Don’t worry — these policies aren’t just for giant corporations. Small businesses and solo owners often need them too, and surprisingly, they can be pretty affordable depending on your situation. In this guide we’ll break down what that $1M policy really covers (hint: it’s usually general liability limits), give you real cost ranges, and share friendly tips on how to get the coverage you need without overpaying.

What’s Actually Covered in a Million Dollar Business Insurance Policy?

- What's Actually Covered in a Million Dollar Business Insurance Policy?

- The Real Cost of a Million Dollar Business Insurance Policy

- 7 Key Factors That Affect Your Million Dollar Policy Cost

- 7 Smart Ways to Save on Your Million Dollar Business Insurance

- Million Dollar Policy Costs for Specific Industries

- Frequently Asked Questions About Million Dollar Business Insurance

- Frequently Asked Questions About Million Dollar Business Insurance

- Frequently Asked Questions About Million Dollar Business Insurance

- Frequently Asked Questions About Million Dollar Business Insurance

- Frequently Asked Questions About Million Dollar Business Insurance

- Protecting Your Business with the Right Coverage

Before we talk prices, let’s clear up what a “million dollar” policy usually means. Most of the time people are referring to the liability limits on a general liability policy — think of general liability like a safety net for lawsuits from third parties. It’s the core insurance coverage most businesses start with.

Core Coverage in a $1M General Liability Policy

What’s Protected:

- Third-party bodily injury — e.g., a customer slips and gets hurt

- Property damage to others’ stuff — like knocking over a client’s camera

- Personal & advertising injury — think libel or slander claims

- Legal defense costs — yes, even for claims that don’t hold up

- Medical payments for injured third parties — small bills covered quickly

What’s Not Covered:

- Employee injuries — that’s workers’ compensation (different policy)

- Professional mistakes — needs professional liability / E&O (e.g., bad advice)

- Damage to your own property — that’s commercial property insurance (your stuff)

- Cyber attacks — requires cyber liability coverage

- Vehicle incidents — those fall under commercial auto insurance

Quick note on limits: when folks say a “million dollar policy,” they usually mean $1 million per occurrence with a $2 million aggregate for the policy period — so up to $1M for one incident and up to $2M total for all claims during the year. That setup is common, but check your policy wording and client contract requirements — some clients might require higher coverage limits.

The Real Cost of a Million Dollar Business Insurance Policy

So how much does a million dollar business insurance policy actually cost? Short answer: it depends — your industry, location, company size, and a few other things all matter. But let’s get into the numbers so you can get a feel for what to expect.

