Whether your vehicle doubles as your office (hello, client visits), your delivery van, or just something you use for the occasional work errand, knowing the difference between personal and commercial auto insurance can save you a ton of stress — and money — if something goes south.

What is Personal Auto Insurance?

- What is Personal Auto Insurance?

- What is Commercial Auto Insurance?

- Why Your Personal Auto Policy is NOT Enough for Business Use

- Special Considerations: Rideshare, Deliveries, and Gig Work

- Key Differences in Coverage & Limits

- Factors Influencing Commercial Auto Insurance Costs

- How to Choose the Right Insurance for Your Business

- Frequently Asked Questions

- Protect Your Business with the Right Auto Coverage

Think of personal auto insurance as the safety net for your everyday rides — commuting to work, grabbing groceries, road trips, and other non-work stuff. It’s built for your regular life, not your side hustle or delivery runs.

What Personal Auto Insurance Typically Covers

- Your daily commute to and from your workplace (usually covered)

- Personal errands like grocery shopping or picking up the kids

- Social and recreational activities — road trips, weekend drives, etc.

- Occasional, non-business travel

The Business Use Exclusion: The Fine Print That Matters

Here’s the kicker: if you read your personal auto policy (yes, the boring bits), you’ll probably find language that excludes coverage for business use. So if you’re in an accident while using your car for work purposes — like delivering goods or meeting clients — your claim could get denied and you’d be on the hook for damages and legal bills.

Important: “Business use” is often defined pretty broadly. Even a few deliveries, hauling work gear, or driving to client meetings beyond your normal commute can qualify as business use and be excluded.

Quick tip: to find this in your policy, check the declarations page, the definitions section, and the exclusions. If you’re unsure, call your insurer and ask, “Does my personal auto insurance cover business use if I do X twice a week?” — they should give you a straight answer.

What is Commercial Auto Insurance?

Think of commercial auto insurance as the grown-up version of car coverage — it’s made for vehicles that spend their time doing business. Unlike your personal auto policy, commercial coverage is built to handle the extra risks and higher liability that come with driving for work or running a business.

When You Definitely Need Commercial Auto Insurance

If any of the scenarios below sound like your daily routine, you’re probably better off with commercial auto insurance (sometimes called commercial car insurance). No drama — just the right protection.

- Your vehicle is owned or leased by your business (company-owned cars need commercial coverage)

- You transport goods, products, or equipment for payment — e.g., delivering baked goods or hauling supplies

- You use your vehicle to provide services you’re paid for, like a mobile groomer or repair tech

- You drive clients or employees as part of your business — rides, pickups, or client visits

- You charge passengers a fee to ride in your vehicle (taxi, shuttle, or gig transport)

- Your vehicle displays business advertising or logos

- You tow a trailer used for business purposes (extra risk = extra coverage)

- Multiple employees drive the vehicle for work purposes — think shared company cars

Not Sure If You Need Commercial Coverage?

Ask an agent for a quick, free check — a 10-minute chat can clear things up and save you headaches (and cash) later.

Why Your Personal Auto Policy is NOT Enough for Business Use

Using your personal car for business without the right coverage is basically walking a financial tightrope — and trust me, the fall hurts. Here’s what can happen if you rely on a personal auto policy while doing work-related driving.

Denied Claims

If you get in an accident while using your vehicle for work purposes and only have personal coverage, the insurer can deny the claim once they discover the business use. Translation: you could be stuck paying repair bills, medical costs, and legal fees out of pocket. Ouch.

Higher Liability Exposure

Business driving means more time on the road, stranger routes, and often more severe incidents. Personal policies usually have lower liability limits that might not cover big claims, leaving you to cover the excess.

“Simply put, a personal auto policy is not designed to cover the employee using their personal auto for business purposes.”

Business Asset Risk

An accident during business use could trigger claims that exceed your personal policy limits and put both your business and personal assets at risk. Imagine a client sues for big damages — your savings, business bank account, or even your house could be in play.

