Could a single loss stop your business overnight? This question matters if you own or rent a building and keep equipment, inventory, or client records on site.

Hazard insurance for commercial property acts as the foundation of financial protection. Most insurers call this commercial property insurance, and it covers damage from fire, theft, vandalism, wind, and certain weather events.

Small business owners often bundle this into a business owner’s policy (BOP). That policy streamlines pricing and pairs property and liability protection so a company can recover and keep serving customers.

Costs vary with value and location, but many businesses find monthly rates near industry averages manageable. Landlords, lenders, and SBA-backed loans commonly require proof of this coverage, making it a good idea to arrange early.

Key Takeaways

- Protect your business property with confidence

- What hazard insurance for commercial property covers

- What’s not covered and how to fill the gaps

- Cost of commercial property insurance and what drives your rate

- Who needs property coverage and when it’s required

- Policy options: tailor your coverage to your risk

- How to get covered today

- Conclusion

- FAQ

- This coverage protects buildings, contents, and equipment from common perils.

- A BOP can combine property and liability into one simplified policy.

- Average costs are often affordable for small business owners; value and location matter.

- Lenders and landlords commonly require proof of commercial protection—plan ahead.

- Later sections will explain exclusions, add-ons, and how to choose the right coverage.

Learn more about typical coverage details at commercial property insurance and about cost factors at property insurance cost guidance.

Protect your business property with confidence

Protecting your business assets early can keep a small loss from turning into a business-stopping event. Coverage that guards your building, fixtures, and business contents helps reduce financial volatility and keeps operations moving after an incident.

Why small businesses benefit: Replacing stolen tools, damaged electronics, or inventory quickly preserves revenue and client trust. A roof hit by hail or a power surge that fries equipment can be costly. The right policy offsets replacement costs and loss of income while you recover.

This asset-focused protection complements liability protections; it concentrates on what you own or rent inside your space. Policies can be tailored whether you work from a leased suite, a standalone facility, or a home office with business contents.

- Reduces downtime by covering repairs or replacements.

- Helps meet landlord and lender requirements early.

- Supports faster recovery, preserving customer and vendor relationships.

To compare tailored options and secure required certificates, start with a trusted broker and review sample commercial property insurance choices today.

What hazard insurance for commercial property covers

A clear inventory and the right limits make recovery faster and fairer. A typical plan will protect the building shell, tenant build-outs, and permanent fixtures you installed.

Buildings, fixtures, and improvements

Covered items usually include: the main building, attached improvements, and interior build-outs. That means the walls, fixed lighting, and shelving you added are often part of the protection.

Business personal property

Business personal property covers inventory, tools, office equipment, computers, and specialized machinery. Be sure limits match replacement value so fast-changing equipment and stock aren’t underinsured.

Common covered events

- Fire and explosions

- Theft, vandalism, riots

- Wind, hail, and storm-related damage

- Power surges and outages that injure electronics

Optional add-ons and income protection

Policies can reimburse lost business income when physical damage stops operations. Endorsements expand cover for specific risks, but floods or hurricanes in high-risk zones normally need separate solutions.

“Keep an updated asset list by location — shop floor, warehouse, and yard — to speed claims and avoid gaps.”

Learn more about business hazard coverage at business hazard coverage and check legal name requirements at do I need coverage under my business.

What’s not covered and how to fill the gaps

Your core policy won’t automatically handle floods, employee injuries, or vehicle losses. Many standard plans exclude flooding and some hurricane damage in high‑risk zones. Those perils usually need a separate flood plan or a specific endorsement.

Typical exclusions and separate lines

Floods and certain storms: Often excluded; buy separate flood coverage where required.

Vehicles: Business autos need a dedicated commercial auto policy.

Workers’ injuries: Employee harm is handled by workers’ compensation, not property coverage.

Closing gaps and staying compliant

- Ask about endorsements for windstorm nuances or utility interruption.

- Review lease and lender terms for required riders and loss payee language.

- Schedule periodic coverage audits to confirm limits and sublimits.

| Risk | Typical Solution | Why it matters |

|---|---|---|

| Flood / high-risk storm | Separate flood plan | Needed in designated zones and by lenders |

| Company vehicles | Commercial auto policy | Covers vehicles and drivers on duty |

| Employee injury | Workers’ compensation | Meets legal and payroll needs |

Document mitigation steps like surge protection and roof upkeep to improve terms. For guidance on third‑party exposure and general liability alignment, consult your broker.

Cost of commercial property insurance and what drives your rate

Premiums can vary widely, but many small firms pay modest monthly amounts that fit a predictable budget.

Real-world averages help budgeting. Many small businesses pay about $67 per month (roughly $800 annually). Around 35% pay under $50 monthly, and about 27% fall in the $50–$100 range.

Typical price ranges and averages

These numbers are a starting point. Your actual cost depends on limits, deductibles, and policy choices.

