When Your Name = Your Business (And All Your Liability)

- When Your Name = Your Business (And All Your Liability)

- 5 Nightmare Scenarios Where Insurance Saves Your Bacon

- Insurance Types That Won't Make Your Eyes Glaze Over

- Bundling Secrets: How to Save Like a Pro

- What Will This Actually Cost Me? Price Comparison

- FAQ: Quick Answers Before You Panic

- The "Do I Need Insurance?" Decision Guide

- Getting Started: Your Next Steps

- The Bottom Line: Insurance Isn't Optional

When you do business under your own name, you’re operating as what’s legally known as a sole proprietorship. It’s the simplest business structure, but it comes with a major downside: there’s no separation between you and your business. That means if something goes wrong, your personal assets (yes, that includes your house, car, and savings) are fair game for lawsuits and claims.

Think of it this way: your personal savings account isn’t a force field against business mishaps. When you do business under your name without insurance, you’re essentially saying, “I’ll personally cover any damages that occur.” And trust me, those damages can add up fast.

Even if you are just starting out or have a side hustle, accepting payment for your products or services brings risk. Do I need insurance to do business under my name if I’m just getting started? Yes, liability does not consider your business size or revenue. It only takes one incident to cause a financial nightmare.

Not Sure What Insurance You Need?

Get a free, no-obligation quote tailored to your specific business needs in under 10 minutes.

5 Nightmare Scenarios Where Insurance Saves Your Bacon

Still thinking you can skip business insurance because you’re “careful” or “don’t have many clients yet”? Let me walk you through some real-world scenarios that could happen to anyone doing business under their own name:

- The Home Office Hazard: A client visits your home office for a meeting, trips over your dog’s toy, and breaks their wrist. Medical bills? $5,000. Lawsuit for pain and suffering? $25,000. Your homeowner’s insurance? They’ll likely deny the claim because it was business-related.

- The Digital Disaster: You’re a web designer who accidentally deletes a client’s entire e-commerce database during an update. Their store is down for three days, resulting in $10,000 in lost sales. Without professional liability insurance, that’s coming out of your pocket.

- The Delivery Dilemma: You use your personal car to deliver products to customers. One day, you get into a fender bender while making a delivery. Your personal auto insurance denies the claim because you were using your vehicle for business purposes.

- The Copyright Catastrophe: You unknowingly use a copyrighted image in a client’s brochure. The copyright holder sues both you and your client for $15,000. Without general liability insurance with advertising injury coverage, you’re on your own.

- The Equipment Emergency: Your $3,000 laptop and $2,000 camera—essential tools for your business—are stolen from your car. Personal insurance typically offers minimal coverage for business equipment, leaving you to replace these items out-of-pocket.

These aren’t far-fetched scenarios—they happen to real business owners every day. When you’re doing business under your name, insurance isn’t just a “nice to have”; it’s your financial safety net against these very real risks.

Insurance Types That Won’t Make Your Eyes Glaze Over

Now that I hope I’ve shown you that you need insurance for your business, let’s look at the main types of coverage to consider. I promise to keep this jargon-free and actually useful:

General Liability: The “Oops-I-Broke-It” Policy

General liability insurance is your first line of defense when doing business under your name. It covers third-party bodily injury, property damage, and advertising injury claims. Think of it as your “I accidentally broke something or hurt someone” protection.

Real-world example: A freelance photographer’s lighting equipment falls and injures a client during a photoshoot. General liability covers the client’s medical expenses and legal costs if they sue.

Typical cost: $300-$600 per year for most small businesses operating under their own name.

Professional Liability: For “My Advice Backfired” Moments

Also known as Errors and Omissions (E&O) insurance, this covers claims related to mistakes, missed deadlines, or professional negligence. If you provide any kind of service, advice, or expertise, you need this when doing business under your name.

Real-world example: A freelance accountant makes a mistake in their calculations. This causes their client to pay extra taxes and penalties. Professional liability covers the damages and legal defense.

Typical cost: $500-$1,000 per year, depending on your profession and revenue.

Protect Your Business Today

Don’t wait for a disaster to strike. Get the right insurance coverage for your business needs.

Business Property: When Your Stuff Is Your Livelihood

This covers your business equipment, inventory, and supplies against theft, damage, or destruction. When you run a business from home, your homeowner’s policy usually covers only about $500 of business property. This amount is not enough for most entrepreneurs.

