What You’ll Learn in This Guide

- What You'll Learn in This Guide

- What Does "Full Coverage" Auto Insurance Actually Mean?

- Average Auto Insurance Rates in 2025 for Full Coverage

- 7 Expert Strategies to Get the Best Rate on Auto Insurance Online

- Maximize Savings with Auto and Home Insurance Bundles

- Is Full Coverage Auto Insurance Worth It? When You Need It

- Understanding Your Auto Insurance Full Coverage Policy

- How to Compare Auto Insurance Full Coverage Providers

- Frequently Asked Questions About Full Coverage Auto Insurance

- Frequently Asked Questions About Full Coverage Auto Insurance

- Frequently Asked Questions About Full Coverage Auto Insurance

- Making the Right Choice for Your Auto Insurance Needs

- What “full coverage” auto insurance actually includes

- Average auto insurance rates in 2025 for full coverage policies

- How to find the best rate on auto insurance online

- When full coverage is worth the investment (and when it’s not)

- How auto and home insurance bundles can maximize your savings

- Expert strategies to lower your premiums without sacrificing protection

What Does “Full Coverage” Auto Insurance Actually Mean?

The term “full coverage” can be misleading since it doesn’t actually cover everything. Instead, it typically refers to a policy that combines several key coverage types to provide comprehensive protection in most situations.

Liability Coverage

Required in nearly every state, liability coverage helps pay for damages you cause to others in an accident. This includes both bodily injury liability (medical expenses) and property damage liability (vehicle repairs).

Collision Coverage

This covers damage to your own vehicle after an accident, regardless of who’s at fault. If you back into a pole or collide with another car, collision coverage helps pay for repairs after you pay your deductible.

Comprehensive Coverage

This protects your vehicle from non-collision incidents like theft, vandalism, fire, natural disasters, and hitting an animal. It’s sometimes called “other than collision” coverage.

Additional Coverages Often Included in “Full” Policies

- Uninsured/Underinsured Motorist: Protects you if you’re hit by a driver with insufficient or no insurance

- Personal Injury Protection (PIP): Covers medical expenses regardless of fault (required in no-fault states)

- Medical Payments: Helps with medical costs for you and your passengers after an accident

- Gap Insurance: Covers the difference between your car’s value and what you owe on your loan if your car is totaled

- Roadside Assistance: Provides help with breakdowns, flat tires, and other roadside emergencies

- Rental Car Reimbursement: Covers rental car costs while your vehicle is being repaired

Ready to see what full coverage would cost you?

Get personalized quotes from top insurers and compare rates in minutes.

Average Auto Insurance Rates in 2025 for Full Coverage

The national average cost for full coverage auto insurance in 2025 is approximately $1,950 per year (or about $162 per month). However, rates vary significantly based on several factors:

Did you know? Drivers with poor credit can pay up to twice as much for the same full coverage policy compared to those with excellent credit. Improving your credit score could significantly reduce your auto insurance rates in 2025.

7 Expert Strategies to Get the Best Rate on Auto Insurance Online

-

Compare Multiple Quotes

The single most effective way to find the best rate on auto insurance is to compare quotes from multiple providers. Rates can vary by hundreds or even thousands of dollars between companies for the exact same coverage. Use online comparison tools to quickly gather quotes from several insurers.

-

Bundle Auto and Home Insurance

One of the most significant discounts available is the auto and home insurance bundle. Insurance companies typically offer 10-25% off when you combine policies. Getting an auto and home insurance quote together rather than separately can lead to substantial savings while simplifying your insurance management.

-

Increase Your Deductible

Your deductible is what you pay out-of-pocket before your insurance kicks in. Raising your deductible from $500 to $1,000 could lower your premium by 10-15%. Just make sure you have enough savings to cover the higher deductible if you need to file a claim.

-

Take Advantage of Discounts

Insurance companies offer numerous discounts that many drivers don’t know about. These can include safe driver discounts, good student discounts, military discounts, professional organization memberships, and discounts for vehicle safety features.

-

Enroll in Telematics Programs

Many insurers now offer usage-based insurance programs that track your driving habits through a mobile app or device. Safe driving behaviors can earn you discounts of up to 30% on your auto insurance full coverage policy.

