Speaking as a small business owner, I get it—insurance isn’t exactly your favorite topic (I’d rather talk product launches or redesigns, too). But it’s one of those boring-but-crucial bits of business that can actually save your company when stuff goes sideways. So grab a coffee, and I’ll walk you through general liability insurance for your business in plain English—no awkward insurance-speak, just the useful stuff.

Introduction: Safeguarding Your Business from the Unexpected

- Introduction: Safeguarding Your Business from the Unexpected

- What Exactly is General Liability (GL) Insurance?

- Who Needs General Liability Insurance? Essential Scenarios & Professions

- General Liability vs. Business Owner's Policy (BOP): Choosing Your Best Fit

- General Liability Insurance Cost: What to Expect and How to Save

- How to Choose the Right General Liability Policy for Your Business

- General Liability FAQs: Answering Your Most Pressing Questions

- Adapting Your General Liability Coverage as Your Business Grows

- Conclusion: Protect Your Hard Work and Plan for Peace of Mind

Let’s be honest—running a business already has enough curveballs. The last thing you want is a lawsuit eating up your savings because someone slipped on a wet floor or your Instagram post accidentally borrows a competitor’s catchphrase. (Yikes!)

General liability insurance—aka business liability insurance or commercial general liability—is basically your business’s financial bodyguard. It helps cover third-party claims (that means people who aren’t your employees) for things like bodily injury, property damage, and advertising boo-boos. In short: if a customer gets hurt or someone else’s stuff gets damaged because of your operations, this coverage steps in.

Here’s what this guide will walk you through—quick and practical: what general liability insurance covers (and what it doesn’t), who actually needs it, how it stacks up against other business insurance options, what it might cost you, and how to pick the right coverage without overpaying. No fluff—just the stuff you need to decide if this is worth it for your business.

Not Sure If Your Business Needs Protection?

Take our quick 2-minute assessment to determine your business’s risk exposure and insurance needs.

What Exactly is General Liability (GL) Insurance?

A Core Definition:

Think of general liability insurance as the sturdy, no-nonsense part of your business insurance lineup. It’s the baseline coverage that helps protect your business from the everyday risks that happen when you interact with customers, clients, vendors, or the public. Other types of insurance cover specific needs (like your building or professional advice), but general liability covers the common stuff that can trigger claims against your business.

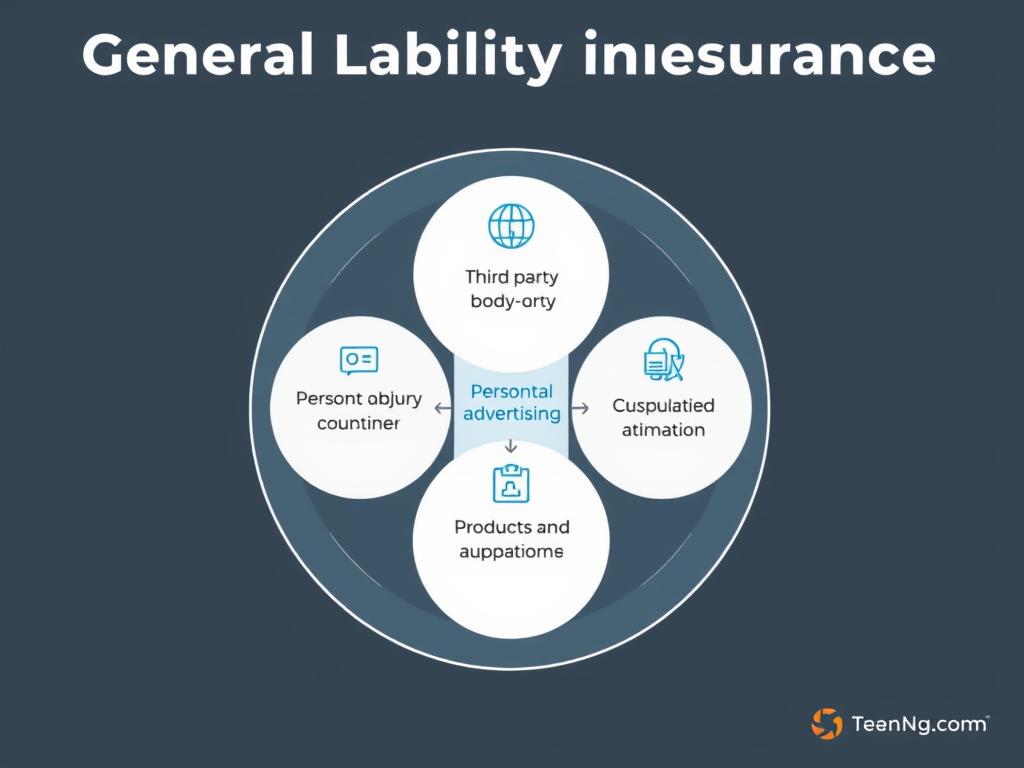

Key Coverages of General Liability Insurance (with Examples):

Third-Party Bodily Injury

This pays medical bills and legal fees if someone who isn’t your employee gets hurt on your premises or because of your operations.

