What you’ll learn in this guide:

- Who the employer mandate applies to and how to tell if you’re an ALE

- What coverage you must offer (if any) and what “affordable” means

- Practical options for providing benefits and avoiding fines

If you want a quick checklist, skip to the compliance tips — otherwise, let’s walk through your options step by step.

The Employer Mandate: ACA Requirements for Providing Health Insurance

- The Employer Mandate: ACA Requirements for Providing Health Insurance

- What Health Insurance Coverage Must Employers Provide?

- Do Small Businesses Have to Offer Health Insurance to Employees?

- Penalties for Not Providing Health Insurance to Employees

- Special Cases: Part-Time Employees, Seasonal Workers, and Independent Contractors

- State-Specific Health Insurance Requirements for Employers

- Alternatives to Traditional Group Health Insurance

- Tips for ACA Compliance and Avoiding Penalties

- Frequently Asked Questions About Employer Health Insurance Requirements

- Conclusion: Making Informed Decisions About Employee Health Insurance

Understanding your obligations under the ACA employer mandate is essential for compliance

Under the Affordable Care Act (ACA), some employers must offer health insurance or risk financial penalties. That employer shared responsibility provision applies to applicable large employers — often shortened to ALEs — and it’s worth knowing whether your business counts as one.

What is an Applicable Large Employer (ALE)?

An Applicable Large Employer (ALE) is any employer with 50 or more full-time employees, or a mix of full-time and part-time workers whose combined hours equal at least 50 full-time equivalent employees. In plain terms: if you’ve got 50 or more full-time equivalent employees based on the previous calendar year, you’re treated as an ALE for the current year.

How to Calculate Full-Time Equivalent (FTE) Employees:

- Count each employee who works at least 30 hours per week as one full-time employee.

- For part-time employees (those working fewer than 30 hours per week), total their monthly hours and divide by 120 to get FTEs.

- Add the full-time employee count to the part-time FTE total.

- If the sum is 50 or more, your business is considered an ALE and may need to offer coverage.

Quick calculator-style example: say you have 40 employees who work 30+ hours and 20 part-timers who each average 20 hours/week. The part-time FTE math looks like this: (20 employees × 20 hours × ~4 weeks) ÷ 120 = ~13.33 FTEs. Add that to 40 full-time employees and you get about 53.33 FTEs — so you’d be an ALE.

Why this matters: ALE status determines whether employers must offer qualifying coverage to avoid penalties. For employers full-time staff counts, hours per week rules, and FTE calculations are the key pieces of information — so keep good records and use consistent methods when you’re doing these counts.

What Health Insurance Coverage Must Employers Provide?

If your business qualifies as an ALE, you need to offer health insurance that meets a few specific tests so you don’t get hit with penalties. Think of these as the “must-haves” for employer coverage under the ACA.

Coverage Requirements for ALEs

Minimum Essential Coverage (MEC)

Minimum essential coverage means the plan provides the baseline set of benefits defined by the ACA — including the ten essential health benefits and preventive services. In short: your plan has to be real coverage, not just a skimpy option that leaves employees exposed.

Minimum Value

Minimum value means the plan pays for at least 60% of the expected costs of medical care for a typical population (this is roughly a “bronze-level” plan or better). If your plan doesn’t meet minimum value, you could still be on the hook for penalties even if you technically offer something.

Affordability

Affordability is about how much the employee pays. To avoid a penalty, employee contributions for self-only coverage can’t exceed the ACA affordability threshold (the percentage is updated annually — the example below uses 2023 as a reference). Employers often use safe-harbor methods tied to wages to simplify this calculation.

Dependent Coverage

You must offer coverage to full-time employees and their dependents — defined under the ACA as children (biological and adopted) up to age 26. The ACA doesn’t force you to cover spouses, though many employers choose to do so.

Health plans must meet minimum essential coverage and affordability requirements

Who Must Receive Coverage?

ALEs must offer qualifying coverage to at least 95% of their full-time employees and their dependents. For ACA purposes, a full-time employee is someone who averages at least 30 hours per week (about 130 hours per month).