Key factors that change your rates

- Location: local crime, weather exposure, and fire protection class affect pricing.

- Building size & age: older or larger buildings often raise rates.

- Value of contents: high-value equipment or lots of inventory increases premiums.

- Industry risk: storing flammables or operating in catastrophe zones can push costs higher.

Ways to save

Bundling and mitigation pay off. A BOP that combines property and general liability often costs less than buying each separately.

Discounts commonly come from UL-listed fire alarms, monitored security, sprinkler systems, and routine maintenance logs. Adjusting deductibles and aligning limits to replacement value also shapes your annual cost.

| Action | Typical Effect on Cost | Why it Matters |

|---|---|---|

| Bundle (BOP) | Lower overall premium | Simplifies billing and reduces overlap |

| Security & fire systems | Discounts available | Reduces loss likelihood and claims |

| Higher deductible | Lower premium | Transfers small losses to the company |

| Commercial package policy | Higher limits, tailored cover | Better for high-risk or specialized operations |

Who needs property coverage and when it’s required

Many leases and loan agreements make proof of adequate coverage a non-negotiable step before you move in or close.

Landlords, lenders, and SBA rules

Leases often obligate tenants to carry limits that name the landlord as a loss payee. Those documents specify minimum limits and acceptable deductibles.

The SBA requires hazard insurance on loan collateral. The commercial property portion of a BOP usually meets that rule and eases closing.

Industries with higher exposure

Manufacturers face big machinery losses. Wholesalers and distributors hold large inventories that raise risk.

Retailers and restaurants see higher theft, fire, and spoilage chances. Many owners carry higher limits to protect business continuity.

Home-based businesses and gaps

Homeowner policies often limit business coverage. Home-based entrepreneurs should add a tailored policy or endorsement to protect business assets.

- Align effective dates with lease starts and loan closings to avoid compliance gaps.

- Keep equipment and inventory valuations current so claims pay full replacement.

- Document controls — fire suppression, secure storage, and CCTV — to support underwriting and better terms.

Policy options: tailor your coverage to your risk

Choose a policy type that matches how fast your equipment loses value and how wide you want protection to be.

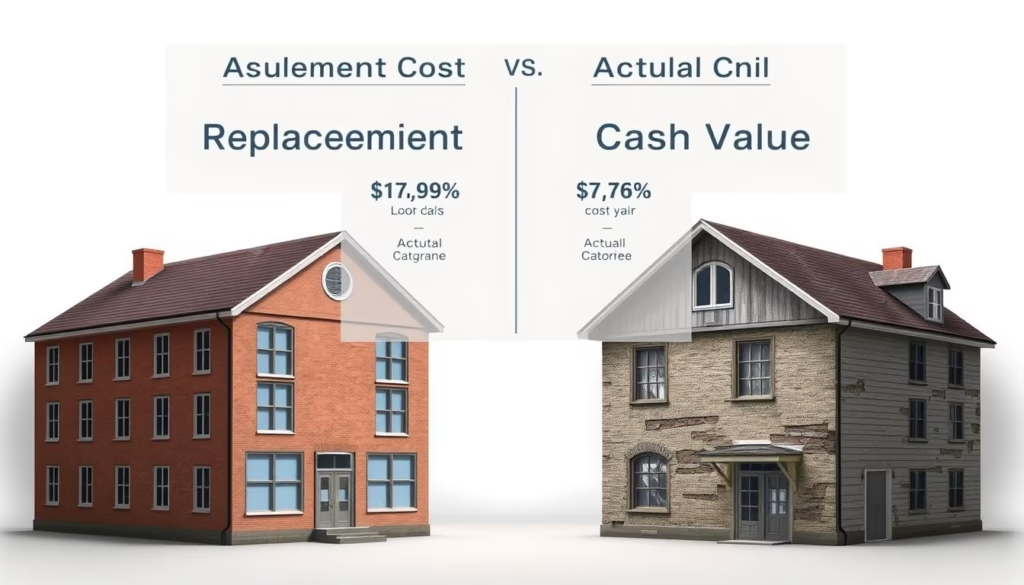

Replacement cost vs. actual cash value

Replacement cost pays to replace damaged items with new ones of like kind and quality. It avoids deductions for age or wear.

Actual cash value pays the depreciated amount. That lower payout can leave an out-of-pocket gap when equipment ages quickly.

- replacement: best when electronics or machinery lose value fast.

- cash value: lower premium but higher risk of uncovered loss.

- Align the valuation with your tolerance for depreciation risk.

Open perils vs. named perils

Open-perils covers all causes except those explicitly excluded. It gives broad protection and fewer claim disputes.

Named-perils lists covered causes only. It costs less but limits what triggers a payout.

BOP vs. commercial package policy vs. standalone commercial property

A BOP bundles building and contents with general liability. It suits lower-risk small businesses and is often cost-effective.

