Key Takeaways

- Key Takeaways

- Average Business Insurance Costs in 2025

- Factors That Influence Business Insurance Costs

- Understanding Different Business Insurance Types and Their Costs

- Business Insurance Costs by Industry

- 10 Proven Strategies to Reduce Your Business Insurance Costs

- Real-World Examples: How Businesses Reduced Their Insurance Costs

- Avoid These Costly Business Insurance Mistakes

- Frequently Asked Questions About Business Insurance Costs

- Frequently Asked Questions About Business Insurance Costs

- Making Smart Business Insurance Decisions in 2025

- The average cost of a Business Owner’s Policy (BOP) is about $57 each month. This adds up to $684 each year. A BOP gives important coverage for most small businesses.

- Your industry, location, business size, claims history, and coverage needs are the primary factors affecting your business insurance costs.

- Bundling policies, implementing risk management practices, and comparing quotes from multiple providers can significantly reduce your insurance expenses.

- Different types of business insurance have varying costs: general liability ($42/month), professional liability ($61/month), and workers’ compensation ($45/month) on average.

- Small businesses can save on insurance by paying premiums annually, raising deductibles strategically, and reviewing policies regularly.

Average Business Insurance Costs in 2025

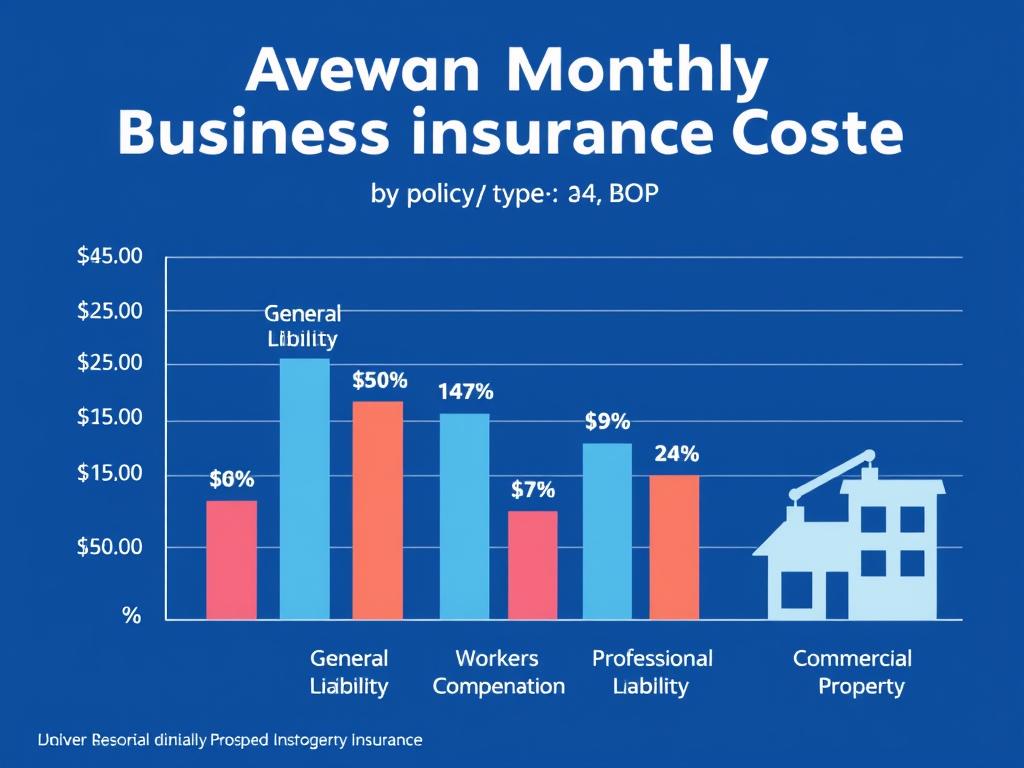

When budgeting for business insurance costs, it’s helpful to understand the typical premiums for different coverage types. Your rates may vary based on different factors. However, these averages can help you start planning.

| Insurance Type | Average Monthly Cost | Average Annual Cost | What It Covers |

| General Liability Insurance | $42 | $504 | Third-party bodily injury, property damage, and advertising injury claims |

| Business Owner’s Policy (BOP) | $57 | $684 | Combines general liability, commercial property, and business interruption coverage |

| Professional Liability Insurance | $61 | $732 | Claims of professional mistakes, negligence, or inadequate work |

| Workers’ Compensation | $45 | $540 | Employee injuries and illnesses related to their work |

| Commercial Property Insurance | $67 | $804 | Business property damage from fire, theft, and certain natural disasters |

| Cyber Liability Insurance | $145 | $1,740 | Data breaches, cyberattacks, and related customer notifications |

Ready to find affordable business insurance?

