In this comprehensive guide, we’ll demystify CSL auto insurance, explain how it differs from split limit policies, and help you determine which option might provide better protection for your unique circumstances. With rising medical costs and increasingly expensive vehicle repairs, choosing the right liability coverage structure has never been more important for your financial security.

To fully grasp the implications of what is csl in auto insurance, understanding the differences in liability coverage options is essential.

The Foundation: Understanding Auto Liability Insurance

- The Foundation: Understanding Auto Liability Insurance

- Decoding Split Limit Liability Insurance

- What is CSL in Auto Insurance? Combined Single Limit Explained

- CSL vs. Split Limits: Which Offers Better Protection?

- How to Choose Between CSL and Split Limit Auto Insurance

- Beyond Liability: Creating a Comprehensive Auto Insurance Plan

- Making an Informed Decision About Your Auto Liability Coverage

Before diving into the specifics of CSL in auto insurance, it’s essential to understand the basic components of auto liability coverage. Liability insurance is designed to protect you financially if you’re at fault in an accident that causes injuries to others or damage to their property.

Bodily Injury Liability Coverage

Bodily injury liability provides coverage for injuries you cause to others in an at-fault accident. This can include medical expenses, lost wages, and in some cases, compensation for pain and suffering. Without adequate bodily injury coverage, you could be personally responsible for these costs, which can quickly escalate into hundreds of thousands of dollars.

Property Damage Liability Coverage

Property damage liability covers the cost of repairing or replacing another person’s property that you damage in an accident. This typically includes their vehicle but can also extend to structures like fences, buildings, or utility poles. With today’s vehicles often costing $30,000 or more, having sufficient property damage coverage is crucial.

It’s important to note that liability insurance does not cover your own injuries or damage to your vehicle. For those protections, you would need additional coverages like personal injury protection, medical payments, collision, or comprehensive coverage.

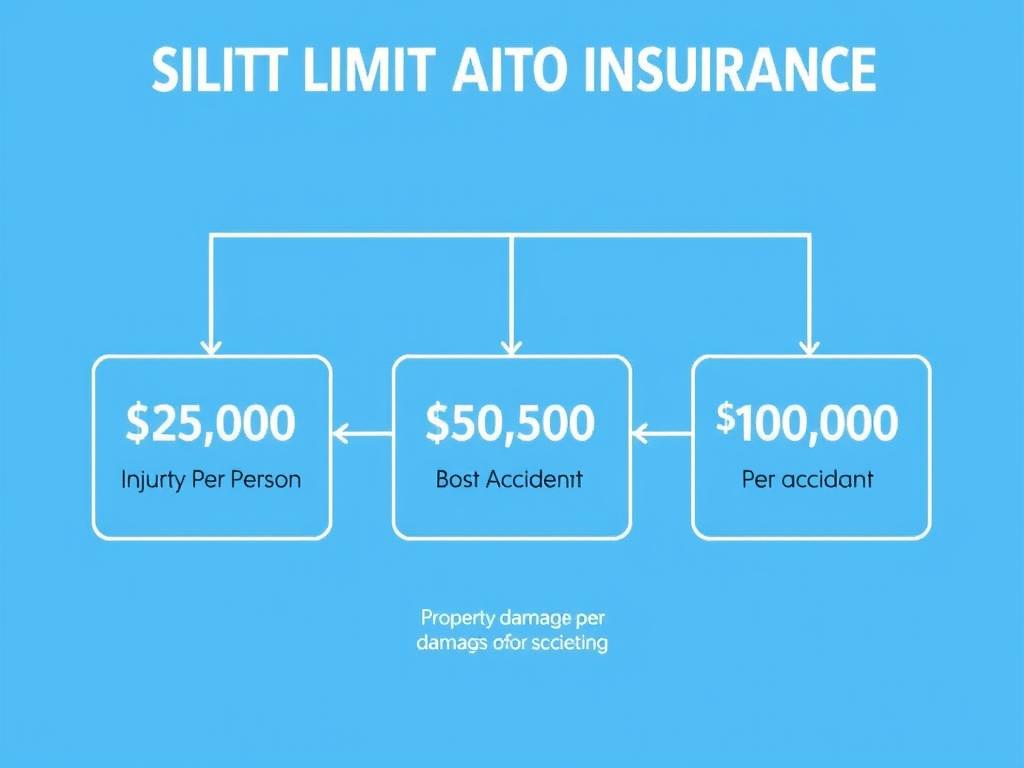

Decoding Split Limit Liability Insurance

When you look at your auto insurance policy, you might see liability limits expressed as three numbers, such as 100/300/50. This format represents what’s known as “split limits” for your liability coverage. Understanding what these numbers mean is essential for assessing whether your coverage is adequate.

The Three Numbers Explained

In a split limit policy, the three numbers represent different aspects of your liability coverage:

- The first number indicates the maximum amount your insurance will pay for bodily injury per person in an accident (e.g., $100,000).