Real-world example: Imagine a customer slips on a freshly mopped floor and breaks their arm. General liability can cover their medical costs and defend you if they sue. Short takeaway: covers people getting hurt.

Third-Party Property Damage

Helps pay to repair or replace someone else’s property that you or your staff accidentally damage while working.

Real-world example: An employee installing software knocks coffee into a client’s pricey computer. GL insurance would help cover the replacement. Short takeaway: covers damage to other people’s stuff, not yours.

Personal and Advertising Injury

Covers non-physical harms like libel, slander, or accidental copyright issues in your advertising or marketing.

Real-world example: Your marketing post borrows a slogan that’s too close to a competitor’s — if they sue for copyright or slander, this coverage helps with legal costs. Short takeaway: protects your ads and reputation-related slip-ups.

Products-Completed Operations

Applies when something you sold or a job you finished later causes injury or damage to someone else.

Real-world example: You sell water bottles and a design flaw causes leaks that ruin a customer’s belongings. Claims from that incident could be covered. Short takeaway: covers harm from your products or completed work (but not recalls).

What General Liability Insurance Typically Doesn’t Cover (and What Does):

- Damage to your own property — that’s commercial property insurance or property insurance in a BOP

- Employee injuries or illnesses — workers’ compensation covers that

- Professional mistakes or negligence — look at professional liability insurance (errors & omissions)

- Business-related auto accidents — get commercial auto insurance

- Illegal acts — intentional wrongdoing is excluded from all policies

- Cyber attacks or data breaches — you’ll need specialized cyber insurance

- Employment disputes — employment practices liability insurance handles discrimination or wrongful termination claims

- Product recalls — recall coverage is separate from standard GL

Pro Tip: A lot of small business owners mix up general liability and professional liability. Quick rule: general liability handles physical risks (injury, property damage, advertising injury), while professional liability (errors & omissions) covers financial losses from mistakes in your services or advice. If you do both in-person work and give professional advice, you might need both types of coverage.

Who Needs General Liability Insurance? Essential Scenarios & Professions

Is GL Insurance Legally Required? (The “Not Always, But Often” Truth):

Short answer: most of the time, no—general liability insurance for my business isn’t usually mandated by federal or state law the way auto insurance or workers compensation can be. That said, “not legally required” doesn’t mean “not necessary.”

Why? Lots of third parties effectively make it a requirement. Even if a law doesn’t force you, contracts, landlords, and clients often will.

Crucial Requirements from Third Parties:

- Commercial Landlords: Try signing a lease without proof of general liability insurance — most landlords will ask for a certificate of insurance before handing over keys.

- Business Clients/Contracts: Bigger clients and vendors commonly require vendors and contractors to carry liability insurance as part of the contract.

- Licensing Boards: Some professional licenses or permits demand proof of coverage.

- Government Contracts: Want to bid on government work? Expect insurers to be on the checklist.

- Industry Standards: In many sectors, carrying general liability is considered simply good business practice.

Common Scenarios Where GL is Crucial for Protection:

Ask yourself: do any of these sound like you? If yes, you’re a strong candidate for general liability coverage.

You Have a Physical Location

If customers, clients, vendors, or delivery drivers come to your place, slip-and-fall or other accidents are real risks. If someone gets hurt, general liability helps cover medical bills and legal fees. (Quick anecdote: a friend of mine had to show a COI to their landlord before moving into a retail unit — no COI, no lease.)

You Work at Client Sites

If you or employees handle work at clients’ locations or touch client property, you could be on the hook for damage or injury that happens while you’re there. GL helps protect your business from those third-party claims.

You Advertise Your Business

Running ads or posting on social? Advertising injury claims (like accidental copyright or slogan disputes) can happen. General liability can step in to cover defense costs and settlements for these ad-related claims.

You Use Independent Contractors

Even if freelancers or subcontractors do the work, you can be named in a claim. Having general liability reduces the risk that a contractor’s mistake turns into a business-threatening lawsuit.

You Sell Products

Manufacturing, selling, or distributing products exposes you to product-related claims. Products-completed operations coverage—part of many GL policies—helps cover resulting property damage or injuries.