Compare quotes from top-rated providers and find coverage that fits your budget.

Factors That Influence Business Insurance Costs

Understanding what affects your business insurance costs can help you make strategic decisions to manage your premiums. Insurance companies consider numerous factors when calculating your rates:

Industry Type and Risk Level

Your industry significantly impacts your business insurance costs. High-risk industries, such as construction, manufacturing, and restaurants, usually pay more for insurance. In contrast, low-risk businesses, like consulting firms or accounting practices, pay less.

For example, restaurants may pay about $413 each month for a Business Owner’s Policy. In contrast, accounting firms might pay only $85 a month for the same coverage because they have a lower risk profile.

Business Size and Revenue

Larger businesses with more employees, higher revenue, and more valuable assets typically face higher business insurance costs. This is because they present greater potential for claims and higher claim values.

Your annual revenue, payroll size, and number of employees are important factors for insurers. They use these metrics to calculate your premiums. This is especially true for workers’ compensation and general liability insurance.

Location Factors

Where your business operates plays a significant role in determining your business insurance costs. Businesses in urban areas with higher crime rates or regions prone to natural disasters often pay more for coverage.

State regulations also impact insurance requirements and costs. For example, workers’ compensation insurance costs vary significantly from state to state based on local laws and claim histories.

Claims History

Your business’s claims history is one of the most influential factors affecting your insurance costs. Companies with a history of frequent or severe claims typically pay higher premiums than those with few or no claims.

Keeping a clean claims record with good risk management can help lower your business insurance costs over time.

Coverage Limits and Deductibles

The coverage limits you choose and the deductibles you’re willing to accept significantly impact your business insurance costs. Higher coverage limits mean higher premiums, while higher deductibles typically result in lower premiums.

For general liability insurance, most small businesses choose $1 million per occurrence and $2 million aggregate limits, balancing protection with affordable premiums.

Business Experience and Stability

Newer businesses often face higher business insurance costs than established companies with a proven track record. Insurers view businesses with longevity as more stable and less risky.

Your business structure, financial stability, and credit history can affect your insurance rates. More stable organizations usually get better rates.

Want to know exactly what affects your rates?

Speak with a licensed insurance agent who can analyze your specific business factors.

Understanding Different Business Insurance Types and Their Costs

Each type of business insurance serves a specific purpose and comes with its own cost structure. Understanding these differences can help you build a comprehensive protection plan that fits your budget.

General Liability Insurance

Average Cost: $42/month or $504/year

General liability insurance protects your business from third-party claims of bodily injury, property damage, and advertising injury. It’s the foundation of most business insurance programs.

Cost factors include your industry, business size, location, and coverage limits. Retail businesses and contractors typically pay more due to higher customer interaction and risk exposure.

Business Owner’s Policy (BOP)

Average Cost: $57/month or $684/year

A Business Owner’s Policy bundles general liability, commercial property, and business interruption coverage at a discounted rate compared to purchasing these policies separately.

BOPs are great for small to medium-sized businesses. They work well for businesses with physical locations and under $5 million in yearly revenue.

Professional Liability Insurance

Average Cost: $61/month or $732/year

Errors and Omissions (E&O) insurance protects you from claims about professional mistakes, negligence, or poor work.

Costs differ a lot by profession. Financial advisors, healthcare providers, and IT consultants have higher rates. This is because their claims can be more serious.

Workers’ Compensation Insurance

Average Cost: $45/month or $540/year

Workers’ compensation covers medical expenses and lost wages for employees who suffer work-related injuries or illnesses. It’s legally required in most states for businesses with employees.

Premiums are calculated based on payroll size, job classifications, and your company’s claims history. High-risk industries like construction pay significantly more.

Commercial Property Insurance

Average Cost: $67/month or $804/year

Commercial property insurance protects your business buildings, inventory, equipment, and fixtures from fire, theft, vandalism, and certain natural disasters.

