What would your family do if your paycheck stopped tomorrow? That question forces a choice: leave loved ones at risk or lock in protection now.

Term life plans often give clear options: locked premiums for 10, 15, or 20 years, or a yearly renewable plan that starts lower and rises over time. Many policies are convertible to permanent coverage and remain portable if you leave an employer.

Most death benefits are paid income tax-free to beneficiaries, which can replace wages, cover debts, and handle final costs when it matters most. Availability, riders, and costs vary by state, with special rules in New York and different underwriters for firms like New York Life and Aflac.

Start with clear goals, compare options, and then speak with a licensed agent to confirm eligibility and state-specific details. For a practical primer on family-focused choices, see this helpful guide.

Why term life insurance is a smart choice for

Key Takeaways

- Decide how much coverage you need to replace income and handle debts during the vulnerable period.

- Choose between fixed-period premiums (10–20 years) or a yearly renewable option that rises over time.

- Look for convertibility and rider features if you expect major life changes.

- Death benefits are typically income tax-free for beneficiaries.

- Product details and availability vary by state—confirm the issuing company and rules where you live.

Term life insurance at a glance for families in the United States

Short-term protection can give a family clear financial breathing room. A well-chosen policy guarantees a death benefit for a set period. That period often aligns with mortgage paydown, child-raising, or tuition timelines.

What a term life policy offers right now

Most plans offer fixed options of 10, 15, or 20 years. You may also see a yearly renewable plan with lower starting premiums that rise later.

Many designs include a conversion window so you can move from temporary coverage to permanent coverage without fresh underwriting.

Who typically benefits from term coverage

Households with growing children or large debts often prefer this type of policy. It provides focused protection while costs stay more predictable than permanent choices.

“A clear coverage period can match major life milestones and ease future expenses.”

- Guaranteed death benefit during the chosen years

- Common lengths: 10, 15, 20 years, or yearly renewable

- Convertible options available within set windows

- Benefits often pass to beneficiaries income tax-free

- Availability and riders vary by state

| Feature | Typical Options | Why it matters |

|---|---|---|

| Length | 10 / 15 / 20 years | Matches key financial milestones |

| Premium type | Level or yearly renewable | Predictable cost vs. lower start rate |

| Convertibility | Windowed conversion to permanent | Keeps future options without new underwriting |

| Tax treatment | Death benefits generally income tax-free | Supports beneficiaries’ finances |

How to buy insurance life term with confidence

Start with a clear plan. Gather a personalized quote online, then connect with a licensed agent who knows state rules and product differences. This two-step approach speeds choices and avoids surprises.

Get a quote and connect with a licensed agent

Begin with a tailored quote to see rough costs and compare options. An agent can explain underwriting, conversion windows, and rider choices so the policy matches your needs.

Choose your term length: 10, 15, or 20 years, or yearly renewable

Decide whether you want level payments for 10, 15, or 20 years or a yearly renewable plan that starts lower and rises over time. New York Life, for example, offers both level term and yearly renewable choices.

Understand applications, eligibility, and state-by-state availability

Application rules change by state. Some products allow quick approval with health questions only; others require medical evidence. State Farm notes some plans can increase premiums up to age 95 with caps.

“Ask about convertibility and state-specific forms up front — it can preserve options without new underwriting.”

- Confirm what products and riders are available where you live.

- Compare long-term cost, including premium caps and renewal rules.

- Keep all application answers and agent correspondence for smooth issuance.

For a reliable starting point, review a focused guide such as term life insurance and then discuss specifics with your local agent.

Coverage options and key features to consider

Know which benefits you can add to a policy so it fits changing needs, such as disability protections or living access to cash. Start by weighing premium structure against your budget and planning horizon.

Yearly renewable vs. level premiums

Yearly renewable plans often start with lower payments but rise each year. That can make short-term protection inexpensive at first but costlier over time.

By contrast, a level premium locks payments for a set number of years (10, 15, or 20), making budgeting easier.

Convertible coverage to permanent policies

Many policies include a conversion window so you can switch to permanent life insurance without new underwriting.

Evaluate the window and any age limits. Converting preserves insurability and can add cash value later.

Riders that personalize your policy

Common riders include a Living Benefit for terminal illness, a Disability Waiver of Premium, and spouse purchase options. Availability and names vary by state; New York uses specific rider titles.

Ask an agent for the costs and waiting periods before relying on any rider.

Portability and tax treatment

Individual coverage can move with you if you change jobs. Confirm portability so protection is not tied to an employer plan.

“Beneficiaries generally receive the death benefit income‑tax free, but early access via some riders can have tax implications.”