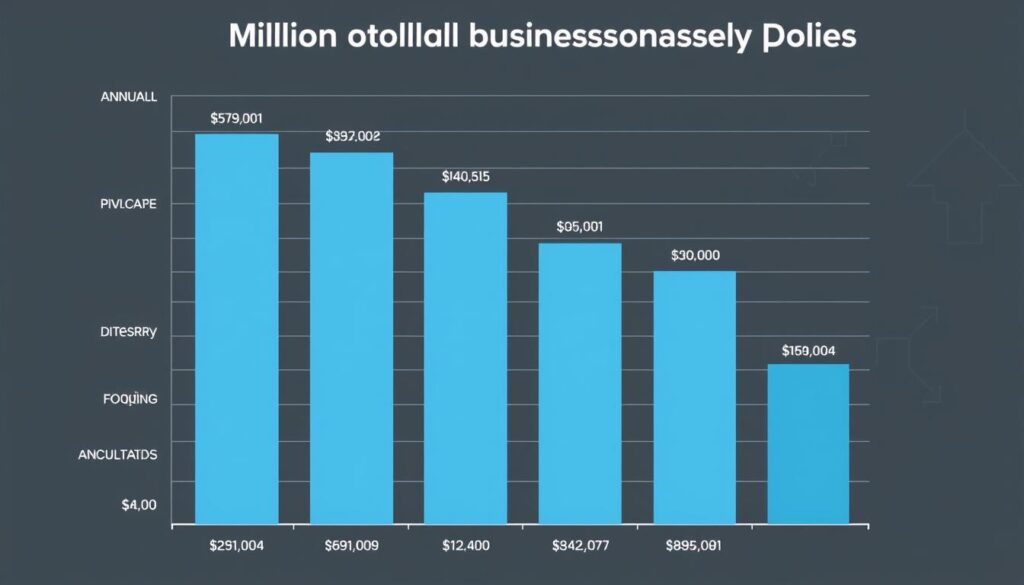

Average Cost Breakdown by Industry

| Industry | Monthly Cost | Annual Cost | Risk Level |

| Construction | $177 | $2,125 | High |

| Restaurants | $146 | $1,753 | High |

| Retail Stores | $66 | $790 | Medium |

| Cleaning Services | $133 | $1,596 | Medium-High |

| IT/Technology | $27 | $320 | Low |

| Consulting | $22 | $265 | Low |

Here’s a quick takeaway: on average, small businesses pay roughly $42 to $69 per month for a million dollar general liability policy — about $500 to $824 a year. But as the table shows, your industry can swing that number a lot. Yep — construction and restaurants tend to cost more; consultants and many tech businesses usually pay much less.

Want a quick mental example? If your restaurant premium is $146/month, that’s about $1,750 a year — roughly the cost of a couple hundred office lattes or one decent piece of kitchen equipment. Not the most fun purchase, but it beats covering a big claim out of pocket.

Remember: these are baseline business insurance numbers. Your actual rate will change depending on your claims history, how many employees you have, your location, and the specific coverage limits you pick. Think of the table as a starting point — tweak up or down based on your situation.

Find Your Exact Rate

Every business is unique. Grab a quick quote from a few insurance companies to see where you land — it only takes a few minutes.

7 Key Factors That Affect Your Million Dollar Policy Cost

Want to shave your insurance costs? First, know what actually moves the needle. Insurance companies look at a handful of things when pricing a million dollar policy — here are the big ones, explained in plain English (with real-world examples).

1. Industry Risk Level

Some industries are just riskier. Construction, roofing, and other hands-on trades face more physical dangers, so liability costs more. Insurers assign risk codes and higher-risk industries pay higher rates — no surprises there.