- The second number represents the maximum total payout for bodily injury per accident, regardless of how many people are injured (e.g., $300,000).

- The third number shows the maximum amount for property damage per accident (e.g., $50,000).

How Split Limits Work in Practice

Let’s consider a scenario with a 100/300/50 split limit policy: If you cause an accident that injures two people, with one person having $90,000 in medical bills and the other having $250,000, your insurance would cover the first person’s bills completely but only $100,000 of the second person’s expenses (due to the per-person limit). The total payout would be capped at $300,000 for injuries, even if the combined medical costs exceed that amount.

Additionally, if you damaged the other party’s vehicle worth $45,000, your property damage coverage would likely cover it. However, if you hit a luxury vehicle worth $75,000, your $50,000 property damage limit would leave you personally responsible for the remaining $25,000.

What is CSL in Auto Insurance? Combined Single Limit Explained

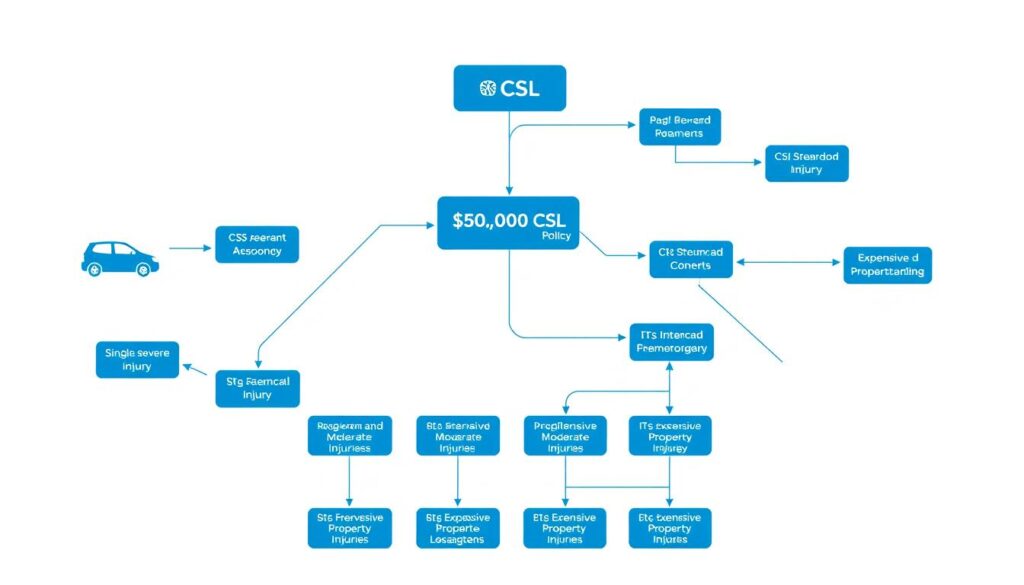

A Combined Single Limit (CSL) policy takes a different approach to liability coverage. Instead of separating your coverage into three distinct limits, CSL provides one aggregate limit that can be used for any combination of bodily injury and property damage claims resulting from a single accident.

CSL Auto Insurance Definition

CSL in auto insurance refers to a policy structure that provides a single dollar amount of coverage that applies to all bodily injury and property damage liability claims combined. For example, a policy with a $300,000 CSL means you have up to $300,000 in total coverage for all damages—both bodily injury and property damage—arising from a single accident.

How CSL Insurance Coverage Works

With a CSL policy, there’s greater flexibility in how your coverage is applied. Using our previous example, if you had a $300,000 CSL policy and caused an accident where one person had $250,000 in medical expenses and you also caused $50,000 in property damage, your policy would cover the entire amount.

The key advantage of CSL insurance coverage is that it doesn’t restrict how much can be allocated to bodily injury per person or property damage specifically. The entire limit is available to be used as needed, which can be beneficial in accidents with significant injuries or expensive property damage.

What does CSL mean in auto insurance policy? It means you have a single pool of funds that can be allocated flexibly between bodily injury and property damage claims, rather than having separate limits for each type of damage.

CSL vs. Split Limits: Which Offers Better Protection?

| Feature | Combined Single Limit (CSL) | Split Limits |

| Format | One number (e.g., $300,000) | Three numbers (e.g., 100/300/50) |

| Flexibility | High – entire limit available for any combination of claims | Limited – separate caps for bodily injury per person, per accident, and property damage |

| Best For | Accidents with significant injuries to one person or expensive property damage | Accidents involving multiple people with moderate injuries |

| Premium Cost | Generally higher | Generally lower |

| Underinsurance Risk | Lower for single severe claims | Higher if one category of damage exceeds its sub-limit |

When CSL Offers Better Protection

Understanding how CSL works in auto insurance claims is crucial for determining when it might be the better option. CSL policies typically provide superior protection in scenarios where:

- You cause serious injuries to a single person that exceed the per-person limit of a comparable split limit policy

- You damage expensive property, such as a luxury vehicle or commercial building

- You want simpler coverage without worrying about separate sub-limits

When Split Limits Might Be Preferable

Split limit policies could be more advantageous when:

- You’re primarily concerned about accidents involving multiple people with moderate injuries

- You’re looking to minimize premium costs while maintaining state-required coverage

- You have other assets protection strategies in place, such as an umbrella policy

Expert Tip: When comparing a CSL policy to a split limit policy, a good rule of thumb is to compare the CSL amount to the sum of the second and third numbers in the split limit. For example, a $300,000 CSL might be roughly comparable to a 100/300/100 split limit in terms of total coverage available.