You’re Open to the Public

If your business has foot traffic (retail, restaurants, cafes, events), your odds of a third-party injury claim go up. GL is a key layer of protection.

Professions That Highly Benefit from General Liability:

Almost any business can benefit, but these folks usually find GL essential:

- Contractors (all types)

- Landscapers

- Cleaning services

- Restaurants & cafes

- Retail stores

- Event planners

- Photographers

- IT consultants

- Real estate agents

- Marketing agencies

- Fitness instructors

- Home service providers

- Freelancers who meet clients in person

- Graphic designers

- Web developers

- Tutors & instructors

- Food truck operators

- Consultants

Wondering if your specific business needs general liability insurance?

Get a personalized recommendation based on your industry, business size, and specific risk factors.

General Liability vs. Business Owner’s Policy (BOP): Choosing Your Best Fit

Understanding the “GL Plus” Concept:

When you’re shopping for business insurance, you’ll usually see two routes: buy standalone general liability insurance or go with a business owner’s policy (BOP). Think of a BOP as “GL plus” — it bundles general liability with other core coverages into one package. Often that bundle costs less than buying each policy separately, but as always, shop around.

It’s the meal-kit vs. grocery-aisle decision: the meal kit (BOP) hands you the basics wrapped up and ready, while à la carte (standalone GL) lets you pick only what you want.

What a BOP Typically Bundles:

General Liability Insurance

The standard third-party protection—bodily injury, property damage, and advertising injury claims are covered here.

Commercial Property Insurance

Covers your business building (if you own it) and assets like inventory, equipment, and furniture against fire, theft, vandalism, and some weather damage.

Business Interruption Insurance

Replaces lost income if a covered event (say, a fire) forces your business to close temporarily—helpful to keep paying bills and employees during downtime.

Optional Coverages You Can Add to a BOP:

Many insurers let you tack on extras so your BOP fits your specific needs:

- Cyber insurance for data breaches

- Employee theft coverage for internal fraud

- Equipment breakdown coverage for mechanical failures

- Forgery coverage for financial document fraud

- Spoiled merchandise coverage for perishable inventory

- Professional liability if your services carry advice-related risk

GL vs. BOP: Detailed Comparison Table:

| Feature | General Liability | Business Owner’s Policy (BOP) |

| Core Coverage | Third-party bodily injury, property damage, personal/advertising injury | GL + Commercial Property + Business Interruption |

| Focus | Third-party liability risks only | Broader protection for common small business risks |

| Included Policies | Stand-alone liability policy | Bundle of multiple coverages |

| Cost-Effectiveness | Lower upfront if you only need liability | Often more affordable than buying separate policies |

| Recommended For | Businesses with minimal property or no physical location | Small to mid-size businesses with a location and assets |

How to Decide: Which Policy is Right for Your Business?

Choose General Liability If:

- You have no physical premises or significant business assets — you mainly provide services.

- You mostly work at client sites and don’t store inventory.

- You’re tight on budget and only need liability coverage.

- Your landlord only asks for liability coverage.

- You’re a sole proprietor/freelancer with minimal equipment.

Choose a BOP If:

- You own or rent a physical business location with customers or inventory.

- You have valuable equipment or inventory to protect.

- You want coverage for lost income if your business must pause after a covered event.

- You want the convenience and cost savings of one combined policy.

- You’d like room to add extras like cyber or equipment breakdown coverages.

“As a small business owner, I initially just wanted general liability insurance. But when I saw that a BOP would also protect my equipment and cover lost income if we had to close temporarily—all for just about 15% more—it was a no-brainer to go with the bundle.”

General Liability Insurance Cost: What to Expect and How to Save

Alright, let’s talk money — because I know that’s the part everyone fast-forwards to. The good news: general liability insurance is usually pretty affordable for most small businesses, especially when you compare it to the cost of defending a claim or covering damages out of pocket.

Average Costs for Small Businesses:

Industry data shows small businesses typically pay somewhere between $300 and $1,000 per year for general liability insurance — roughly $25–$85 per month. Your actual price will depend on your business type, location, and how risky your operations are.

Quick Cost Snapshot: Many small businesses end up paying about $400–$600 annually for a standard $1 million per occurrence / $2 million aggregate policy. That’s around $33–$50/month — probably less than your coffee habit.

Key Factors That Influence Your GL Premium:

Risk Exposure / Type of Business

This matters most. High-risk industries (construction, restaurants) pay more than low-risk ones (consulting, bookkeeping) because the chance of injury or property damage is higher.