- Have your agent compare total payments over the full projection, not just first-year costs.

- Verify rider names and form numbers by state before selection.

- Use a trusted quote source such as term life insurance for a starting comparison and then confirm details locally.

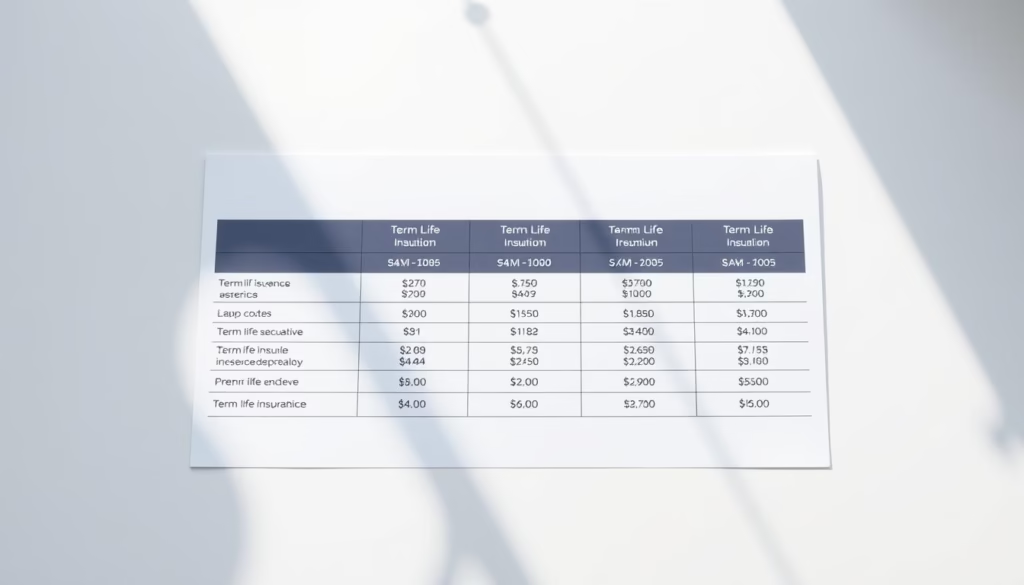

Costs, premiums, and long‑term value

Premium choices change how much you pay now and how much coverage costs over the long run.

Level premiums versus increasing payments

Level premiums lock a fixed payment for a set number of years. That makes monthly budgeting easy and predictable.

By contrast, rising premiums start lower but can climb later. Some plans increase annually up to age 95 and include a policy cap.

How needs, term length, and coverage amount affect cost

Your total cost depends on coverage amount, chosen period, health, and added riders like disability waivers or living benefits.

Ask for side‑by‑side illustrations comparing level versus yearly renewals over the full time you expect to keep a policy.

Cash value and how loans or withdrawals change value and death benefit

Permanent policies build cash value that can be borrowed, but loans accrue interest. Unpaid loans and withdrawals reduce cash value and the guaranteed death benefit.

There may be tax consequences for loans or large withdrawals; consult a qualified adviser for specifics.

“Evaluate total payments, not just first‑year rates, to judge long‑term value.”

| Feature | Level Premium | Increasing Premium |

|---|---|---|

| Cost predictability | High | Low |

| Early-year affordability | Moderate | Higher |

| Long‑term value | Better for fixed needs | May cost more over many years |

For a clear comparison, review a detailed term life insurance illustration before you decide.

State availability, insurance companies, and important disclosures

Where you live can change which companies, forms, and rider names are available to you.

Availability varies by state. Some carriers use different underwriting entities in New York than elsewhere. Aflac, for example, underwrites through American Family Life Assurance Company of Columbus and, in New York, through American Family Life Assurance Company of New York.

Check the issuing company on your quote. State Farm and New York Life use separate entities by jurisdiction. That affects forms, premiums, and rider availability.

Why contact a local agent

A local agent reads state filings and explains how accelerated death benefits may affect public assistance or be taxable. Agents also confirm which riders and disability options apply in your state.

| Item | Variation By State | What to verify |

|---|---|---|

| Issuing company | Different carrier entities in some states | Which company will issue your policy |

| Riders & names | Names, costs, waiting periods differ | Rider availability and fees |

| Accelerated benefits | May affect benefits or be taxable | Impact on public assistance and tax |

Read state disclosures and keep copies of forms. For full details and company-specific notices, review the policy disclosures and speak with a licensed local agent before you apply.

Conclusion

A focused policy can protect income during the years your loved ones need it most.

Choose a structure—level or yearly renewable—that matches your budget and the protection period you expect.

Confirm which riders and conversion options are available where you live, and verify the issuing insurance company on any quote.