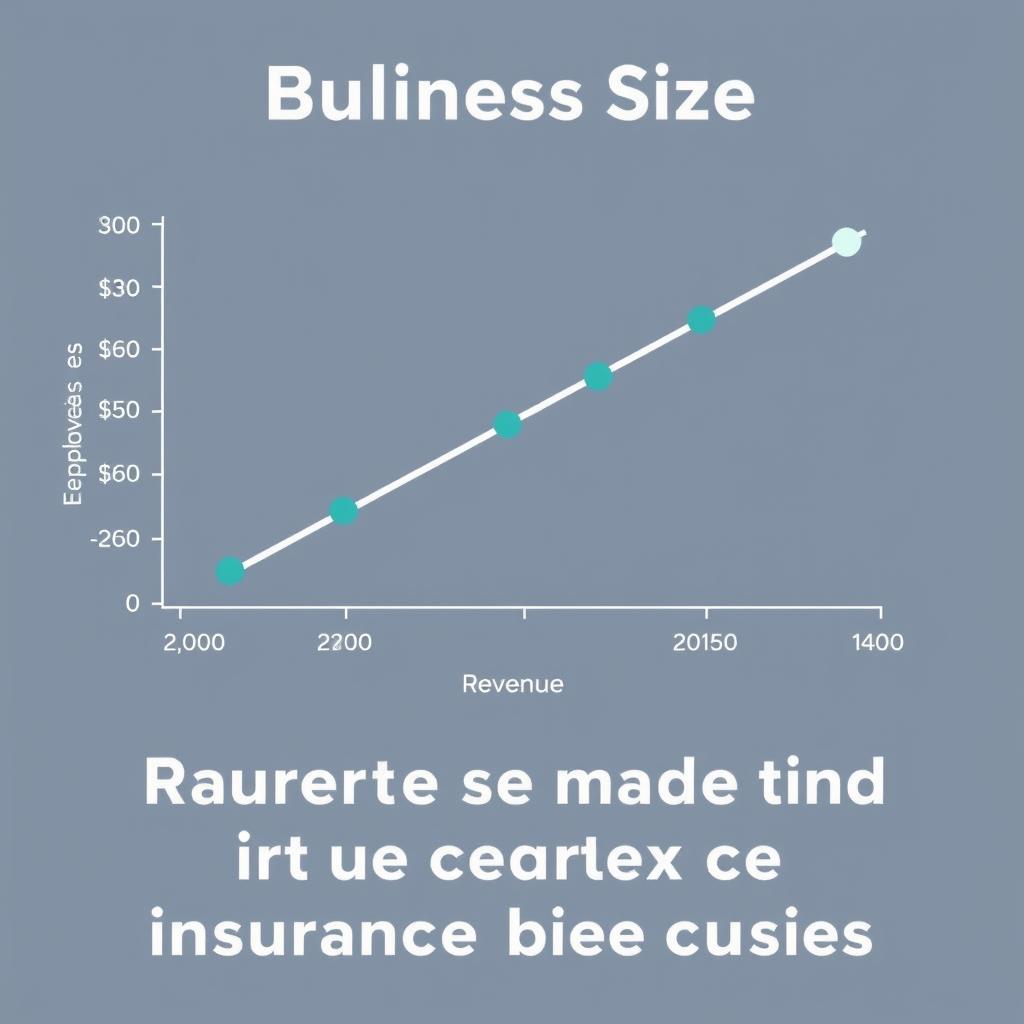

2. Business Size & Revenue

More employees and higher revenue usually mean higher premiums. Every extra employee nudges your liability exposure up, and companies doing over $1M in revenue often see noticeable premium jumps.