-

Maintain Good Credit

In most states, insurance companies use credit-based insurance scores to determine rates. Paying bills on time and reducing debt can improve your credit score and lower your insurance premiums significantly.

-

Review and Update Your Policy Annually

As your vehicle ages, you may want to adjust your coverage. Additionally, life changes like moving, changing jobs, or improving your credit score can all impact your rates. An annual review ensures you’re not overpaying.

Ready to start saving on your auto insurance?

Compare cheap auto and home insurance quotes from top providers and see how much you could save.

Maximize Savings with Auto and Home Insurance Bundles

Bundling your auto and home insurance policies is one of the most effective ways to reduce your overall insurance costs. When you compare auto and home insurance bundle discounts across providers, you’ll typically find savings of 10-25% on both policies.

Benefits of Bundling

- Average savings of 15-25% on both policies

- Single deductible option for related claims

- Simplified billing and policy management

- Reduced risk of coverage gaps

- Often includes loyalty discounts that increase over time

Potential Drawbacks

- May not always result in the lowest possible price

- Could face double rate increases if company raises premiums

- Switching becomes more complicated if you’re unhappy

- Might miss specialized coverage from niche insurers

How to Find the Best Auto and Home Insurance Bundle

- Get quotes from at least 3-5 different insurers that offer both auto and home coverage

- Compare the bundled price to what you’d pay for separate policies from specialized insurers

- Look beyond the price at coverage limits, deductibles, and customer service ratings

- Ask about additional discounts that can be stacked with your bundle savings

- Consider regional insurers that may offer more competitive rates in your specific area

“The best auto and home insurance bundle isn’t always from the company with the catchiest commercials. Take the time to compare options and you could save hundreds or even thousands per year while improving your coverage.”

Is Full Coverage Auto Insurance Worth It? When You Need It

While full coverage auto insurance provides comprehensive protection, it’s not always necessary for everyone. Understanding when you need a full coverage policy versus when you can opt for less coverage can help you make the right financial decision.

When Full Coverage Is Essential

- You have a car loan or lease: Lenders and leasing companies typically require full coverage to protect their investment

- Your vehicle is new or high-value: If your car is worth more than $5,000, full coverage usually makes financial sense

- You couldn’t afford to replace your car: If losing your vehicle would create financial hardship, full coverage provides peace of mind

- You live in a high-risk area: Areas with high rates of theft, vandalism, or natural disasters benefit from comprehensive coverage

- You have significant assets to protect: Higher liability limits protect your savings and property from lawsuits

When You Might Consider Reducing Coverage

- Your car is older or low-value: If your car is worth less than $3,000, the cost of full coverage might exceed the potential payout

- Your car is paid off: Without a lender requiring full coverage, you have more flexibility

- You have substantial savings: If you could easily replace your vehicle out-of-pocket

- You have another vehicle available: If losing access to this particular car wouldn’t significantly impact your life

The 10% Rule: A common guideline is that if your annual premium for comprehensive and collision coverage exceeds 10% of your car’s value, you might consider dropping these coverages. For example, if your car is worth $4,000, and comprehensive/collision costs more than $400 per year, it might not be cost-effective.

Understanding Your Auto Insurance Full Coverage Policy

To make informed decisions about your auto insurance, it’s important to understand the key components of your policy and how they work together to protect you.

| Coverage Type | What It Protects | Typical Limits | Required? |

| Bodily Injury Liability | Other people’s medical expenses if you cause an accident | $100,000 per person/$300,000 per accident | Yes (in most states) |

| Property Damage Liability | Damage you cause to others’ property | $50,000-$100,000 | Yes (in most states) |

| Collision | Your vehicle after an accident | Actual cash value minus deductible | No (unless leased/financed) |

| Comprehensive | Non-collision damage (theft, weather, etc.) | Actual cash value minus deductible | No (unless leased/financed) |

| Uninsured Motorist | Damages caused by uninsured drivers | Matches bodily injury limits | Varies by state |

| Personal Injury Protection | Medical expenses regardless of fault | $10,000-$50,000 | Required in no-fault states |

Understanding Deductibles and Their Impact

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. For example, with a $500 deductible, you’d pay the first $500 of repair costs after an accident, and your insurance would cover the rest up to your policy limits.