Business Location

Premiums vary by state and even by zip code — more litigation, higher living costs, or frequent natural hazards can raise rates.

Years in Business / Experience

Brand-new businesses usually pay more; established companies with clean records often get better rates.

Coverage Limits & Deductibles

Higher limits or lower deductibles = higher premiums. Typical baseline is $1M/$2M, but you may need more depending on your exposure.

Claims History

Previous claims can bump up your price. A clean claims record helps keep premiums down.

Average Annual Premiums by Industry:

To give you some context, here are sample averages (sourced from industry data):

| Industry | Average Annual Premium for General Liability Insurance |

| Business Consulting | $780 |

| Accountants | $675 |

| Engineering | $595 |

| Retail Stores | $696 |

| Restaurants | $2,408 |

| Manufacturers | $651 |

| Photographers | $437 |

What You Might Pay — Mini Scenarios

Just to make it tangible:

- Low-risk freelancer (e.g., consultant): could be toward the lower end — $300–$500/yr.

- Retail store with foot traffic: mid-range — $500–$800/yr depending on location and inventory.

- Restaurant or high-risk contractor: much higher — potentially $1,500–$3,000+/yr.

Strategies to Potentially Reduce Your General Liability Insurance Costs:

Want to lower that premium? These moves often help:

Bundle Policies

Combining coverages (like in a BOP) often nets a discount versus buying separate policies.

Choose Higher Deductibles

Opting for a bigger deductible lowers your premium — just be sure you can cover it if you ever claim.

Implement Safety Protocols

Good safety and risk-management practices can qualify you for better rates.

Pay Annually

Many insurers offer a small discount if you pay the annual premium in one shot instead of monthly.

Shop Around

Quotes can vary a lot. Compare multiple insurers to find the best value for the coverage you need.

Work with an Agent

An experienced insurance agent can match coverage to your risks and sometimes find discounts you wouldn’t spot alone.

Ready to see how affordable general liability insurance can be?

Get personalized quotes from top-rated providers based on your specific business needs.

How to Choose the Right General Liability Policy for Your Business

Picking the right general liability insurance isn’t just about finding the cheapest policy—it’s about getting the coverage that actually fits your business. Below is a friendly, step-by-step checklist to help you figure out what you need and why.

Step-by-Step Guide to Smart Coverage:

-

Assess Your Business Risks

What could realistically go wrong in your day-to-day? Do customers visit your space? Do you work at client sites? Do you sell products? Figure out the main risks first—this makes choosing coverage way easier.

-

Determine Your Specific Coverage Needs

Match your risks to coverage: retail shops prioritize slip-and-fall protection, while ad agencies might care more about advertising injury. Be specific so you don’t pay for stuff you don’t need.

-

Review Policy Limits (Per Occurrence & Aggregate)

Policies usually list a per-occurrence limit (what they pay for any one claim) and an aggregate limit (total they’ll pay in a year). Common baseline is $1M per occurrence / $2M aggregate—good for many small businesses, but a restaurant or contractor may want higher.

-

Evaluate Exclusions and Endorsements

Every policy has exclusions—things it won’t cover. Read those sections. If there’s a gap, ask about endorsements (extra coverage you can add) to plug it.

-

Compare Providers and Policies

Get quotes from multiple insurers and compare the actual coverage, not just the price. Reputation and claims service matter—cheaper isn’t better if your claim gets tied up for months.

-

Understand the Total Cost

Look at both premium and deductible. Lower premium can mean a higher deductible, so make sure the out-of-pocket amount is something you’d handle if a claim happens.

-

Consult with an Insurance Agent/Broker

An experienced agent can explain tricky terms, show you real-world examples, and sometimes find discounts or package deals (policies you can’t easily get on your own).

-

Consider Bundling Policies

Bundling general liability with other coverages (like commercial property in a BOP) often saves money and simplifies management.

-

Read the Fine Print

Before you sign, read the full policy. Confirm limits, exclusions, and any conditions you must meet. If anything’s unclear, ask until it isn’t.

-

Review Your Policy Regularly

Set a calendar reminder to revisit your coverage annually or whenever your business changes—hiring employees, adding locations, or launching new products all affect your risk.

Insurance Tip: When comparing quotes, make sure you’re comparing identical coverage limits and deductibles. A cheaper policy may actually be skimping on protection.

Quick Examples to Help You Decide

- Photographer: usually OK with a $1M/$2M policy if they mostly meet clients and do shoots—consider adding equipment coverage separately.

- Restaurant: consider higher limits and additional coverage (like commercial property and higher liability limits) because of food and foot-traffic risks.