Quick affordability example: if the affordability threshold is 9.12% (as it was in 2023), and an employee’s household income is $50,000, a self-only premium over $4,560/year would be considered unaffordable ($50,000 × 9.12% = $4,560). Employers often use safe-harbor tests based on wages to estimate affordability instead of actual household income.

Important: The ACA doesn’t require employers to offer health insurance to part-time employees (those working under 30 hours per week), but part-time hours are still counted when you calculate whether you’re an ALE.

Do Small Businesses Have to Offer Health Insurance to Employees?

If your business has fewer than 50 full-time equivalent employees, you’re not on the hook for the ACA employer mandate — meaning small businesses aren’t required by federal law to provide health insurance. That said, many small employers still choose to offer benefits because it helps them compete for talent and keep workers healthy.

Small businesses with fewer than 50 FTEs have more flexibility with health insurance offerings

Here are a few solid reasons small businesses often offer group health insurance anyway:

Benefits of Offering Health Insurance as a Small Business

- Attract and retain talented employees — job-seekers expect benefits these days

- Improve employee health and productivity (fewer sick days, more focus)

- Potential tax advantages — small employers may qualify for the Small Business Health Care Tax Credit

- Gain a competitive edge in your industry and boost morale

- Reduce turnover and related rehiring costs

Small Business Health Options Program (SHOP)

Small businesses with 1–50 employees can shop for group health insurance through the SHOP marketplace. SHOP helps businesses access group plans and may make group health more affordable than going it alone.

Some states also offer SHOP alternatives or additional programs, so if your team works across state lines, check those state rules too.

Need Help Navigating Small Business Health Insurance Options?

Our health benefits specialists can walk you through whether a group health plan, an HRA, or SHOP makes the most sense for your business size and budget.

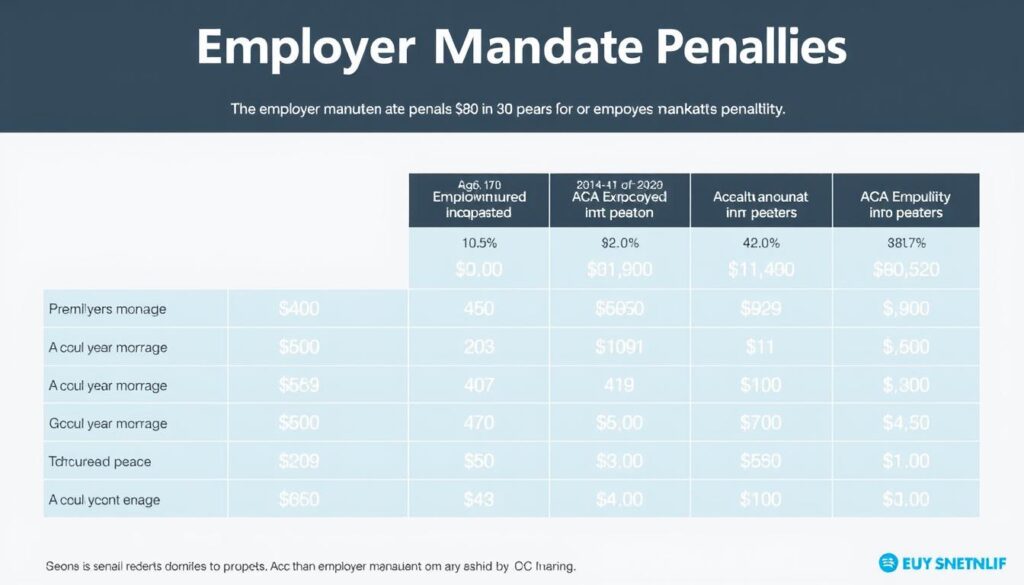

Penalties for Not Providing Health Insurance to Employees

If your business is an ALE and you don’t follow the employer mandate, you could face meaningfully expensive penalties. Penalties typically kick in when at least one full-time employee receives a premium tax credit to buy Marketplace coverage because your employer didn’t offer qualifying options.