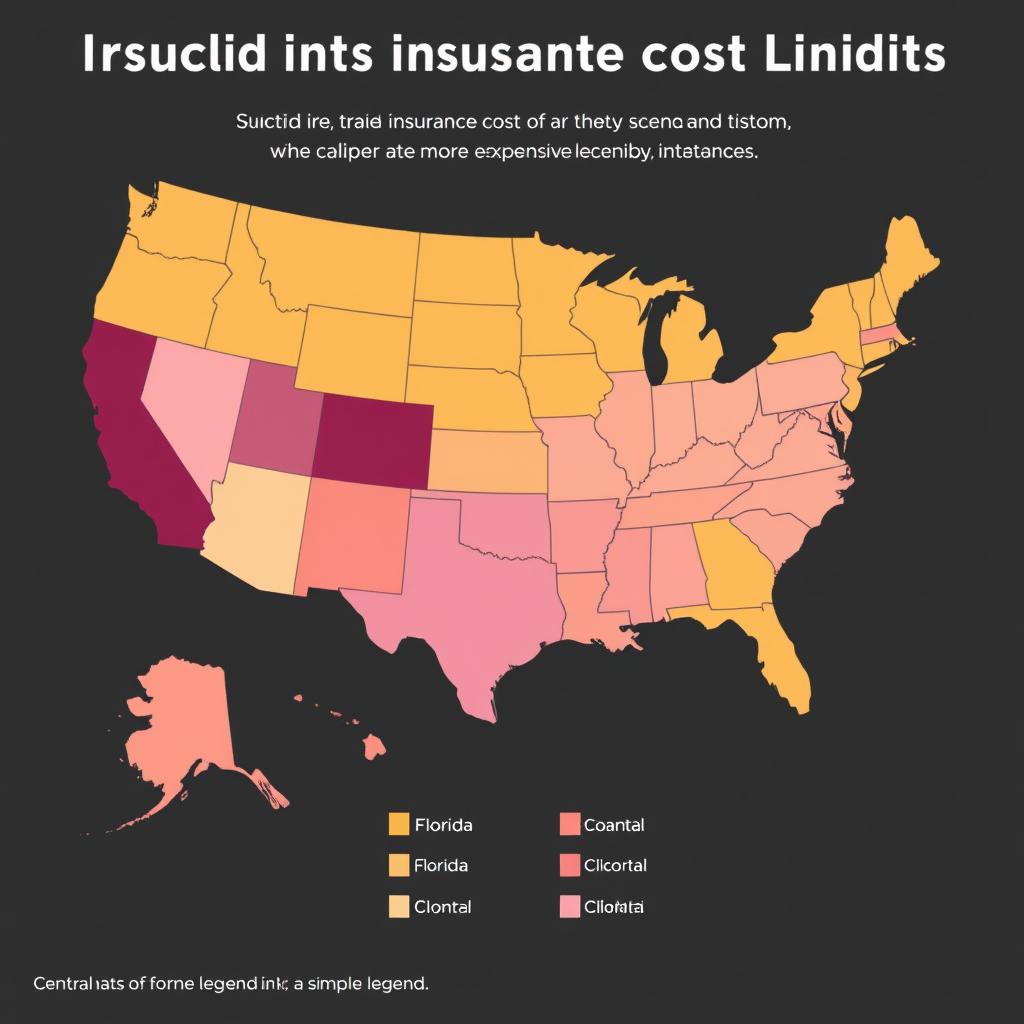

3. Location Factors

Where you operate matters. A shop in downtown Miami can pay a lot more than the same shop in rural Idaho because of local lawsuits, crime, and natural disaster risks. Location can change your rate significantly.

4. Claims History

If you’ve filed claims before, expect higher rates. A history of claims signals more risk to insurers, so premiums can climb for several years after each claim. Many small businesses weigh paying minor losses out of pocket to keep their claims history clean.

5. Coverage Limits & Deductibles

Higher limits mean higher premiums — bumping your liability from $1M to $2M typically raises the price. Conversely, choosing a higher deductible can lower your premium, but you’ll pay more out of pocket if something happens. It’s a classic trade-off: save now or gamble later.

6. Business Experience

Insurers like stability. Businesses that have been running for 5+ years usually qualify for better rates than brand-new startups, because experience often means fewer surprises and lower perceived risk.

Wondering How These Factors Affect Your Rate?

Chat with an agent who can run the numbers for your specific situation — and remember to get quotes from at least three insurance companies so you can compare rates and coverage.

7 Smart Ways to Save on Your Million Dollar Business Insurance

Needing solid coverage doesn’t mean you have to drain the bank. Here are practical, down-to-earth ways to lower your million dollar business insurance costs without leaving yourself open to huge risk.

1. Bundle Your Policies

Combine your general liability with property (a Business Owner’s Policy or BOP) and you can often save 10–15%. It’s like buying a combo meal — same coverage, usually at a discount.

2. Raise Your Deductible (Carefully)

Bumping your deductible from, say, $500 to $2,500 can cut premiums by roughly 10–20%. Pro: lower monthly cost. Con: you need cash on hand if you claim — don’t pick a deductible you can’t actually pay.

3. Implement Risk Management Practices

Install safety programs, run employee training, and document it. Insurers may offer discounts (often 5–15%) for formal risk management — and fewer incidents mean fewer claims and lower future costs.

4. Pay Annually Instead of Monthly

Many insurance companies give a 5–10% break for paying the full premium upfront. If you can swing it, one annual payment beats smaller monthly fees — like paying in cash for a bulk save.

5. Shop Around and Compare Quotes

Premiums can vary 20–30% between insurers for the same coverage. Get quotes from at least three insurance companies, or use an independent broker to do the legwork. A few minutes comparing rates can save you real money.