Legal and Contractual Issues

Lots of contracts and state rules require commercial coverage. Running on a personal policy could breach contracts or break regulations, creating another layer of liability you don’t want.

Special Considerations: Rideshare, Deliveries, and Gig Work

The gig economy changed everything — and not always in ways your personal auto insurance likes. If you drive for an app, deliver stuff, or use your car for a home-based hustle, pay attention: these scenarios often fall into “business use.”

Rideshare Drivers (Uber/Lyft)

If you drive for Uber, Lyft, or similar apps, your regular personal car policy usually doesn’t cover you while you’re working. The rideshare companies provide some protection, but there are gaps — especially when you’re logged into the app but waiting for a request. Tip: look into a rideshare endorsement or a specialized policy if you spend serious time driving for apps.

Food and Package Delivery

Delivering pizzas, groceries, or packages is almost always treated as business use. Even occasional delivery gigs can trigger exclusions on a personal auto policy. If you’re doing delivery work, consider commercial auto coverage or ask your insurer about a business use endorsement — it might be cheaper than you think and way less painful than an uncovered accident.

Home-Based Businesses

Running a business from home doesn’t automatically mean your personal auto policy covers business trips. If you frequently visit clients, haul inventory, or transport samples, you’re probably using your personal vehicle for business and should check your coverage.

Pro Tip: Quick checklist — check the app company’s insurance page, read your personal policy’s exclusions, and ask your agent: “If I use my personal vehicle for X trips a week, am I covered?” That three-question combo clears up most confusion.

Key Differences in Coverage & Limits

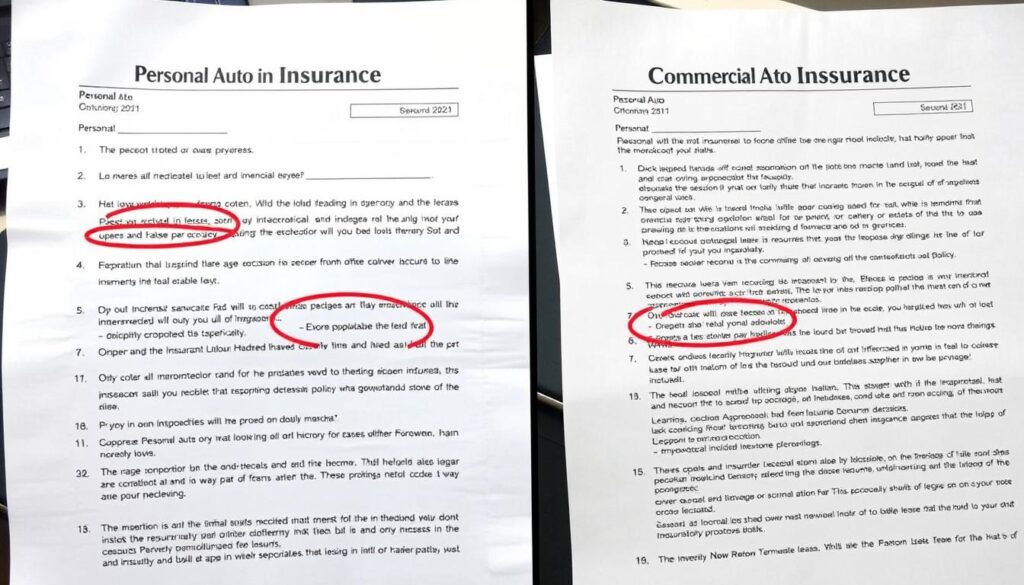

Alright, let’s keep this simple: personal and commercial auto policies look similar on the surface, but they’re built for different jobs. Knowing the main differences helps you pick the right coverage so you’re not left holding the bill after an accident.