Costs depend on the value of the property, the type of construction, and the location. They also depend on fire protection systems and local risk factors, such as crime rates or weather patterns.

Cyber Liability Insurance

Average Cost: $145/month or $1,740/year

Cyber liability insurance covers costs associated with data breaches, cyberattacks, ransomware, and customer notifications. It’s increasingly essential for all businesses that handle sensitive data.

Premiums vary based on your data volume, security measures, industry, and previous incidents. Healthcare and financial services face higher rates.

Not sure which coverage types you need?

Get a customized insurance recommendation based on your specific business.

Business Insurance Costs by Industry

Your industry is one of the most significant factors affecting your business insurance costs. Here’s how average premiums for a Business Owner’s Policy vary across different sectors:

| Industry | Average Monthly BOP Premium | Risk Level | Key Cost Factors |

| Restaurants | $413 | High | Fire hazards, customer injuries, food-related claims |

| Retail Stores | $152 | Medium | Customer foot traffic, inventory value, shoplifting risk |

| Construction | $170 | High | Workplace injuries, property damage, equipment value |

| Manufacturing | $115 | Medium-High | Equipment value, product liability, workplace safety |

| Professional Services | $86 | Low-Medium | Professional errors, client data security |

| Beauty Salons | $113 | Medium | Customer injuries, product reactions, equipment |

| Accounting | $85 | Low | Professional errors, client data security |

| Photography | $72 | Low | Equipment value, on-location risks |

Knowing where your business stands on the risk spectrum can help you predict your insurance costs. It can also show you where risk management might lower your premiums.

Find industry-specific coverage at competitive rates

Get quotes tailored to your business type from insurers who specialize in your industry.

10 Proven Strategies to Reduce Your Business Insurance Costs

While adequate insurance coverage is essential, there are legitimate ways to lower your business insurance costs without sacrificing protection:

1. Bundle Your Policies

Purchasing multiple policies from the same insurer often results in significant discounts. A Business Owner’s Policy (BOP) combines general liability and commercial property coverage. It offers a lower rate than buying them separately.

Many insurers offer additional discounts when you add workers’ compensation, commercial auto, or cyber liability coverage to your package.

2. Raise Your Deductibles Strategically

Increasing your deductibles—the amount you pay out-of-pocket before insurance kicks in—can significantly lower your premiums. However, be sure to choose deductibles you can actually afford in the event of a claim.

For example, increasing your property insurance deductible from $500 to $2,500 could lower your premium by 15-20%. You would still have protection against major losses.

3. Implement Risk Management Practices

Insurers offer lower rates to businesses that demonstrate commitment to safety and risk reduction. Implementing formal safety programs, security systems, fire protection, and employee training can qualify you for significant discounts.

Keep a record of your risk management efforts. Share this information with your insurance provider when you renew your policy. This may help you get better rates.

4. Pay Premiums Annually

Many insurers charge additional fees for monthly or quarterly payment plans. Paying your entire premium upfront can save you 5-10% on your total insurance costs.

If cash flow is a concern, think about saving a set amount each month. This way, you will be ready to pay when it’s time to renew.

5. Shop Around and Compare Quotes

Insurance premiums can vary significantly between providers for the same coverage. Getting quotes from multiple insurers ensures you’re getting competitive rates for your specific business needs.

Working with an independent insurance agent can make this process easier. They represent many companies and can help you find the best value.

6. Review and Update Coverage Regularly

As your business evolves, your insurance needs change. Regular policy reviews ensure you’re not paying for unnecessary coverage or underinsuring critical areas.

Set up yearly meetings with your insurance agent. This will help you change coverage limits, add or remove items, and make sure your policy matches your current business needs.

7. Maintain Good Credit

Many insurers use credit-based insurance scores when determining premiums. Maintaining good business credit can help you secure lower insurance rates.

Pay your bills on time. Keep your debt at a manageable level. Check your business credit reports regularly. This helps ensure they are accurate and lets you fix any issues quickly.

8. Consider a Business Owner’s Policy

For small to medium-sized businesses, a Business Owner’s Policy (BOP) offers substantial savings compared to purchasing general liability and property insurance separately.

BOPs typically include business interruption coverage as well, providing additional protection at no extra cost.

9. Join Industry Associations

Many professional and trade groups offer members access to group insurance rates. These rates can be much lower than individual policies.