Real-world example: A graphic designer’s $2,500 computer and $1,000 tablet are stolen from their car. Business property insurance covers the replacement costs.

Typical cost: $300-$500 per year for $10,000 in coverage.

Home-Based Business Insurance: When Your Office Is Also Your Living Room

If you’re wondering “do I need insurance to run a business from home under my name,” the answer is definitely yes. This specialized coverage bridges the gap between homeowner’s insurance and business insurance for those operating from their residence.

Real-world example: A client slips on your icy front steps while coming for a business meeting at your home office. Home-based business insurance covers their medical expenses, which your homeowner’s policy would likely deny.

Typical cost: $250-$500 per year for basic coverage.

Bundling Secrets: How to Save Like a Pro

Now, let’s talk about everyone’s favorite topic when it comes to insurance: saving money. Bundling your home and auto insurance can save you money. The same goes for business insurance policies. Bundling them often gives you big discounts.

Think of it like buying chips and salsa—sure, you could buy them separately, but the combo pack is almost always a better deal. Here are some smart bundling options when you do business under your name:

Business Owner’s Policy (BOP)

Combines general liability and business property insurance at a discount of 10-15% compared to buying separately.

Perfect for: Most small businesses operating under their own name with physical assets.

Professional Package

Bundles professional liability with general liability and often cyber coverage, saving 5-10%.

Perfect for: Consultants, freelancers, and service providers doing business under their name.

Home-Based Business Bundle

Combines business coverage with enhanced homeowner’s protection, often at 15-20% less than separate policies.

Perfect for: Anyone running a business from home under their own name.

Liability Package

Combines general, professional, and cyber liability at a discount of 10-15%.

Perfect for: Digital professionals and those with minimal physical assets.

Find Your Perfect Insurance Bundle

Compare customized insurance bundles from top providers and save up to 25% on your coverage.

What Will This Actually Cost Me? Price Comparison

One of the biggest objections to getting business insurance when operating under your own name is cost. But let’s put this in perspective with some real numbers:

| Profession | General Liability | Professional Liability | BOP Bundle |

| Freelance Writer | $350/year | $480/year | $700/year |

| Photographer | $425/year | $550/year | $850/year |

| Web Designer | $400/year | $750/year | $950/year |

| Consultant | $450/year | $900/year | $1,100/year |

| Handyman | $650/year | $500/year | $950/year |

Now, compare these annual premiums to the potential costs of a single claim:

Reality Check: The average slip-and-fall claim costs $20,000. A professional negligence claim averages $50,000. Most small businesses using their own name can get full coverage for under $100 a month. That’s about the cost of a few visits to a coffee shop each week.

FAQ: Quick Answers Before You Panic

Q: Do I need insurance to do business under my name if I’m just a part-time freelancer?

Yes, even part-time freelancers need insurance. Your risk exposure isn’t determined by how many hours you work—it’s based on the nature of what you do. A part-time web designer can make the same costly mistake as a full-time one. Plus, many clients require insurance regardless of your work schedule.

Q: But I work in pajamas from my couch—does that count as a “business location” that needs insurance?

Your home office absolutely counts as a business location, and your regular homeowner’s insurance likely excludes business activities. If a delivery person trips on your porch or if someone steals your business equipment, you need the right coverage. Home-based business insurance is specifically designed for pajama-wearing entrepreneurs like you.

Q: Do I need business insurance for sole proprietorship if I have an LLC instead?

Yes, you still need business insurance even with an LLC. An LLC offers some protection for your personal assets. However, it does not protect your business assets or shield you from professional liability claims. Think of an LLC as your first line of defense, and insurance as your second (equally important) line.

Q: What kind of insurance do I need to start a business under my name?

At minimum, most businesses operating under their owner’s name should have general liability insurance. Depending on your specific business, you should also consider professional liability, business property, and home-based business insurance. Start with general liability and add coverage as your business grows and evolves.

Q: Do clients really care if I have business insurance?

Increasingly, yes. Many clients—especially larger companies and government agencies—require proof of insurance before signing contracts. Having insurance signals professionalism and responsibility. Plus, clients feel more secure knowing they won’t be left holding the bag if something goes wrong with your work.

Still Have Questions?

Speak with a business insurance specialist who can answer your specific questions about insurance requirements for your situation.