6. Review and Update Coverage Annually

As your business changes, so do your insurance needs. Do a yearly check: remove unneeded coverages, adjust limits, and see if you qualify for new discounts — it keeps costs aligned with actual risks.

7. Maintain a Clean Claims History

If possible, pay small losses out of pocket. Filing lots of small claims can hike premiums; a cleaner claims history could earn you “claim-free” savings over time (often a noticeable percentage).

Example quick math: if raising your deductible drops your premium by 15% on a $100/month policy, you save $15/month — $180/year. Not bad for a small change, as long as you can cover the higher deductible if something happens.

Ready to Save on Your Business Insurance?

See what different insurers would charge you — try getting three quick quotes, compare deductibles, and check which discounts you qualify for. It only takes a few minutes.

Million Dollar Policy Costs for Specific Industries

Not all businesses pay the same for a million dollar policy — your industry plays a huge role. Below are typical ranges so you can get a quick sense of what businesses like yours might expect to pay for general liability coverage.

Construction & Contractors

If you work in construction, expect higher rates — you’re in a high-risk industry. Typical costs run roughly $177 to $256 per month (about $2,125 to $3,067 a year). Specialized trades like roofers or plumbers can pay even more due to extra exposure.

Food & Hospitality

Restaurants and food businesses face lots of foot traffic and food-related risks, so premiums are higher — around $141–$146 per month (about $1,690–$1,750 a year). Food trucks often sit near that range too.

Retail Businesses

Retail is usually more affordable — think around $66 per month (about $790/year) for a standard shop. But if you sell high-end goods or have heavy customer traffic, expect higher rates.

Professional Services

Consultants, accountants, and similar pros often see some of the lowest general liability rates — commonly $22 to $40 per month ($265–$480/year). Their lower physical risk profile helps keep costs down.

IT & Technology

Tech and IT firms generally pay on the lower end for general liability — often around $27 per month (about $320/year). Many tech businesses also add cyber liability and professional liability (E&O) because contract requirements or data risk demand it.

Healthcare Providers

Medical and healthcare businesses have specialized needs; general liability typically runs $45 to $113 per month ($539–$1,352/year), but costs vary a lot by specialty, patient volume, and whether professional liability is required.

Find Industry-Specific Insurance Rates

These numbers are a good baseline, but your actual business insurance cost will depend on your coverage limits, location, claims history, and other details. Get personalized quotes to see your exact rate.

Frequently Asked Questions About Million Dollar Business Insurance

Still got questions about the cost of a million dollar business insurance policy? You’re not alone — here are the common ones, with quick answers and a little extra context so you can act on them.

Is a million dollar business insurance policy enough coverage?

TL;DR: For a lot of small businesses, yes — but not always. A

Frequently Asked Questions About Million Dollar Business Insurance

Still got questions about the cost of a million dollar business insurance policy? You’re not alone — here are the common ones, with quick answers and a little extra context so you can act on them.

Is a million dollar business insurance policy enough coverage?

TL;DR: For a lot of small businesses, yes — but not always. A $1M per occurrence / $2M aggregate general liability setup is a common baseline.

If you work in a higher-risk industry, have valuable assets, or your clients require higher limits, you might need more. Quick action: check client contracts and imagine a worst-case lawsuit — could $1M cover it? If not, bump the limits.

How much does a $1 million general liability insurance policy cost for a small business?

TL;DR: Most small businesses pay roughly $42–$69 per month (about $500–$824 a year), but it varies a lot by industry.

Low-risk firms like consultants may pay as little as $22/month; high-risk businesses, like some construction outfits, might see $177/month or more. Tip: get three quotes to find where you fall on that range.

Can I get a million dollar business insurance policy if I’m a sole proprietor or home-based business?

TL;DR: Yep. Sole proprietors and home-based businesses can often buy $1M liability coverage and usually pay less — commonly around $24–$40/month.

Even home-based operations have liability risks when clients visit or you sell products. Quick next step: list your main exposures (clients at home, shipping products, etc.) and mention them when you get quotes so the policy fits your needs.