“The biggest mistake I see small business owners make is focusing solely on price when choosing general liability insurance. The few dollars you save per month won’t matter if you face a claim that isn’t covered because you chose inadequate protection.”

General Liability FAQs: Answering Your Most Pressing Questions

Does general liability insurance cover theft?

Short answer: no. General liability insurance covers third-party injuries and damage, not theft of your own stuff. If you want protection for stolen equipment, inventory, or business property, look at commercial property insurance or a BOP that includes property coverage.

Is general liability insurance tax deductible?

Yep—most of the time premiums for general liability are tax-deductible as a normal business expense. Still, check with your accountant or tax pro to make sure you’re applying current rules correctly.

Can I get general liability insurance online quickly?

Absolutely. Many insurers offer online quotes and buy flows—you can sometimes get a quote and policy in 10–15 minutes if your business is straightforward. You’ll need basic info like industry, revenue, employees, and location. Immediate proof of insurance is often available after purchase, though options vary by carrier.

What information do I need to apply for GL insurance?

Here’s the usual checklist:

- Legal business name and structure (LLC, sole proprietor, etc.)

- Business tax ID (if you have one)

- Physical address and contact info

- Years in business

- Number of employees

- Annual revenue (actual or projected)

- Short description of your business activities

- Previous insurance history and any past claims

How do General Liability and Professional Liability (E&O) differ for freelancers?

Great question—and a common point of confusion. In simple terms:

- General liability insurance covers physical risks: a client trips at your studio, or you accidentally damage a client’s equipment.

- Professional liability (errors & omissions) covers mistakes in your work that cause a client financial loss—like bad advice, missed deadlines, or errors in deliverables.

Many freelancers need both, depending on how they work. If you meet clients in person and also provide professional services, consider bundling both types of coverage.

Still have questions about general liability insurance?

Talk to a licensed insurance agent who can give tailored answers for your business.

Adapting Your General Liability Coverage as Your Business Grows

Why Growth Means Rethinking Insurance:

Your business changes fast — and your insurance should keep up. The policy that fit your one-person hustle might not cut it once you add employees, locations, or new services. Think of insurance like a suit: good for now, awkward later if you don’t resize it.

Key Growth Milestones and Their Insurance Impact:

New Location(s)

Opening another storefront or office usually increases your liability exposure — different building layouts, more customers, new local rules.

Quick action: Contact your agent and update your policy to list the new location so it’s covered.

Hiring Employees

More people = more ways things can go wrong. Plus, once you hire, you may need workers’ compensation depending on your state rules.

Quick action: Review your general liability limits and add workers’ compensation if required; your agent can help confirm state requirements.

Introducing New Products or Services

New offerings often bring new risks — product defects, service mistakes, or different customer expectations.

Quick action: Ensure your GL policy covers the new activities and consider product liability or professional liability if appropriate.

Buying or Leasing New Equipment

Big-ticket gear or vehicles changes your asset profile and may need extra coverage like commercial auto or inland marine for portable equipment.

Quick action: Add property coverage for new assets and check whether specialty policies are needed.

Increased Revenue & Client Base

More customers and visibility can mean a higher chance of claims — you might need higher limits or an umbrella policy to stay protected.

Quick action: Reassess limits and consider a commercial umbrella to extend protection above your base policy.

Important: Schedule an insurance review at least once a year or whenever something big changes. Many business owners forget to update policies and end up with gaps that leave them exposed.

Conclusion: Protect Your Hard Work and Plan for Peace of Mind

So—do you need general liability insurance for your business? For most business owners, the short answer is yes. It might not be legally required the way auto insurance or workers’ comp can be, but general liability provides protection against many common and costly risks your business could face.

Think of general liability insurance as an investment in your business’s future, not just another monthly bill. For a relatively small premium—often less than your team’s coffee tab—you get coverage that can stop a claim from turning into a bankruptcy-level problem.

Quick takeaways:

- General liability insurance protects against third-party claims for bodily injury, property damage, and advertising injury.

- It may not be legally required everywhere, but leases, contracts, and industry standards often make it effectively mandatory.

- Consider a business owner’s policy (BOP) if you also need commercial property and business interruption protection.

- Costs vary by industry and risk, but general liability is usually affordable for most small businesses.

- As your business grows, review your coverage and limits so you stay properly protected.

The business world is unpredictable, and even careful owners can’t prevent every mishap. General liability insurance helps you focus on growth, knowing you’ve got a financial backstop if something goes wrong.

Ready to protect your business? Take the next step—your future self will thank you.

Ready to protect your business?

Get personalized general liability insurance quotes from top-rated providers in just minutes.