Lower Deductible ($250-$500)

- Higher monthly premiums

- Lower out-of-pocket costs when filing a claim

- Better for those with limited savings

- Good if you have a higher likelihood of claims

Higher Deductible ($1,000-$2,000)

- Lower monthly premiums

- Higher out-of-pocket costs when filing a claim

- Better for those with adequate emergency savings

- Good if you have a clean driving record

How to Compare Auto Insurance Full Coverage Providers

Not all insurance companies are created equal. When shopping for full coverage auto insurance, consider these factors beyond just the premium price:

Financial Strength

Check ratings from agencies like A.M. Best, Moody’s, or Standard & Poor’s to ensure the company has the financial stability to pay claims, especially after widespread disasters.

Customer Service

Review customer satisfaction ratings from J.D. Power and consumer review sites. A slightly higher premium might be worth it for superior claims handling and customer support.

Coverage Options

Compare the flexibility to customize your policy with additional coverages like gap insurance, new car replacement, or accident forgiveness that might be valuable to you.

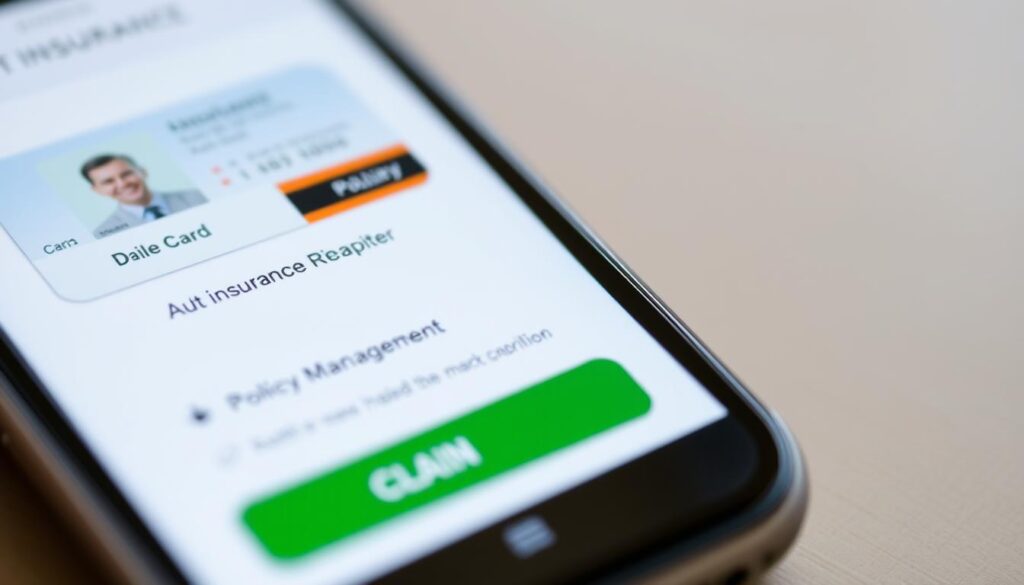

Digital Tools and Accessibility

Modern insurance companies offer various digital tools that can make managing your policy easier and potentially save you money:

- Mobile apps for policy management, bill payment, and digital ID cards

- Online claims filing with photo/video upload capabilities

- Telematics programs that track driving habits and offer discounts for safe driving

- Virtual assistants for quick customer service

- Paperless policy options that often come with small discounts

Ready to find your best full coverage option?

Compare personalized quotes from top-rated insurers and see how much you could save on auto insurance full coverage.

Frequently Asked Questions About Full Coverage Auto Insurance

What is the average cost of full coverage car insurance in 2025?

The national average cost for full coverage auto insurance in 2025 is approximately

Frequently Asked Questions About Full Coverage Auto Insurance

What is the average cost of full coverage car insurance in 2025?