Do I need both general liability and professional liability in my million dollar policy?

TL;DR: Maybe. They cover different stuff — so many businesses need both.

General liability covers physical injuries and property damage. Professional liability (E&O) covers mistakes, bad advice, or missed deadlines. Example: an IT consultant needs GL in case a client trips in the office, and professional liability if a software bug costs the client money. Pro tip: if you give advice or professional services, add E&O.

How can I find the cheapest million dollar business insurance policy?

TL;DR: Compare quotes, but don’t just chase the lowest price — check coverage and limits too.

Try a Business Owner’s Policy (BOP) to bundle general liability and property, use documented risk management to earn discounts, and pick deductibles that make sense for your cash flow. Work with an independent agent who can shop multiple insurance companies. Action step: get at least three quotes and compare both price and what’s actually covered.

Is the cost of million dollar business insurance tax deductible?

TL;DR: Usually yes — business insurance premiums are generally deductible as ordinary business expenses.

This typically includes general liability, professional liability, and property insurance. Keep good records of premium payments and check with a tax pro for specifics to your situation.

Still Have Questions?

Talk to an agent — they’ll walk you through what your business needs and give personalized insurance rates based on your situation.

M per occurrence / M aggregate general liability setup is a common baseline.

If you work in a higher-risk industry, have valuable assets, or your clients require higher limits, you might need more. Quick action: check client contracts and imagine a worst-case lawsuit — could

Frequently Asked Questions About Million Dollar Business Insurance

Still got questions about the cost of a million dollar business insurance policy? You’re not alone — here are the common ones, with quick answers and a little extra context so you can act on them.

Is a million dollar business insurance policy enough coverage?

TL;DR: For a lot of small businesses, yes — but not always. A $1M per occurrence / $2M aggregate general liability setup is a common baseline.

If you work in a higher-risk industry, have valuable assets, or your clients require higher limits, you might need more. Quick action: check client contracts and imagine a worst-case lawsuit — could $1M cover it? If not, bump the limits.

How much does a $1 million general liability insurance policy cost for a small business?

TL;DR: Most small businesses pay roughly $42–$69 per month (about $500–$824 a year), but it varies a lot by industry.

Low-risk firms like consultants may pay as little as $22/month; high-risk businesses, like some construction outfits, might see $177/month or more. Tip: get three quotes to find where you fall on that range.

Can I get a million dollar business insurance policy if I’m a sole proprietor or home-based business?

TL;DR: Yep. Sole proprietors and home-based businesses can often buy $1M liability coverage and usually pay less — commonly around $24–$40/month.

Even home-based operations have liability risks when clients visit or you sell products. Quick next step: list your main exposures (clients at home, shipping products, etc.) and mention them when you get quotes so the policy fits your needs.

Do I need both general liability and professional liability in my million dollar policy?

TL;DR: Maybe. They cover different stuff — so many businesses need both.

General liability covers physical injuries and property damage. Professional liability (E&O) covers mistakes, bad advice, or missed deadlines. Example: an IT consultant needs GL in case a client trips in the office, and professional liability if a software bug costs the client money. Pro tip: if you give advice or professional services, add E&O.

How can I find the cheapest million dollar business insurance policy?

TL;DR: Compare quotes, but don’t just chase the lowest price — check coverage and limits too.

Try a Business Owner’s Policy (BOP) to bundle general liability and property, use documented risk management to earn discounts, and pick deductibles that make sense for your cash flow. Work with an independent agent who can shop multiple insurance companies. Action step: get at least three quotes and compare both price and what’s actually covered.

Is the cost of million dollar business insurance tax deductible?

TL;DR: Usually yes — business insurance premiums are generally deductible as ordinary business expenses.

This typically includes general liability, professional liability, and property insurance. Keep good records of premium payments and check with a tax pro for specifics to your situation.

Still Have Questions?

Talk to an agent — they’ll walk you through what your business needs and give personalized insurance rates based on your situation.