| Feature | Personal Auto Insurance | Commercial Auto Insurance |

| Liability Limits | Typically lower (often $100,000-$300,000) | Higher limits available (often $1 million+) |

| Covered Drivers | Named individuals and immediate family | Business owners, employees, and permissive users |

| Vehicle Types | Personal cars, SUVs, trucks | Wide range including specialized business vehicles |

| Business Use Coverage | Excluded (except limited commuting) | Fully covered |

| Cost | Generally lower premiums | Higher premiums reflecting increased risk |

In plain English: personal policies are fine for everyday driving, but they usually have lower limits and don’t cover business use. Commercial auto insurance gives you higher limits, broader protection for different drivers and vehicle types, and covers the actual risks of business driving.

Additional Coverage Options for Business Vehicles

Commercial auto policies can include add-ons you won’t usually find on a personal auto policy. These matter a lot if you’re hauling goods, lending vehicles to employees, or carrying expensive gear.

- Hired and Non-Owned Auto Coverage: Covers when you rent a vehicle or when employees use their personal vehicles for your business — e.g., an employee borrows their car to deliver an order.

- Cargo Coverage: Protects goods, products, or equipment being transported (handy if you deliver inventory or samples).

- Business Interruption: Pays for lost income while a vehicle is being repaired after a covered loss.

- Gap Insurance: Covers the difference between what you owe on a loan and what the insurer pays if the vehicle is totaled.

- Specialized Equipment Coverage: Protects tools or built-in equipment that a personal policy might exclude.

- Loading and Unloading Liability: Covers accidents that happen while loading or unloading cargo — a surprisingly common source of claims and property damage.

Tip: check your policy limits against the typical lawsuit sizes in your industry. If you’re in a high-risk business, that $300k personal limit might not cut it. Ask your agent to explain limits and show examples for your line of work.

Factors Influencing Commercial Auto Insurance Costs

Yep, commercial auto insurance usually costs more than personal coverage — but how much you pay depends on a bunch of real-world stuff. Think of it like ordering coffee: size, extras, and how often you go all add up.

Driver Factors

- Driving records of all covered drivers — tickets and accidents matter

- Number of authorized drivers — more drivers can mean higher cost

- Driver experience and age — younger or inexperienced drivers can raise rates

- Previous claims history — a clean claims record helps keep costs down

Vehicle Factors

- Type and size of vehicle(s) — vans and big trucks usually cost more

- Vehicle age and value — newer, pricier vehicles can bump premiums

- Number of vehicles in fleet — fleets are priced differently than single cars

- Vehicle storage location — parking in a high-crime area can increase rates

Business Factors

- Industry and business type — delivery vs. consulting = different risk

- Annual mileage and radius of operation — more miles = more exposure

- Type of cargo transported — hauling expensive or hazardous goods ups the risk

- Years in business — established businesses often get better rates

As a ballpark from industry data (Insureon), small businesses often see averages around $147 per month (about $1,762 annually) for commercial auto insurance — but your actual cost can be very different depending on the factors above.

Quick money-saving tips: keep driving records clean, limit the number of authorized drivers, install safety tech (dash cams, telematics), and shop multiple quotes. Even small changes can lower your auto insurance cost.

Find Affordable Commercial Auto Coverage

Want someone to shop for quotes? We can compare providers and help you find better coverage for less.

How to Choose the Right Insurance for Your Business

Picking the right auto insurance doesn’t have to feel like decoding a secret map. Follow these easy steps — do them in order, and you’ll have a solid sense of whether you need a commercial policy, a business use endorsement, or both.

- Assess Your Vehicle Usage – Track your trips for two weeks: how often you drive for work, whether you transport goods or people, and roughly how many miles you put on. This tells you whether you’re using your personal auto or a business vehicle for work purposes.

- Review Your Current Policy – Read your personal auto policy’s declarations page and the exclusions section. Ask: “Does my personal auto policy cover business use for X?” (Bring examples like “deliveries twice a week” when you call.)