Understanding potential penalties can help employers make informed decisions about health coverage

Types of Employer Mandate Penalties

| Penalty Type | Trigger | 2023 Penalty Amount | Example Calculation |

| Penalty A: No Coverage Offered | Employer does not offer minimum essential coverage to at least 95% of full-time employees and their dependents | $2,880 per full-time employee (minus the first 30 employees) | For a company with 100 full-time employees: (100-30) × $2,880 = $201,600 annual penalty |

| Penalty B: Inadequate Coverage | Employer offers coverage, but it doesn’t meet minimum value or affordability requirements | $4,320 per full-time employee receiving a premium tax credit (cannot exceed Penalty A amount) | If 20 employees receive tax credits: 20 × $4,320 = $86,400 annual penalty |

Important: These penalty amounts are adjusted annually for inflation. The numbers shown are for 2023 — double-check the current year’s amounts before you do any compliance math.

There are also other employer-related liabilities to watch: failing to file required information returns (Forms 1094-C and 1095-C) or missing employee statements can bring separate fines and headaches. Bottom line — penalties and reporting are two different buckets, and both matter.

Quick checklist to help avoid penalties:

- Confirm whether you’re an ALE (count full-time equivalent employees).

- Offer qualifying coverage to at least 95% of full-time employees if you’re an ALE.

- Make sure plans meet minimum value and affordability tests (document your calculations).

- File Forms 1094‑C and 1095‑C accurately and on time.

- Re-check current penalty amounts and IRS guidance for the applicable year.

Need a fast reality check on potential penalty amounts? Use the IRS resources or an employer penalty calculator to run your own scenario — and consider talking to a benefits advisor if you’re near the ALE threshold or unsure about affordability calculations.

Special Cases: Part-Time Employees, Seasonal Workers, and Independent Contractors

Worker classification matters — a lot. Whether someone is full-time, part-time, seasonal, or an independent contractor affects your full-time equivalent counts, who you must offer coverage to, and what your legal obligations look like.

Proper worker classification is essential for determining health insurance obligations

Part-Time Employees

Short answer: part-time workers (those working fewer than 30 hours per week) generally don’t have to be offered employer health insurance under the ACA. That said, their hours still count when you calculate full-time equivalent employees — so part-time staff can push you into ALE territory if you’re not careful.

Seasonal Workers

Seasonal workers are usually those employed for a limited period each year — often defined around a 120-day season. There’s a helpful carve-out: if your workforce exceeds 50 FTEs for 120 days or fewer in a year and the excess employees during that time were seasonal, you may not be treated as an ALE. In practice, check the exact “seasonal” timing and document the period carefully.

Independent Contractors

Independent contractors generally aren’t counted as employees for FTE calculations, and you don’t have to offer them employer-sponsored insurance. But beware: misclassifying someone who is essentially an employee can lead to penalties and back taxes. The IRS and courts look at who controls the work, payment, and relationship — not just what a contract says.

“The determination of whether a worker is an independent contractor or an employee depends on the facts and circumstances of each case. The IRS uses a ‘right-to-control’ test that examines behavioral control, financial control, and the relationship between the parties.”

Do part-time employees count toward ALE status?

Yes — part-time hours are converted into full-time equivalent employees when you do the math, even though employers typically aren’t required to offer them health insurance.

How do seasonal employees affect my employer obligations?

If your headcount tops 50 FTEs for 120 days or fewer and those extra workers were seasonal, you might not be treated as an ALE. Document the season and employee types carefully to support that position.

Can I count independent contractors as employees to avoid ALE status?

No — you shouldn’t treat contractors as employees just to manipulate counts. Misclassification risks fines and back taxes. Follow IRS guidance and consider a worker-classification review if you’re unsure.