M cover it? If not, bump the limits.

How much does a

Frequently Asked Questions About Million Dollar Business Insurance

Still got questions about the cost of a million dollar business insurance policy? You’re not alone — here are the common ones, with quick answers and a little extra context so you can act on them.

Is a million dollar business insurance policy enough coverage?

TL;DR: For a lot of small businesses, yes — but not always. A $1M per occurrence / $2M aggregate general liability setup is a common baseline.

If you work in a higher-risk industry, have valuable assets, or your clients require higher limits, you might need more. Quick action: check client contracts and imagine a worst-case lawsuit — could $1M cover it? If not, bump the limits.

How much does a $1 million general liability insurance policy cost for a small business?

TL;DR: Most small businesses pay roughly $42–$69 per month (about $500–$824 a year), but it varies a lot by industry.

Low-risk firms like consultants may pay as little as $22/month; high-risk businesses, like some construction outfits, might see $177/month or more. Tip: get three quotes to find where you fall on that range.

Can I get a million dollar business insurance policy if I’m a sole proprietor or home-based business?

TL;DR: Yep. Sole proprietors and home-based businesses can often buy $1M liability coverage and usually pay less — commonly around $24–$40/month.

Even home-based operations have liability risks when clients visit or you sell products. Quick next step: list your main exposures (clients at home, shipping products, etc.) and mention them when you get quotes so the policy fits your needs.

Do I need both general liability and professional liability in my million dollar policy?

TL;DR: Maybe. They cover different stuff — so many businesses need both.

General liability covers physical injuries and property damage. Professional liability (E&O) covers mistakes, bad advice, or missed deadlines. Example: an IT consultant needs GL in case a client trips in the office, and professional liability if a software bug costs the client money. Pro tip: if you give advice or professional services, add E&O.

How can I find the cheapest million dollar business insurance policy?

TL;DR: Compare quotes, but don’t just chase the lowest price — check coverage and limits too.

Try a Business Owner’s Policy (BOP) to bundle general liability and property, use documented risk management to earn discounts, and pick deductibles that make sense for your cash flow. Work with an independent agent who can shop multiple insurance companies. Action step: get at least three quotes and compare both price and what’s actually covered.

Is the cost of million dollar business insurance tax deductible?

TL;DR: Usually yes — business insurance premiums are generally deductible as ordinary business expenses.

This typically includes general liability, professional liability, and property insurance. Keep good records of premium payments and check with a tax pro for specifics to your situation.

Still Have Questions?

Talk to an agent — they’ll walk you through what your business needs and give personalized insurance rates based on your situation.

million general liability insurance policy cost for a small business?

TL;DR: Most small businesses pay roughly – per month (about 0–4 a year), but it varies a lot by industry.

Low-risk firms like consultants may pay as little as /month; high-risk businesses, like some construction outfits, might see 7/month or more. Tip: get three quotes to find where you fall on that range.

Can I get a million dollar business insurance policy if I’m a sole proprietor or home-based business?

TL;DR: Yep. Sole proprietors and home-based businesses can often buy

Frequently Asked Questions About Million Dollar Business Insurance

Still got questions about the cost of a million dollar business insurance policy? You’re not alone — here are the common ones, with quick answers and a little extra context so you can act on them.

Is a million dollar business insurance policy enough coverage?

TL;DR: For a lot of small businesses, yes — but not always. A $1M per occurrence / $2M aggregate general liability setup is a common baseline.

If you work in a higher-risk industry, have valuable assets, or your clients require higher limits, you might need more. Quick action: check client contracts and imagine a worst-case lawsuit — could $1M cover it? If not, bump the limits.

How much does a $1 million general liability insurance policy cost for a small business?

TL;DR: Most small businesses pay roughly $42–$69 per month (about $500–$824 a year), but it varies a lot by industry.

Low-risk firms like consultants may pay as little as $22/month; high-risk businesses, like some construction outfits, might see $177/month or more. Tip: get three quotes to find where you fall on that range.