- Consider a Business Use Endorsement – If your use is very limited, some insurers offer a business use endorsement that tacks onto a personal auto policy. It’s cheaper than full commercial coverage but more limited — good for light-duty side gigs.

- Get Multiple Quotes – Shop commercial auto insurance quotes from several providers. Compare policy limits, who is covered, and extra options like hired non-owned auto coverage. Little differences in limits can mean big differences after a claim.

- Consult with an Insurance Professional – Bring your trip log and a few questions: “If I make X deliveries per week, should I add a business use endorsement or switch to commercial auto insurance?” An agent can recommend the best mix of protection and price.

Hybrid Solutions: When You Need Both Policies

Sometimes the answer is “both.” Here’s a quick decision cheat-sheet:

- Hired and Non-Owned Auto Insurance (HNOA) – Add this to a business policy to cover employees using their personal vehicles for occasional business runs (e.g., an employee borrows their car to deliver a client order).

- Business Use Endorsement – Works for limited, predictable business use on a personal auto policy — good for small side gigs but not heavy delivery work.

- Specialized Rideshare Policies – If you drive for apps, these hybrid policies fill gaps between your personal auto policy and the rideshare company’s coverage.

Prep a one-page “policy checklist” before you call an agent: your trip log, vehicle info, who drives, and two scenarios you want covered. It’ll make the conversation fast and useful — and you’ll walk away with real protection, not just impressions.

Frequently Asked Questions

Does my personal auto insurance cover me for business use?

Short answer: probably not. Most personal auto insurance policies exclude driving done for business purposes (deliveries, client visits, hauling work gear). What to do now: check your policy’s exclusions, keep a quick trip log, and call your agent to ask whether your specific activities are covered.

What kind of business use requires commercial auto insurance?

If your vehicle is owned or leased by a business, used by employees, transports goods for pay, carries work equipment, or shows business logos, you usually need commercial auto insurance. Even occasional paid deliveries or client transport can push you into needing a commercial policy. Quick tip: when in doubt, ask your agent with a real example (e.g., “I do three deliveries a week — am I covered?”).

Do rideshare drivers need commercial auto insurance?

Most personal auto policies won’t cover rideshare driving. While Uber, Lyft, and others provide some protection, there are gaps — for example, when you’re logged into the app but waiting for a request. Consider a rideshare endorsement or specialized TNC/rideshare policy to fill those gaps. Action: check the rideshare company’s coverage page and ask your insurer about a rideshare add-on.

Can I add an endorsement to my personal policy for business use?

Sometimes. Some insurers offer a business use endorsement for limited, occasional business activities on a personal auto policy. It’s usually cheaper than full commercial auto insurance but more restrictive. Best move: describe your exact use to an agent and ask whether an endorsement will actually cover your situation.

What happens if I use my personal vehicle for business without commercial insurance?

If you’re in an accident while using your personal vehicle for business and your policy excludes that use, your claim can be denied — meaning you could be on the hook for all damages, medical bills, and legal fees. Bottom line: check your policy now, and if needed, switch to commercial auto insurance or add the right endorsement before something happens.

Protect Your Business with the Right Auto Coverage

This isn’t just wording on a policy — the difference between personal and commercial auto insurance can be the line between staying in business and getting hit with massive bills. If you use your vehicle for any business purposes, double-check your coverage now.

Don’t wait for an accident to find out your personal car insurance won’t help. Even a five-minute check of your policy’s exclusions can save you from big out-of-pocket damage and liability later.

Get Peace of Mind Today

Want a low-effort next step? Grab our quick 5-minute checklist or have an expert review your policy to spot gaps in coverage and protection.

Schedule Your Free Policy Review

Prefer to talk? Call us at: 518-392-9311

Disclaimer: This article is for informational purposes only — not legal or insurance advice. We’re not lawyers or your insurer; check with a licensed insurance professional to pick the right policy for your situation.