Use a local agent to compare premiums, project payments over time, and discuss converting to permanent coverage to build cash value without new underwriting.

For a quick primer on costs and advantages, review the benefits of term coverage, then apply with confidence knowing the death benefit is designed to protect your family when it matters most.

FAQ

What does a term life policy offer right now?

A term policy provides a fixed death benefit for a set period, typically 10, 15, or 20 years. It offers straightforward coverage at generally lower premiums than permanent options. Policies can include level premiums or yearly renewable rates and may offer riders for disability waiver, accelerated benefits, or spouse coverage to tailor protection for your family’s needs.

Who typically benefits from term coverage?

Families with mortgages, small business owners, and parents who need cost-effective protection during income-earning years often choose term coverage. It suits those seeking temporary protection until debts are paid, children are independent, or savings reach a target. It’s also useful for people wanting coverage without the cash value features of permanent products.

How do I get a quote and connect with a licensed agent?

Start by gathering basic health, age, and coverage-amount information. Use online quoting tools from reputable companies like Prudential, Northwestern Mutual, or New York Life, or contact a local licensed agent to compare offers. An agent helps explain underwriting steps, medical exam requirements, and state-specific rules.

How do I choose my term length: 10, 15, or 20 years, or a yearly renewable option?

Match term length to your financial horizon—how long you need income protection or how long debts will last. Shorter terms cost less but cover shorter periods; 20-year terms suit young families planning long-term security. Yearly renewable plans can be flexible but become more expensive with age.

What should I know about applications, eligibility, and state-by-state availability?

Eligibility depends on age, health, occupation, and lifestyle. Underwriting can require medical exams or be simplified through no-exam policies at higher cost. Product features and regulatory rules vary by state; New York often has distinct product filings and extra disclosure requirements, so check availability with a licensed agent in your state.

What’s the difference between yearly renewable term and level term premiums?

Yearly renewable plans reset premiums annually based on your current age, so costs rise sharply over time. Level term locks the premium for the full term, giving predictable payments. Level-term policies usually cost more upfront but save money over longer coverage periods.

Can I convert term coverage to permanent policies?

Many term policies include a convertible option that lets you move to permanent coverage—such as whole life or universal life—without further medical underwriting, up to a conversion age or within a conversion window. Conversion preserves insurability but often increases premiums and adds cash-value features.

Which riders can personalize my policy?

Common riders include accelerated death benefit (living benefits), disability waiver of premium, child term, and spouse coverage. These add flexibility for illness, job loss, or growing families. Riders and costs vary by company and state; confirm availability and tax treatment with your agent.

Is coverage portable beyond employer-sponsored plans?

Yes. Individual policies remain with you if you change jobs, unlike many employer-provided plans. Portable coverage avoids the risk of losing protection when employment ends, though rates and features depend on the policy already in force.

How are death benefits and riders treated for tax purposes?

Generally, death benefits paid to beneficiaries are income-tax-free. Certain riders, like accelerated death benefits for terminal illness, may have specific tax rules. Loan activity or withdrawals from permanent products can trigger tax consequences. Consult a tax advisor or agent for details.

How do level premiums compare with premiums that increase over time?

Level premiums remain constant throughout the chosen term, offering budgeting certainty. Increasing-premium options, such as yearly renewable plans, start lower but escalate with age, often becoming costly later. Evaluate long-term affordability before choosing.

How do needs, term length, and coverage amount affect cost?

Cost depends on age, health, term length, and death benefit size. Longer terms and larger coverage amounts raise premiums. Lifestyle factors, tobacco status, and occupation also influence underwriting and price. Run several quotes to find the best balance of protection and cost.

What is cash value and how does it apply to permanent policies?

Cash value accumulates only in permanent products like whole life or universal life. It grows tax-deferred and can fund loans or withdrawals, but borrowing reduces the death benefit if not repaid. Term coverage does not build cash value and focuses solely on pure protection.

How do loans and withdrawals impact cash value and the death benefit?

Loans against cash value accrue interest and reduce the death benefit until repaid. Withdrawals permanently reduce the cash value and may lower the benefit. Excess withdrawals can trigger surrender charges or taxable events, depending on the product and policy age.

Are products and features different in New York?

Yes. New York has unique regulatory standards and product filings, which can lead to different policy forms, riders, and pricing. Some companies modify offerings to comply with state rules. Work with a New York–licensed agent to understand local differences.

Who underwrites coverage and why contact a local agent?

Major underwriters include companies like MassMutual, MetLife, and Guardian, but availability varies by state and product. A local licensed agent explains underwriting standards, helps collect medical records, and guides you through state-specific disclosures and filing rules.