

What information do I need to get real-time quotes from the Colorado marketplace and private carriers?

You’ll need basic personal details (name, birthdate), home ZIP code, estimated household income for the year, and the number of people in your household. If you already have current coverage, bring your plan name and member ID. Having recent pay stubs or tax forms helps produce accurate premium and subsidy estimates.

How do cost estimators preview premiums, deductibles, and out-of-pocket maximums?

Cost tools combine your household details with plan features to show monthly premiums, expected deductibles, copays, and the annual out-of-pocket limit. They may also estimate annual costs based on typical utilization, such as doctor visits and prescriptions, so you can compare total expected spend across plans.

Why do plan prices change each year and how should that affect my shopping?

Carriers update rates due to medical inflation, changes in provider contracts, and shifts in the enrolled population. Review plans yearly during Open Enrollment to confirm network, benefits, and premium changes. Even if you keep the same carrier, pricing and covered services can shift, so comparison can save money.

What free expert help is available to review my options in Colorado?

Connect for Health Colorado certifies brokers and navigators who provide free in-person or virtual counseling. Local community health centers and nonprofit organizations also offer enrollment assistance. These experts can explain plan differences, subsidy eligibility, and help complete applications.

How do the Gold, Silver, and Bronze plan levels differ when balancing premiums and care needs?

Bronze plans usually have the lowest premiums but higher out-of-pocket costs, suited for people who rarely need care. Silver plans balance premiums and cost-sharing and can qualify for cost-sharing reductions if you’re eligible. Gold plans have higher premiums and lower out-of-pocket costs, useful if you expect frequent care or ongoing prescriptions.

What essential health benefits are included with every individual plan in Colorado?

All marketplace-compliant plans cover ten essential benefits: ambulatory care, emergency services, hospitalization, maternity and newborn care, mental health and substance use treatment, prescription drugs, rehabilitative services, lab services, preventive services, and pediatric services. Coverage specifics and cost-sharing can vary by plan.

Are mental health, prescription drugs, preventive care, ER visits, and hospitalization covered?

Yes. These services fall under essential benefits and appear in most plans, but drug formularies, prior authorization rules, and in-network provider access differ. Check each plan’s summary of benefits to confirm coverage levels and any restrictions for specialists or medications.

What options exist for maternity and newborn care, and can I add dental and vision?

Maternity and newborn care are standard on marketplace plans. Many insurers offer separate dental and vision policies for adults and pediatric dental coverage is often included for children. You can add standalone dental or vision plans during Open Enrollment or a qualifying life event if permitted.

What small business coverage options are available for employers in Colorado?

Small Business Health Options Program (SHOP) plans help employers provide group coverage. Options include employer contribution flexibility, multiple plan choices for employees, and access to brokers who specialize in group benefits. Eligibility and plan offerings depend on company size and carrier networks.

When is Open Enrollment in Colorado and what are the exact dates?

Open Enrollment for individual marketplace plans runs Nov. 1, 2024 through Jan. 15, 2025. During that window, you can sign up for new coverage or change plans for the coming year. Enrollment deadlines may affect your plan’s effective date, so enroll early when possible.

What life events qualify me for Special Enrollment outside Open Enrollment?

Qualifying events include marriage, birth or adoption of a child, loss of other health coverage, moving to Colorado or a new ZIP code, and changes in immigration status. These events typically trigger a 60-day Special Enrollment period to sign up or change coverage.

When will my plan start after I enroll?

Effective dates depend on your enrollment date and the marketplace rules. If you enroll by the 15th of a month during Open Enrollment, coverage usually begins the first day of the next month. For some qualifying events, coverage can start immediately or on a specific date tied to the event.

What documents and information should I prepare for eligibility and enrollment?

Gather proof of identity (driver’s license or passport), Social Security numbers for household members applying, income verification (pay stubs or tax returns), and documents related to qualifying events (marriage certificate, birth certificate, loss of coverage notice). Having these ready speeds enrollment and subsidy decisions.

How do premium tax credits, cost-sharing reductions, and Colorado premium assistance lower my costs?

Premium tax credits lower your monthly payment based on household income and family size. Cost-sharing reductions reduce deductibles and copays for eligible enrollees selecting Silver plans. Colorado also offers state-level premium assistance programs for certain residents, which can further reduce costs when you enroll through Connect for Health Colorado.

Where should I apply for subsidies or Medicaid in Colorado?

Apply for marketplace subsidies and private plans at Connect for Health Colorado. For Medicaid coverage, including Health First Colorado, apply through Colorado’s state Medicaid portal or the county department of human services. Navigators and certified brokers can help determine which program fits your situation.