These group policies are often tailored to your industry’s specific risks and may offer broader coverage than standard policies.

10. Work with an Experienced Agent

An insurance agent who knows your industry can find coverage gaps. They can suggest the right limits and locate the best policies for your needs.

Experienced agents know many insurers. They understand which companies offer the best rates for businesses like yours.

Ready to lower your business insurance costs?

Get expert advice on implementing these money-saving strategies for your specific business.

Real-World Examples: How Businesses Reduced Their Insurance Costs

These case studies demonstrate how real businesses implemented strategic changes to significantly lower their insurance premiums while maintaining adequate coverage.

Case Study: Retail Boutique

Challenge:

A small clothing boutique was paying $3,600 annually for separate general liability, property, and business interruption policies.

Solution:

The owner changed to a Business Owner’s Policy. They installed a security system with cameras and fire alarms. They also raised their deductible from $500 to $1,000.

Result:

Annual insurance costs decreased to $2,100—a 42% savings—while maintaining comprehensive coverage and adding cyber liability protection.

Case Study: Construction Company

Challenge:

A growing construction firm was facing a 30% increase in workers’ compensation premiums due to two recent claims.

Solution:

The company started a safety program. They held training sessions every week. They also made a return-to-work program for injured workers.

Result:

They not only avoided the increase, but they also got a 15% premium reduction the next year. This happened because their experience modification rate improved.

Case Study: Accounting Firm

Challenge:

A 10-person accounting firm was paying high costs for professional liability and cyber insurance. This was because they handled sensitive client data.

Solution:

They implemented enhanced cybersecurity measures, encrypted all client data, conducted staff training, and documented their risk management procedures.

Result:

Their insurer reduced their professional liability and cyber insurance premiums by 25%, saving $3,800 annually while improving their security posture.

Want similar results for your business?

Our insurance specialists can help you identify opportunities to reduce your premiums.

Avoid These Costly Business Insurance Mistakes

Many businesses unknowingly make insurance decisions that lead to higher costs or inadequate coverage. Here are the most common pitfalls to avoid:

Common Insurance Mistakes

- Focusing only on price: Picking the cheapest policy can lead to gaps in coverage. These gaps can be financially harmful when you make a claim.

- Underinsuring your business: Many businesses select coverage limits that are too low to fully protect their assets and operations.

- Overlooking business interruption coverage: This crucial protection is often missing from basic policies but is essential for surviving temporary closures.

- Not updating policies as your business grows: As your business gets bigger, your coverage needs change. This means you need to review your policies regularly.

- Misclassifying employees: Incorrect worker classifications can lead to higher workers’ compensation premiums and potential audit issues.

- Not understanding policy exclusions: Every policy has limitations and exclusions that could leave you exposed to significant risks.

- Shopping for insurance before renewal: You can often switch insurers during your policy if you find better rates. This is especially true after making risk improvements.

Best Insurance Practices

- Work with a knowledgeable agent: Look for an agent who knows your industry well. They can help you find your specific risks.

- Conduct annual coverage reviews: Schedule regular policy reviews to ensure your coverage keeps pace with your evolving business.

- Document your assets properly: Maintain updated inventory lists with photos and values to ensure adequate coverage and smoother claims.

- Know your policy well: Take time to read and understand what is covered and what is not in each policy you buy.

- Implement risk management strategies: Proactively reduce your risk profile through safety programs and security measures.

- Consider specialized coverage: Industry-specific policies often provide better protection than generic coverage at similar costs.

- Prepare for claims properly: Know the claims process before an incident occurs to ensure faster resolution and full compensation.

Ensure your business is properly protected

Get a comprehensive insurance review to identify potential coverage gaps and cost-saving opportunities.

Frequently Asked Questions About Business Insurance Costs

How much does small business insurance typically cost?

The average small business spends about ,988 each year on important coverage. This includes three types of insurance:

- A Business Owner’s Policy for 4 a year.

- Commercial auto insurance for

Frequently Asked Questions About Business Insurance Costs

How much does small business insurance typically cost?

The average small business spends about $2,988 each year on important coverage. This includes three types of insurance:

- A Business Owner’s Policy for $684 a year.

- Commercial auto insurance for $1,764 a year.

- Workers’ compensation insurance for $540 a year.

However, costs vary significantly based on your industry, location, business size, and specific coverage needs.