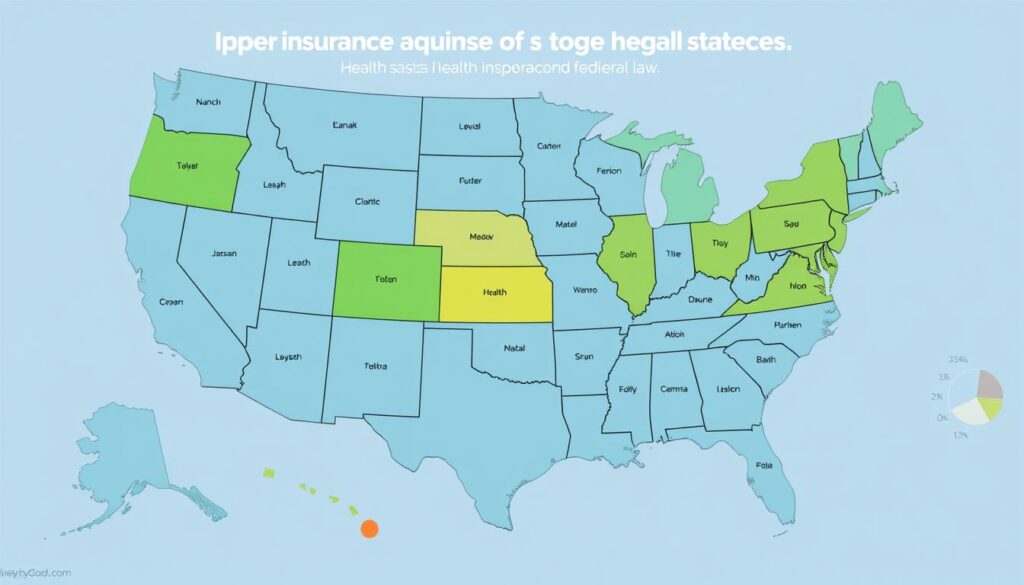

State-Specific Health Insurance Requirements for Employers

The ACA sets the federal baseline, but state laws can add extra layers employers need to watch. If you’ve got employees in more than one state, those local rules could affect what you must offer or how you administer benefits.

Several states have implemented additional health insurance requirements beyond federal law

States with Additional Employer Health Insurance Mandates

California

California has its own individual mandate and detailed rules around plan design and consumer protections. While this typically affects residents more than employers directly, businesses with California employees should double-check compliance and notice requirements.

Massachusetts

Massachusetts requires certain employers to make a “fair and reasonable” contribution toward employee coverage if they have 11 or more FTEs. That’s an employer-focused rule that can affect benefit design and budgeting.

Hawaii

Hawaii’s Prepaid Health Care Act is one of the oldest state-level employer mandates: it generally requires employers to provide health benefits to workers who average 20 or more hours per week over a qualifying period.

Other places — New Jersey, Vermont, and Washington, D.C., among them — have individual mandates or related rules that can indirectly affect employer responsibilities. The bottom line: check the law in each state where you have workers to avoid surprises.

Need Help with State-Specific Requirements?

State laws vary across the United States and can change. Our experts can help you map obligations by state and make sure your benefits and notices meet local requirements.

Alternatives to Traditional Group Health Insurance

If you’re weighing whether to offer group coverage, there are several alternatives that let you provide health insurance benefits without the one-size-fits-all group plan. These can help businesses manage costs while still giving employees meaningful health coverage.

Exploring alternative health benefit options can help employers find solutions that fit their needs

Health Reimbursement Arrangements (HRAs)

HRAs are employer-funded accounts that reimburse employees for qualified medical costs — including individual health insurance premiums in many cases. They’re flexible and come in a few flavors, each with pros and cons.

Individual Coverage HRA (ICHRA)

ICHRA lets employers of any size reimburse employees for individual health insurance premiums and qualified medical expenses. For ALEs, an ICHRA can satisfy the employer mandate if the reimbursements make coverage affordable and provide minimum value.

Good if: you want to let employees pick their own plans. Watch out: you must design it carefully to meet affordability rules for full-time employees.

Qualified Small Employer HRA (QSEHRA)

QSEHRA is for employers with fewer than 50 full-time employees and lets you reimburse medical expenses and individual premiums up to annual limits. It’s a simple way for small businesses to provide health insurance benefits without a group plan.

Good if: you’re a small business wanting a predictable benefit. Watch out: reimbursements are capped each year and rules must be followed to preserve employee tax benefits.

Group Coverage HRA (GCHRA)

Also called an Integrated HRA, a GCHRA pairs with a traditional group health plan to help cover out-of-pocket costs. It’s useful when you want to beef up employee benefit value without larger premium contributions.

Good if: you already offer group health but want more flexibility. Watch out: integration rules can be technical — get benefits counsel when setting it up.

Other Alternative Options

Association Health Plans (AHPs)

AHPs let small businesses band together to buy coverage as a larger group, potentially lowering costs and expanding plan options. They work best when similar businesses form an association.