Can I get a million dollar business insurance policy if I’m a sole proprietor or home-based business?

TL;DR: Yep. Sole proprietors and home-based businesses can often buy $1M liability coverage and usually pay less — commonly around $24–$40/month.

Even home-based operations have liability risks when clients visit or you sell products. Quick next step: list your main exposures (clients at home, shipping products, etc.) and mention them when you get quotes so the policy fits your needs.

Do I need both general liability and professional liability in my million dollar policy?

TL;DR: Maybe. They cover different stuff — so many businesses need both.

General liability covers physical injuries and property damage. Professional liability (E&O) covers mistakes, bad advice, or missed deadlines. Example: an IT consultant needs GL in case a client trips in the office, and professional liability if a software bug costs the client money. Pro tip: if you give advice or professional services, add E&O.

How can I find the cheapest million dollar business insurance policy?

TL;DR: Compare quotes, but don’t just chase the lowest price — check coverage and limits too.

Try a Business Owner’s Policy (BOP) to bundle general liability and property, use documented risk management to earn discounts, and pick deductibles that make sense for your cash flow. Work with an independent agent who can shop multiple insurance companies. Action step: get at least three quotes and compare both price and what’s actually covered.

Is the cost of million dollar business insurance tax deductible?

TL;DR: Usually yes — business insurance premiums are generally deductible as ordinary business expenses.

This typically includes general liability, professional liability, and property insurance. Keep good records of premium payments and check with a tax pro for specifics to your situation.

Still Have Questions?

Talk to an agent — they’ll walk you through what your business needs and give personalized insurance rates based on your situation.

M liability coverage and usually pay less — commonly around –/month.

Even home-based operations have liability risks when clients visit or you sell products. Quick next step: list your main exposures (clients at home, shipping products, etc.) and mention them when you get quotes so the policy fits your needs.

Do I need both general liability and professional liability in my million dollar policy?

TL;DR: Maybe. They cover different stuff — so many businesses need both.

General liability covers physical injuries and property damage. Professional liability (E&O) covers mistakes, bad advice, or missed deadlines. Example: an IT consultant needs GL in case a client trips in the office, and professional liability if a software bug costs the client money. Pro tip: if you give advice or professional services, add E&O.

How can I find the cheapest million dollar business insurance policy?

TL;DR: Compare quotes, but don’t just chase the lowest price — check coverage and limits too.

Try a Business Owner’s Policy (BOP) to bundle general liability and property, use documented risk management to earn discounts, and pick deductibles that make sense for your cash flow. Work with an independent agent who can shop multiple insurance companies. Action step: get at least three quotes and compare both price and what’s actually covered.

Is the cost of million dollar business insurance tax deductible?

TL;DR: Usually yes — business insurance premiums are generally deductible as ordinary business expenses.

This typically includes general liability, professional liability, and property insurance. Keep good records of premium payments and check with a tax pro for specifics to your situation.

Still Have Questions?

Talk to an agent — they’ll walk you through what your business needs and give personalized insurance rates based on your situation.

Protecting Your Business with the Right Coverage

Knowing roughly how much a million-dollar business insurance policy costs is a great first step. Most small businesses end up paying in the ballpark of $500–$824 per year for a $1M general liability policy, but your actual rate depends on your industry, location, size, and other risk factors.

Keep in mind: price matters, but having the right coverage when something goes wrong is priceless. One lawsuit or big accident could easily wipe out years of premium savings. Use the tips in this guide to lower your insurance costs sensibly, and lean on experienced agents to help match the policy to your business needs.

Quick checklist before you go:

- Get at least 3 quotes to compare rates and coverage.

- Review coverage limits and deductibles — don’t just chase the cheapest premium.

- Consider a BOP if you need both general liability and property coverage.

Protect Your Business Today

Get a quick price check from top insurers and see personalized rates for million dollar business insurance in minutes.