A commercial package policy offers the same bundling with more customization and higher limits. It fits growing or higher-risk operations.

Standalone commercial property works when bundling is not available or not economical.

“Read definitions, exclusions, and conditions closely. Policy forms vary across carriers and small differences matter.”

- Review lender or lease rules; some require replacement cost and specific deductibles.

- Annual reviews help match limits to new assets and changing exposure.

- Choose the type that balances premium with the risk you will accept at claim time.

How to get covered today

Get protection in place quickly by following a few clear steps. Start with a practical inventory and use that list to compare quotes and bind a policy that meets lease or loan needs.

Assess your property values and inventory

Start today by listing buildings, fixtures, and contents with current replacement values. Include fixed improvements, shelving, and costly equipment so limits match real costs.

Tip: Take photos and timestamp invoices to speed claims and verify values later.

Compare quotes and policy limits with top U.S. carriers

Request several quotes that show limits, deductibles, valuation method (replacement cost vs. actual cash value), and key endorsements.

Share security and fire protection details—sprinklers, alarms, and cameras—so underwriters can offer better terms. Consider a BOP to combine general liability with property coverage and lower overall cost.

Start coverage and secure a certificate of insurance

Many carriers can bind coverage quickly and issue a certificate within 24 hours after you sign. Verify named insureds, additional insureds, and loss payees on the insurance policy to meet lease or lender requirements.

- Align effective dates with lease start or loan closing to avoid gaps.

- Choose carriers known for strong claims support and useful add-ons like business interruption and equipment breakdown.

- Review limits annually after renovations or purchases to protect business assets as they grow.

Conclusion

,

A focused plan that covers buildings, contents, and equipment helps businesses recover fast after damage.

Key takeaways: this coverage shields against fire, theft, vandalism, wind, hail, riots, explosions, and power surges. Align limits to replacement value and choose replacement cost when possible to reduce out‑of‑pocket losses.

Remember that lenders, landlords, and the SBA often require proof via a certificate. Flood and certain hurricane losses in high‑risk zones usually need separate solutions. Pick the policy type—BOP, package, or standalone—that matches your operations and budget.

Evaluate your property coverage, compare quotes, and bind the protection you need to keep your business moving. Learn more about commercial property insurance as you decide.

FAQ

What does commercial property coverage protect?

Commercial property coverage protects buildings, fixtures, and improvements, along with business personal property such as equipment, inventory, electronics, and tools. Typical policies cover loss from events like fire, theft, vandalism, wind and hail, and power surges. You can add business interruption or endorsements to extend protection.

What’s not covered under a standard policy and how can I fill gaps?

Standard policies commonly exclude floods, earthquakes, and some hurricane damage in high‑risk zones. You may need separate flood or earthquake policies and endorsements for things like equipment breakdown or ordinance or law coverage. Consider commercial auto and workers’ compensation to cover other business risks.

How do replacement cost and actual cash value differ?

Replacement cost pays to repair or replace items at current market prices without deduction for depreciation. Actual cash value pays replacement cost minus depreciation. Replacement cost generally costs more but provides fuller recovery after a loss.

Should I choose open perils or named perils wording?

Open perils policies cover all risks except those specifically excluded, offering broader protection. Named perils only cover risks listed in the policy. Businesses with higher exposure often favor open perils; cost and risk profile should guide the choice.

How much does coverage typically cost for a small business?

Costs vary by location, building size and age, property value, and industry risk. Small businesses might pay anywhere from a few hundred to several thousand dollars annually. Bundling into a BOP, installing security and fire protection, and choosing appropriate limits help manage premiums.

Are landlords or lenders likely to require coverage?

Yes. Landlords often require tenants to maintain property or liability coverage. Lenders, including SBA loan programs, usually mandate proof of adequate coverage and a certificate of insurance naming them as loss payee or additional insured.

Do home‑based businesses need a separate policy?

Many homeowners policies exclude business losses or limit coverage for business property. Home‑based businesses should review their homeowners policy and likely purchase a business owners policy (BOP) or commercial property coverage to close gaps.

What steps should I take to get covered today?

Assess property values and inventory, document equipment and building details, then compare quotes and policy limits from reputable U.S. carriers like State Farm, Travelers, or Nationwide. Select needed endorsements, start coverage, and obtain a certificate of insurance to satisfy landlords or lenders.

How can I lower my premium without sacrificing protection?

Improve risk controls—install alarms, sprinkler systems, and surge protectors; bundle coverages in a BOP; raise deductibles where sensible; and maintain up‑to‑date loss runs. These actions often reduce costs while keeping adequate limits.

What industries face higher rates and why?

Manufacturers, wholesalers, retailers, and restaurants often face higher rates because they store inventory, use heavy equipment, or have higher foot traffic and food‑service hazards. Industry risk influences underwriting and premium calculations.