The national average cost for full coverage auto insurance in 2025 is approximately $1,950 per year or $162 per month. However, rates vary significantly based on factors like your location, driving history, vehicle type, age, and credit score. Urban areas typically have higher rates than rural areas, and states with no-fault insurance laws often have higher average premiums.

Which company offers the cheapest full coverage for most drivers?

While rates vary by individual circumstances, companies like GEICO, Progressive, and State Farm frequently offer competitive rates for full coverage policies. However, regional insurers sometimes provide the best rates in specific areas. The only way to find your personal best rate is to compare quotes from multiple providers based on your specific situation.

Is full coverage worth it for an older car?

For older vehicles, full coverage may not be cost-effective. A good rule of thumb is the “10% rule”: if your annual premium for comprehensive and collision coverage exceeds 10% of your car’s value, you might consider dropping these coverages. For example, if your car is worth $3,000, and comprehensive/collision costs more than $300 per year, liability-only coverage might make more financial sense.

Do I need full coverage on a financed car?

Yes, lenders almost always require full coverage on financed vehicles until the loan is paid off. This typically includes liability, comprehensive, and collision coverage with deductibles below a certain threshold (often $500 or $1,000). Some lenders may also require gap insurance to cover the difference between what you owe and what your car is worth if it’s totaled.

How can I lower my full coverage car insurance premium?

To lower your premium while maintaining full coverage, consider: increasing your deductible, bundling auto and home insurance policies, taking advantage of all available discounts (safe driver, good student, multi-car, etc.), improving your credit score, enrolling in telematics programs that reward safe driving, and shopping around for quotes annually to ensure you’re getting the best rate.

Does full coverage car insurance replace my car if it’s totaled?

Full coverage will pay the actual cash value (ACV) of your car if it’s totaled, minus your deductible. This is the depreciated value, not the replacement cost for a new vehicle. If you owe more on your loan than the car is worth, gap insurance can cover the difference. Some insurers also offer optional “new car replacement” coverage that will pay for a new vehicle of the same make and model if yours is totaled within a certain time period (typically 1-2 years).

What’s the difference between auto insurance full coverage and state minimum requirements?

State minimum requirements typically only include liability coverage (bodily injury and property damage) to protect others if you cause an accident. Full coverage adds comprehensive and collision coverage to protect your own vehicle, plus potentially other coverages like uninsured motorist protection. State minimums are often insufficient to fully protect your assets in a serious accident, while full coverage provides much more comprehensive protection for both you and your vehicle.

,950 per year or 2 per month. However, rates vary significantly based on factors like your location, driving history, vehicle type, age, and credit score. Urban areas typically have higher rates than rural areas, and states with no-fault insurance laws often have higher average premiums.

Which company offers the cheapest full coverage for most drivers?

While rates vary by individual circumstances, companies like GEICO, Progressive, and State Farm frequently offer competitive rates for full coverage policies. However, regional insurers sometimes provide the best rates in specific areas. The only way to find your personal best rate is to compare quotes from multiple providers based on your specific situation.

Is full coverage worth it for an older car?

For older vehicles, full coverage may not be cost-effective. A good rule of thumb is the “10% rule”: if your annual premium for comprehensive and collision coverage exceeds 10% of your car’s value, you might consider dropping these coverages. For example, if your car is worth ,000, and comprehensive/collision costs more than 0 per year, liability-only coverage might make more financial sense.

Do I need full coverage on a financed car?

Yes, lenders almost always require full coverage on financed vehicles until the loan is paid off. This typically includes liability, comprehensive, and collision coverage with deductibles below a certain threshold (often 0 or

Frequently Asked Questions About Full Coverage Auto Insurance

What is the average cost of full coverage car insurance in 2025?

The national average cost for full coverage auto insurance in 2025 is approximately $1,950 per year or $162 per month. However, rates vary significantly based on factors like your location, driving history, vehicle type, age, and credit score. Urban areas typically have higher rates than rural areas, and states with no-fault insurance laws often have higher average premiums.

Which company offers the cheapest full coverage for most drivers?

While rates vary by individual circumstances, companies like GEICO, Progressive, and State Farm frequently offer competitive rates for full coverage policies. However, regional insurers sometimes provide the best rates in specific areas. The only way to find your personal best rate is to compare quotes from multiple providers based on your specific situation.