What’s the minimum business insurance I need to keep costs low?

At minimum, most businesses should have general liability insurance ($42/month on average) to protect against third-party claims. If you have employees, workers’ compensation is legally required in most states. Businesses with physical locations should also consider property insurance. A Business Owner’s Policy ($57/month on average) often provides the best value for essential coverage.

How can I get the lowest rates on business insurance?

To get the lowest business insurance costs, follow these steps: 1) Compare quotes from different insurers. 2) Bundle policies for discounts. 3) Use risk management practices. 4) Choose higher deductibles if you can. 5) Pay premiums once a year instead of monthly. 6) Keep good credit. 7) Work with an agent who knows your industry.

Does the size of my business affect insurance costs?

Yes, business size significantly impacts insurance costs. Larger businesses usually have more employees and higher revenue. They also own more valuable assets. Because of this, they often pay higher premiums. This is because they have a greater chance of making claims. However, very small businesses sometimes pay higher rates per employee due to less favorable group rates.

How often should I review my business insurance coverage?

You should review your business insurance at least once a year. You should also review it when big changes happen in your business. These changes include several actions.

- Adding or removing locations.

- Buying new equipment.

- Hiring or laying off employees.

- Adding new products or services.

- Experiencing significant revenue growth or decline.

- Changes in state rules that impact your industry.

Is business insurance tax deductible?

Yes, business insurance premiums are generally tax-deductible as ordinary business expenses. This includes premiums for general liability, professional liability, commercial property, workers’ compensation, and other business-related insurance policies. However, life insurance premiums are typically not deductible if the business is the beneficiary. Always consult with a tax professional for advice specific to your situation.

Have more questions about business insurance costs?

Our insurance experts are ready to provide personalized answers.

,764 a year.

- Workers’ compensation insurance for 0 a year.

However, costs vary significantly based on your industry, location, business size, and specific coverage needs.

What’s the minimum business insurance I need to keep costs low?

At minimum, most businesses should have general liability insurance (/month on average) to protect against third-party claims. If you have employees, workers’ compensation is legally required in most states. Businesses with physical locations should also consider property insurance. A Business Owner’s Policy (/month on average) often provides the best value for essential coverage.

How can I get the lowest rates on business insurance?

To get the lowest business insurance costs, follow these steps: 1) Compare quotes from different insurers. 2) Bundle policies for discounts. 3) Use risk management practices. 4) Choose higher deductibles if you can. 5) Pay premiums once a year instead of monthly. 6) Keep good credit. 7) Work with an agent who knows your industry.

Does the size of my business affect insurance costs?

Yes, business size significantly impacts insurance costs. Larger businesses usually have more employees and higher revenue. They also own more valuable assets. Because of this, they often pay higher premiums. This is because they have a greater chance of making claims. However, very small businesses sometimes pay higher rates per employee due to less favorable group rates.

How often should I review my business insurance coverage?

You should review your business insurance at least once a year. You should also review it when big changes happen in your business. These changes include several actions.

- Adding or removing locations.

- Buying new equipment.

- Hiring or laying off employees.

- Adding new products or services.

- Experiencing significant revenue growth or decline.

- Changes in state rules that impact your industry.

Is business insurance tax deductible?

Yes, business insurance premiums are generally tax-deductible as ordinary business expenses. This includes premiums for general liability, professional liability, commercial property, workers’ compensation, and other business-related insurance policies. However, life insurance premiums are typically not deductible if the business is the beneficiary. Always consult with a tax professional for advice specific to your situation.

Have more questions about business insurance costs?

Our insurance experts are ready to provide personalized answers.

Making Smart Business Insurance Decisions in 2025

Understanding business insurance costs is essential for making informed decisions that protect your company while managing your budget effectively.

- Choose the right types of coverage for your risks.

- Use cost-saving strategies.

- Work with skilled insurance experts.

- This way, you can get complete protection at good rates.

Remember that the cheapest policy isn’t always the best value. Focus on finding coverage that protects your business assets and operations. Also, consider future growth while using the cost-reduction strategies in this guide.

As your business evolves, regularly review your insurance program to ensure it continues to meet your changing needs. With the right approach, you can achieve the perfect balance of comprehensive protection and affordable premiums.

Ready to optimize your business insurance coverage?

Get free quotes from top-rated insurers and find the perfect balance of protection and affordability.