How to Choose Between CSL and Split Limit Auto Insurance

Selecting between CSL and split limit auto insurance requires careful consideration of several factors. Here are the key elements to evaluate when making your decision:

Assess Your Risk Profile

Consider your driving habits, the areas where you typically drive, and your potential exposure to high-value vehicles or property. If you frequently drive in affluent areas with expensive vehicles or in dense urban environments with higher accident rates, a CSL policy might offer better protection against catastrophic claims.

Evaluate Your Assets

The more assets you have to protect, the more liability coverage you need. If you own a home, have investments, or have significant savings, you’ll want to ensure your auto liability coverage is sufficient to protect these assets from potential lawsuits following an accident.

CSL Advantages

- Greater flexibility in how coverage is applied

- Better protection for single severe injury claims

- Simpler to understand with one coverage limit

- May provide more total coverage in certain scenarios

CSL Limitations

- Usually comes with higher premiums

- May be excessive for low-risk drivers

- Total limit can be exhausted by multiple claims

- Less common in personal auto policies

Consider Premium Costs

Generally, CSL policies come with higher premiums than split limit policies with comparable coverage. However, the additional cost may be worth it for the extra flexibility and potential protection. Request quotes for both types of policies with comparable coverage levels to determine the actual price difference.

Consult with an Insurance Professional

The difference between CSL and split limit auto insurance can be nuanced, and the best choice depends on your specific circumstances. A licensed insurance agent can help you evaluate your needs and recommend the most appropriate coverage structure for your situation.

Beyond Liability: Creating a Comprehensive Auto Insurance Plan

While understanding what CSL means in auto insurance policy terms is important, liability coverage is just one component of a comprehensive auto insurance plan. To ensure complete protection, consider these additional coverages:

Collision Coverage

Pays for damage to your vehicle resulting from a collision with another vehicle or object, regardless of who is at fault. This coverage is particularly important for newer or more valuable vehicles.

Comprehensive Coverage

Covers damage to your vehicle from non-collision incidents such as theft, vandalism, fire, natural disasters, or animal collisions. Like collision coverage, this is essential for protecting the value of your vehicle.

Uninsured/Underinsured Motorist Coverage

Protects you if you’re in an accident with a driver who has no insurance or insufficient coverage to pay for your damages and injuries. This coverage is especially important given the high number of uninsured drivers on the road.

Medical Payments or Personal Injury Protection

Covers medical expenses for you and your passengers regardless of who is at fault in an accident. Some states require Personal Injury Protection (PIP) as part of their no-fault insurance systems.

The Value of Umbrella Policies

For many drivers, especially those with significant assets to protect, an umbrella policy can provide an additional layer of liability protection beyond what’s offered by auto and home insurance policies. These policies typically offer $1 million or more in additional coverage at a relatively affordable rate.

Making an Informed Decision About Your Auto Liability Coverage

Understanding what CSL in auto insurance means is an important step in ensuring you have the right coverage for your needs. While CSL policies offer greater flexibility in how your coverage is applied, split limit policies may provide adequate protection at a lower cost depending on your specific circumstances.

Remember that state minimum requirements are rarely sufficient to protect you adequately in the event of a serious accident. With rising medical costs and increasingly expensive vehicles on the road, having robust liability coverage—whether through a CSL or split limit policy—is essential for protecting your financial future.

Get Expert Guidance on Your Auto Insurance Options

Still unsure whether a CSL or split limit policy is right for you? Our licensed insurance professionals can help you evaluate your needs and find the optimal coverage for your situation.

What does CSL mean in auto insurance policy documents?

CSL stands for Combined Single Limit, which means your policy provides one aggregate limit for all bodily injury and property damage claims arising from a single accident, rather than separate limits for each type of damage.

Is CSL auto insurance more expensive than split limit coverage?

Generally, yes. CSL policies typically come with higher premiums than split limit policies with comparable coverage levels due to the greater flexibility they offer in how the coverage can be applied.

How do I know if I have enough liability coverage?

A good rule of thumb is to have enough liability coverage to protect your assets in the event of a lawsuit. Consider the value of your home, savings, and investments when determining appropriate coverage levels. Many financial advisors recommend having at least $300,000 in liability coverage, with an umbrella policy for additional protection if you have significant assets.