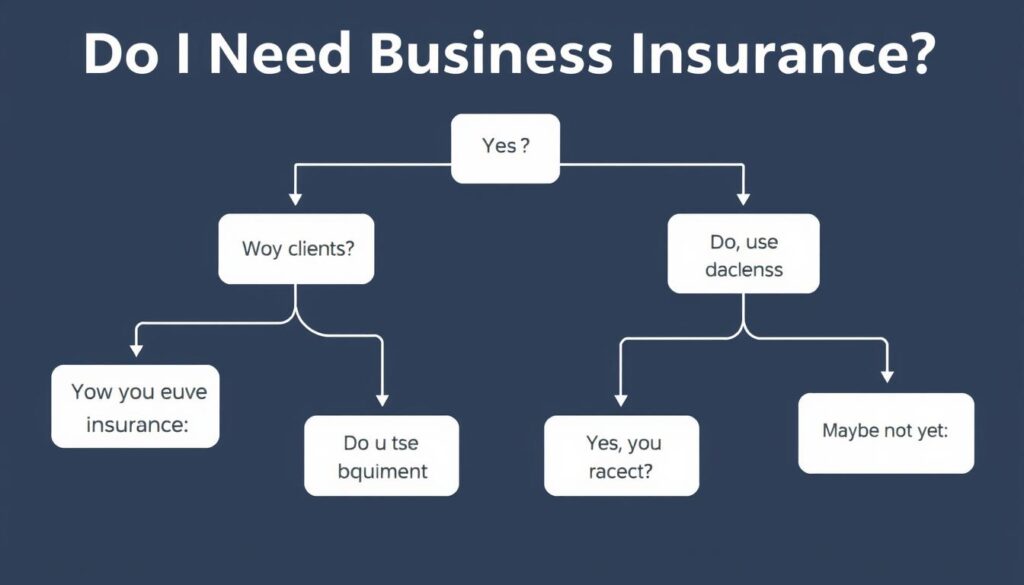

The “Do I Need Insurance?” Decision Guide

Still not sure if you need insurance to do business under your name? This simple flowchart will help you decide:

You DEFINITELY Need Insurance If:

- You interact with clients in person

- You provide professional advice or services

- You use expensive equipment for your work

- You have a home office where clients visit

- You handle client data or sensitive information

- You have contracts requiring insurance

You MIGHT Be Able to Wait If:

- You’re still in the planning stages

- You have zero clients or revenue yet

- You’re doing extremely low-risk activities

- You have minimal valuable business equipment

- You never interact with clients in person

“The time to get insurance isn’t after you’ve grown successful—it’s before the first problem occurs. Insurance is what allows small businesses to become successful businesses by surviving their inevitable growing pains.”

Getting Started: Your Next Steps

Ready to protect your business properly? Here’s how to get started with the right insurance coverage when doing business under your name:

- Assess your specific risks. Make a list of your business activities, equipment, client interactions, and potential liabilities.

- Research insurance providers that specialize in your industry. Look for companies that understand the unique needs of your profession.

- Get multiple quotes. Insurance premiums can vary significantly between providers for the same coverage.

- Ask about bundling options. Most insurers offer discounts when you purchase multiple policies.

- Review policy details carefully. Pay attention to coverage limits, deductibles, and exclusions.

Ready to Protect Your Business?

Get personalized insurance quotes from top providers in just minutes. No obligation, no hassle.

Pro Tip: When asking for quotes, have some basic information about your business ready. This includes your annual revenue, number of employees, years in business, and the services you offer. This helps ensure accurate quotes tailored to your situation.

The Bottom Line: Insurance Isn’t Optional

So, do you need insurance to do business under your name? The evidence is clear: yes, you absolutely do. Operating without proper insurance coverage puts everything you’ve worked for at risk. One accident, one mistake, or one unhappy client could wipe out your savings and derail your business dreams.

Insurance isn’t just about protection—it’s about professionalism. It shows clients you’re serious about your business and prepared for contingencies. It gives you the confidence to take on bigger projects and clients. And most importantly, it lets you sleep at night knowing that a single mishap won’t destroy everything you’ve built.

Don’t wait until after something goes wrong to get the coverage you need. A small monthly investment in good business insurance can help you grow and succeed in the long run.

Protect What You’ve Built

Join thousands of small business owners who sleep better at night knowing their business is properly protected.