Good if: you can join a credible association. Watch out: regulatory treatment of AHPs has changed over time — confirm current rules before committing.

Professional Employer Organizations (PEOs)

PEOs provide payroll and HR services and pool many small employers to secure more competitive group health insurance. Outsourcing to a PEO can give small businesses access to stronger plans.

Good if: you want bundled HR and benefits support. Watch out: review contracts carefully — costs and responsibilities can vary.

Level-Funded Health Plans

Level-funded plans blend self-funding with stop-loss insurance: you pay a predictable monthly amount that covers expected claims and a reserve for higher-than-expected costs. They can be cost-effective for generally healthy workforces.

Good if: you want potential savings and claims transparency. Watch out: risk increases if claims spike.

Direct Primary Care (DPC)

DPC arrangements give employees access to primary care for a fixed monthly fee and are often paired with high-deductible plans. They can improve access to care and lower primary-care costs.

Good if: you want to improve employee access to primary care. Watch out: DPC is not comprehensive insurance — it’s best as part of a broader benefits package.

HRAs offer flexibility for both employers and employees in managing healthcare costs

Which Option Fits Your Business?

Quick decision guide:

- Want simplicity and predictable cost? Consider QSEHRA (if under 50 employees) or joining a PEO.

- Want employee choice and flexibility? ICHRA lets employees choose individual plans while giving them employer-funded help.

- Already offer a group plan but want more value? GCHRA or level-funded plans may help.

- Focus on primary care access? Add DPC to your benefits menu alongside a high-deductible plan.

Example budget snapshot: a small employer might compare offering a modest monthly HRA stipend (e.g., $150/month per employee) versus increasing monthly group premium contributions. HRAs can shift cost predictably to the employer while letting employees choose plans that fit them.

Tips for ACA Compliance and Avoiding Penalties

Keeping up with the ACA’s employer rules doesn’t have to be a scavenger hunt. A little planning, consistent tracking, and simple documentation go a long way to protect your business and your workers.

Regular compliance reviews can help employers stay ahead of ACA requirements

Track Employee Hours Carefully

- Use a reliable time-tracking system (digital timecards reduce errors).

- Monitor hours per week so you can spot employees approaching full-time status.

- Document the measurement method you use (monthly or look-back) and stick to it.

- For variable-hour workers, consider the look-back measurement method to smooth out counting.

Maintain Proper Documentation

- Keep records of all health plan offerings, employee notices, and enrollment materials.

- Document affordability calculations and which safe-harbor you used (wages, rate of pay, or federal poverty line).

- Save employee waivers and enrollment refusals — they’re your proof if questions arise.

- Keep a folder of ACA-related communications and filings for at least the IRS-recommended period.

Stay Current with Reporting Requirements

- File Forms 1094-C and 1095-C accurately — electronic filing may be required above certain thresholds.

- Provide Form 1095-C to employees by the annual deadline (check current IRS guidance for dates).

- Watch for changes in reporting rules or penalty calculations each year.

- If reporting feels overwhelming, consider a benefits administrator or tax pro to help.

Conducting a Self-Audit

A self-audit is one of the smartest things you can do. Do this quarterly or before open enrollment to catch issues early.

- Verify ALE status by recounting full-time equivalent employees and re-checking any seasonal exceptions.

- Confirm that your plans meet minimum value tests and that affordability calculations are documented.

- Review premium amounts and employee contributions to ensure coverage remains affordable.

- Check that qualifying offers are being extended to at least 95% of coverage full-time employees (where applicable).

- Re-examine employee classifications — full-time vs. part-time vs. independent contractors.

- Audit your measurement periods and payroll/HR data for variable-hour workers.

- Ensure dependent coverage is offered as required and notice requirements have been met.

- Keep copies of required notices to employees and proof of delivery.

30-day compliance checklist (do this week):

- Run a headcount to confirm full-time equivalent employees.

- Quickly verify that your most common employee premium for self-only coverage meets affordability safe-harbor.

- Confirm Forms 1094-C/1095-C are on track for filing and distribution.

- Document any recent hires or status changes that could affect ALE status.