Is full coverage worth it for an older car?

For older vehicles, full coverage may not be cost-effective. A good rule of thumb is the “10% rule”: if your annual premium for comprehensive and collision coverage exceeds 10% of your car’s value, you might consider dropping these coverages. For example, if your car is worth $3,000, and comprehensive/collision costs more than $300 per year, liability-only coverage might make more financial sense.

Do I need full coverage on a financed car?

Yes, lenders almost always require full coverage on financed vehicles until the loan is paid off. This typically includes liability, comprehensive, and collision coverage with deductibles below a certain threshold (often $500 or $1,000). Some lenders may also require gap insurance to cover the difference between what you owe and what your car is worth if it’s totaled.

How can I lower my full coverage car insurance premium?

To lower your premium while maintaining full coverage, consider: increasing your deductible, bundling auto and home insurance policies, taking advantage of all available discounts (safe driver, good student, multi-car, etc.), improving your credit score, enrolling in telematics programs that reward safe driving, and shopping around for quotes annually to ensure you’re getting the best rate.

Does full coverage car insurance replace my car if it’s totaled?

Full coverage will pay the actual cash value (ACV) of your car if it’s totaled, minus your deductible. This is the depreciated value, not the replacement cost for a new vehicle. If you owe more on your loan than the car is worth, gap insurance can cover the difference. Some insurers also offer optional “new car replacement” coverage that will pay for a new vehicle of the same make and model if yours is totaled within a certain time period (typically 1-2 years).

What’s the difference between auto insurance full coverage and state minimum requirements?

State minimum requirements typically only include liability coverage (bodily injury and property damage) to protect others if you cause an accident. Full coverage adds comprehensive and collision coverage to protect your own vehicle, plus potentially other coverages like uninsured motorist protection. State minimums are often insufficient to fully protect your assets in a serious accident, while full coverage provides much more comprehensive protection for both you and your vehicle.

,000). Some lenders may also require gap insurance to cover the difference between what you owe and what your car is worth if it’s totaled.

How can I lower my full coverage car insurance premium?

To lower your premium while maintaining full coverage, consider: increasing your deductible, bundling auto and home insurance policies, taking advantage of all available discounts (safe driver, good student, multi-car, etc.), improving your credit score, enrolling in telematics programs that reward safe driving, and shopping around for quotes annually to ensure you’re getting the best rate.

Does full coverage car insurance replace my car if it’s totaled?

Full coverage will pay the actual cash value (ACV) of your car if it’s totaled, minus your deductible. This is the depreciated value, not the replacement cost for a new vehicle. If you owe more on your loan than the car is worth, gap insurance can cover the difference. Some insurers also offer optional “new car replacement” coverage that will pay for a new vehicle of the same make and model if yours is totaled within a certain time period (typically 1-2 years).

What’s the difference between auto insurance full coverage and state minimum requirements?

State minimum requirements typically only include liability coverage (bodily injury and property damage) to protect others if you cause an accident. Full coverage adds comprehensive and collision coverage to protect your own vehicle, plus potentially other coverages like uninsured motorist protection. State minimums are often insufficient to fully protect your assets in a serious accident, while full coverage provides much more comprehensive protection for both you and your vehicle.

Making the Right Choice for Your Auto Insurance Needs

Finding the right auto insurance full coverage policy requires balancing adequate protection with affordable premiums. By understanding what full coverage actually includes, comparing quotes from multiple providers, taking advantage of discounts like auto and home insurance bundles, and regularly reviewing your policy, you can ensure you’re getting the best possible value.

Remember that the cheapest policy isn’t always the best choice—consider the financial strength and customer service reputation of insurers, as well as the specific coverages and limits that meet your unique needs. What works for one driver may not be ideal for another.

As auto insurance rates continue to evolve in 2025, staying informed about industry trends and regularly shopping around for quotes will help you maintain the optimal balance between protection and affordability.

Ready to secure the protection you need at a price you can afford?

Compare personalized auto insurance full coverage quotes from top-rated insurers and find your best rate today.