Need Expert Guidance on ACA Compliance?

Our benefits specialists can help you run a quick audit, set up hours tracking, and make sure your workplace meets federal and state requirements for providing health coverage.

Frequently Asked Questions About Employer Health Insurance Requirements

Understanding the nuances of employer health insurance requirements can help businesses make informed decisions

Do I have to provide health insurance to all employees if I have fewer than 50 full-time employees?

Short answer: no. If you have fewer than 50 full-time equivalent employees, the ACA’s employer mandate doesn’t force you to provide health insurance under federal law. That said, some states may have their own rules, and many small employers choose to offer coverage to attract and keep good workers.

Are employers required to provide health insurance to part-time employees?

No — the ACA doesn’t require offering health insurance to part-time employees (those working under 30 hours per week). But beware: part-time hours still count toward your full-time equivalent employee total, which affects whether you’re an ALE and thus subject to employer rules.

What happens if I don’t offer health insurance to my employees as an ALE?

If you’re an ALE and don’t offer minimum essential coverage to at least 95% of your full-time employees and their dependents, you could face penalties when even one employee receives a premium tax credit on the Marketplace. Penalty figures change each year — for example, 2023 figures were ,880 per full-time employee (minus the first 30) for not offering coverage. Always check current-year amounts before doing the math.

Do I have to pay for all of my employees’ health insurance premiums?

No. The ACA doesn’t mandate a fixed employer contribution. But to avoid affordability-related penalties, an employee’s share for self-only coverage can’t exceed the annual affordability percentage (this percentage is updated yearly; 9.12% was used in 2023). Employers commonly use safe-harbor methods tied to wages to estimate affordability.

Can I offer different health insurance benefits to different groups of employees?

Yes. Employers can offer different benefits to bona fide groups (for example, part-time vs. full-time, or by geographic location). Just make sure group definitions are legitimate and nondiscriminatory — HIPAA and other rules require similarly situated employees be treated the same within those groups.

Can I offer spouse coverage under my plan?

Yes — offering spouse coverage is optional under the ACA. Employers often include spouses as dependents in group plans, but the ACA’s dependent mandate only extends to children up to age 26; spouses aren’t required to be covered.

What about COBRA — do I have to offer it?

If you’re an employer with 20 or more employees and you offer group health coverage, federal COBRA rules generally require you to offer continuation coverage when employees have qualifying events. Some states have “mini-COBRA” laws that apply to smaller employers, so check state law where you operate.

How do I count seasonal workers when determining ALE status?

Seasonal workers can be excluded in a specific situation: if your workforce exceeds 50 FTEs for 120 days or fewer and the employees in excess of 50 during that period were seasonal, you may not be an ALE. Document the seasonal period and employee types carefully — rules are specific and worth confirming for your situation.

Conclusion: Making Informed Decisions About Employee Health Insurance

So — do I have to provide health insurance to all employees? The short, friendly answer: it depends. If your business is an Applicable Large Employer (50 or more full-time equivalent employees), you generally must offer affordable, minimum-value coverage to avoid penalties. If you’re a smaller employer, federal law doesn’t force you to provide health insurance, though many businesses choose to offer benefits anyway.

Offering health insurance benefits can pay off: it helps attract and keep good employees, supports workforce health and productivity, and may bring tax advantages. Whether you decide to provide group plans, use HRAs, or pursue other alternatives, aim for a solution that fits your budget and your people.

Providing health benefits can strengthen employer-employee relationships and support workforce wellbeing

Quick Recap

- If you have 50+ full-time equivalent employees, you’re likely an ALE and must offer qualifying coverage or risk penalties.

- Smaller businesses aren’t required by federal law to provide health coverage, but offering benefits can help recruit and retain workers.

- Explore group plans, HRAs, PEOs, or other options — each has trade-offs for coverage, cost, and admin work.

Before you act, double-check current rules and numbers (they change each year) and consider speaking with benefits specialists, legal advisors, or tax pros who understand employer obligations in the United States and in the states where your employees work.

Ready to Explore Your Health Insurance Options?

Need a quick eligibility check or help deciding whether to offer health insurance? Book a 15-minute consult with our team — we’ll walk through your ALE status, coverage options, and next steps.